Region:Asia

Author(s):Shubham

Product Code:KRAD0791

Pages:91

Published On:August 2025

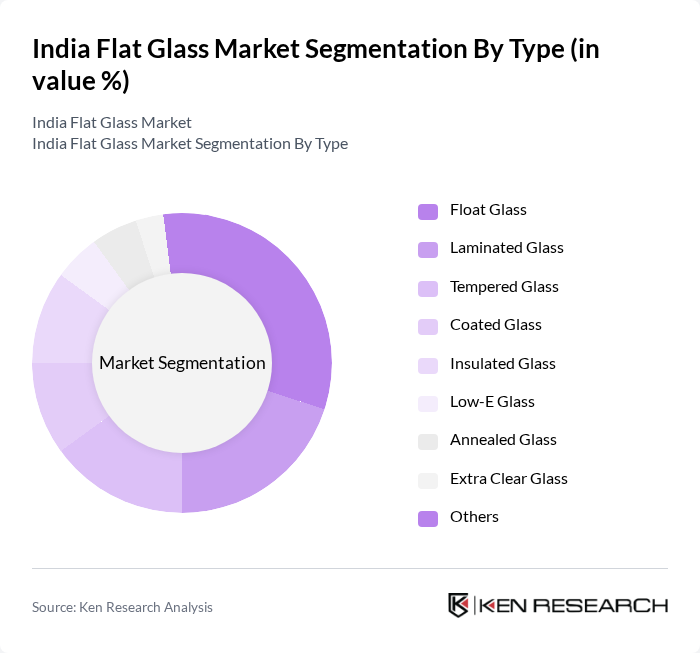

By Type:The flat glass market can be segmented into various types, including Float Glass, Laminated Glass, Tempered Glass, Coated Glass, Insulated Glass, Low-E Glass, Annealed Glass, Extra Clear Glass, and Others. Each type serves distinct applications and consumer preferences, contributing to the overall market dynamics .

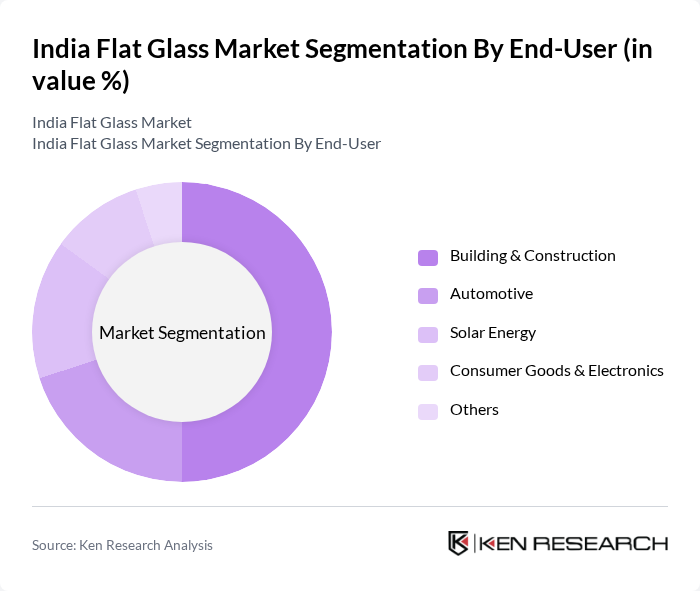

By End-User:The end-user segmentation includes Building & Construction, Automotive, Solar Energy, Consumer Goods & Electronics, and Others. Each segment reflects the diverse applications of flat glass in various industries, highlighting the market's versatility .

The India Flat Glass Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saint-Gobain India Pvt. Ltd., Asahi India Glass Ltd. (AIS), Gujarat Guardian Limited, Gold Plus Float Glass India Ltd., Borosil Renewables Ltd., HNG Float Glass Ltd., Triveni Glass Ltd., ?i?ecam Flat Glass India Pvt. Ltd., Pilkington India Pvt. Ltd. (NSG Group), Fuso Glass India Pvt. Ltd., Glass Wall Systems (India) Pvt. Ltd., Satyam Balajee Glass Pvt. Ltd., Modiguard (Modi Float Glass Pvt. Ltd.), Sejal Glass Ltd., Sudhakar Profiles Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India flat glass market appears promising, driven by ongoing urbanization and technological advancements. As the construction sector continues to expand, the demand for energy-efficient and smart glass solutions is expected to rise. Additionally, the integration of IoT technologies in glass manufacturing will enhance production efficiency and product customization. These trends indicate a robust growth trajectory, positioning the flat glass industry as a key player in India's economic development and sustainability efforts.

| Segment | Sub-Segments |

|---|---|

| By Type | Float Glass Laminated Glass Tempered Glass Coated Glass Insulated Glass Low-E Glass Annealed Glass Extra Clear Glass Others |

| By End-User | Building & Construction Automotive Solar Energy Consumer Goods & Electronics Others |

| By Region | North India West & Central India South India East India |

| By Application | Architectural (Windows, Facades, Partitions) Automotive (Windshields, Windows, Sunroofs) Solar Panels & Photovoltaics Furniture & Interior Others |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Architects, Builders, Project Managers |

| Commercial Building Developments | 80 | Real Estate Developers, Facility Managers |

| Automotive Glass Applications | 60 | Automotive Engineers, Procurement Managers |

| Retail and Distribution Channels | 50 | Retail Managers, Supply Chain Coordinators |

| Energy-efficient Glass Solutions | 40 | Sustainability Consultants, Product Development Managers |

The India Flat Glass Market is valued at approximately USD 3.7 billion, driven by growth in the construction sector, energy-efficient glazing solutions, and consumer preferences for aesthetic and functional glass products.