Region:Asia

Author(s):Dev

Product Code:KRAD1724

Pages:100

Published On:November 2025

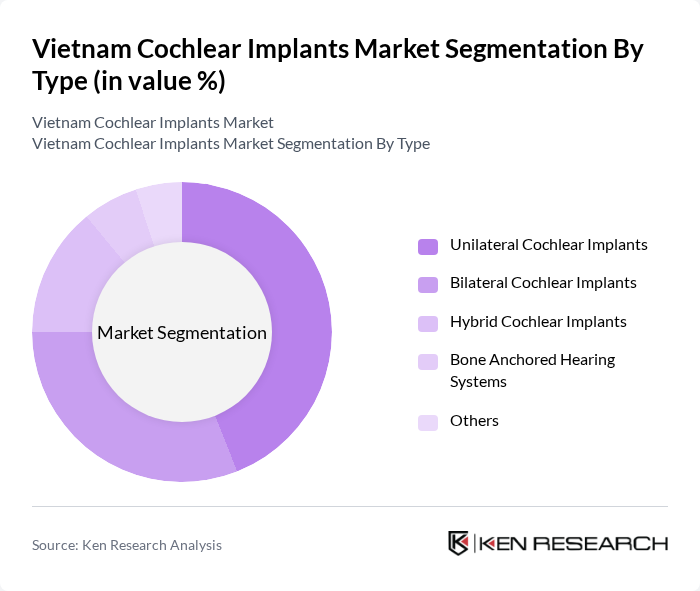

By Type:The cochlear implants market can be segmented into various types, including Unilateral Cochlear Implants, Bilateral Cochlear Implants, Hybrid Cochlear Implants, Bone Anchored Hearing Systems, and Others. Among these,Unilateral Cochlear Implantsare the most widely used due to their effectiveness in treating single-sided deafness, which is prevalent in many patients. The increasing awareness of hearing loss and the benefits of early intervention have led to a growing preference for these implants.Bilateral Cochlear Implantsare also gaining traction as they provide improved sound localization and better hearing in noisy environments, making them a popular choice among users .

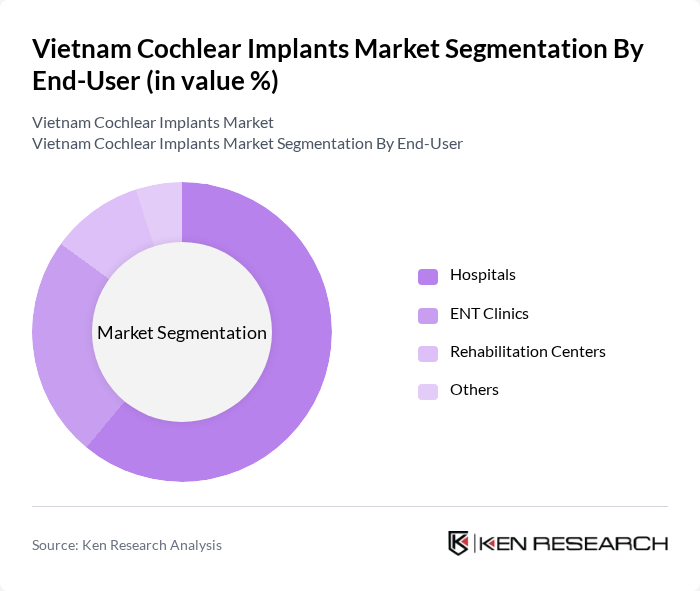

By End-User:The market can also be segmented based on end-users, which include Hospitals, ENT Clinics, Rehabilitation Centers, and Others.Hospitalsare the leading end-users due to their comprehensive facilities and specialized staff capable of performing cochlear implant surgeries. The increasing number of surgeries performed in hospitals is driven by the availability of advanced medical technologies and the growing patient population seeking treatment for hearing loss.ENT Clinicsare also significant players, providing specialized care and follow-up services for patients with cochlear implants .

The Vietnam Cochlear Implants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cochlear Limited, MED-EL Medical Electronics, Advanced Bionics, Oticon Medical, Sonova Holding AG, Nurotron Biotechnology Co., Ltd., GN Hearing, Demant A/S, WS Audiology, Amplifon S.p.A., Starkey Hearing Technologies, Eargo, Inc., Hough Ear Institute, HearingLife, Audicus contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam cochlear implants market is poised for significant growth, driven by technological advancements and increasing public awareness. As healthcare infrastructure improves, more patients will gain access to specialized services. The integration of digital technology in cochlear implants will enhance user experience, while telehealth services will facilitate post-operative care. Additionally, government initiatives aimed at improving healthcare accessibility will further support market expansion, ensuring that more individuals receive timely interventions for hearing loss.

| Segment | Sub-Segments |

|---|---|

| By Type | Unilateral Cochlear Implants Bilateral Cochlear Implants Hybrid Cochlear Implants Bone Anchored Hearing Systems Others |

| By End-User | Hospitals ENT Clinics Rehabilitation Centers Others |

| By Age Group | Pediatric Adult Geriatric Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Implant Technology | Analog Implants Digital Implants Others |

| By Payment Model | Out-of-Pocket Insurance Coverage Government Subsidies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Otolaryngologists, Audiologists |

| Patients with Cochlear Implants | 80 | Patients, Caregivers |

| Hospital Administrators | 60 | Hospital Administrators, Procurement Managers |

| Manufacturers and Distributors | 50 | Sales Managers, Product Specialists |

| Policy Makers | 40 | Health Policy Analysts, Government Officials |

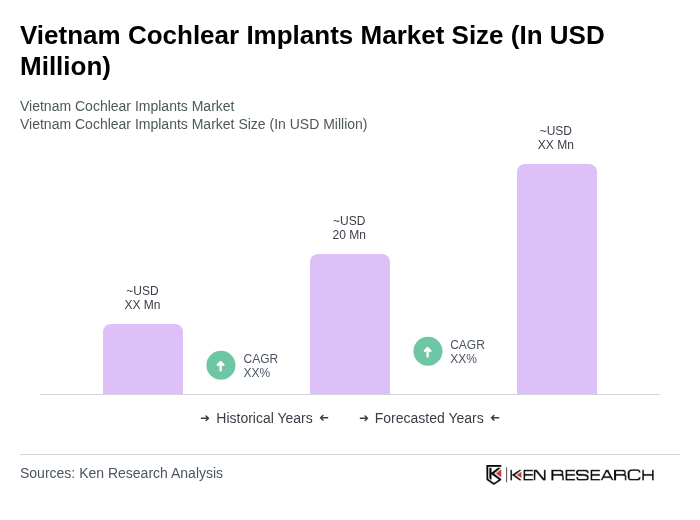

The Vietnam Cochlear Implants Market is valued at approximately USD 20 million, reflecting a significant increase driven by rising awareness of hearing impairments, advancements in medical technology, and increased healthcare expenditure.