Region:Middle East

Author(s):Rebecca

Product Code:KRAD6206

Pages:84

Published On:December 2025

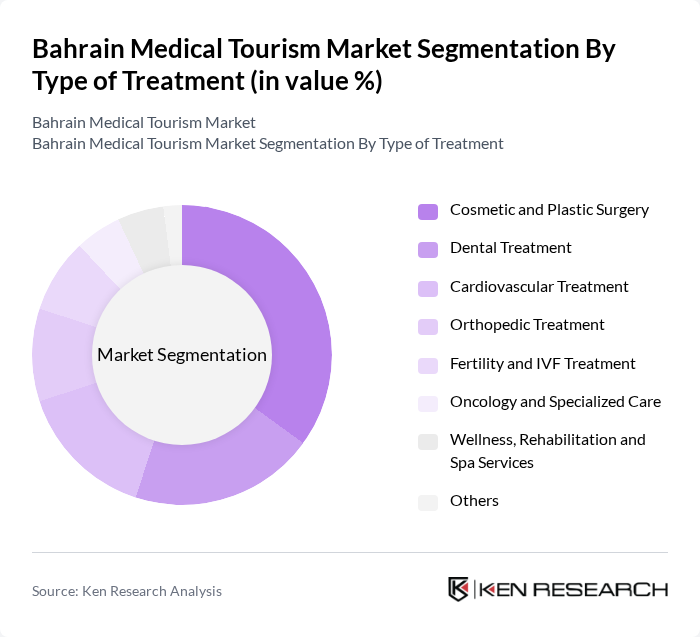

By Type of Treatment:

The major subsegments under this category include Cosmetic and Plastic Surgery, Dental Treatment, Cardiovascular Treatment, Orthopedic Treatment, Fertility and IVF Treatment, Oncology and Specialized Care, Wellness, Rehabilitation and Spa Services, and Others. Among these, Cosmetic and Plastic Surgery is the leading subsegment, driven by increasing consumer awareness and demand for aesthetic procedures. The rise in social media influence and the desire for enhanced personal appearance have significantly contributed to the growth of this segment, making it a preferred choice for many medical tourists.

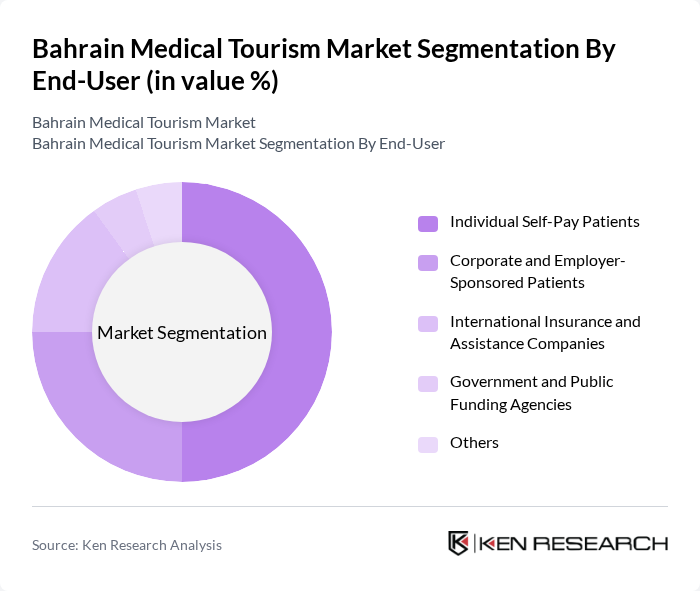

By End-User:

This segmentation includes Individual Self-Pay Patients, Corporate and Employer-Sponsored Patients, International Insurance and Assistance Companies, Government and Public Funding Agencies, and Others. The Individual Self-Pay Patients segment dominates the market, as many medical tourists prefer to pay out-of-pocket for treatments to avoid lengthy insurance processes. This trend is particularly evident among patients seeking elective procedures, where the desire for immediate access to healthcare services drives their decision-making.

The Bahrain Medical Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Specialist Hospital, Royal Bahrain Hospital, American Mission Hospital, KIMSHEALTH Hospital Bahrain, Al Hilal Healthcare Group, King Hamad University Hospital, Salmaniya Medical Complex, Bahrain Defence Force (BDF) Royal Medical Services, Noor Specialist Hospital, Middle East Hospital & Medical Centers, Ibn Al-Nafees Hospital, Al Salam Specialist Hospital, Al Jazeera Medical Center, Royal Bahrain Rehabilitation Center, Dr. Haif Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of Bahrain's medical tourism market appears promising, driven by ongoing investments in healthcare infrastructure and a growing emphasis on patient-centric care. As telemedicine and virtual consultations gain traction, Bahrain can leverage these technologies to enhance accessibility for international patients. Additionally, the increasing focus on wellness tourism presents opportunities for Bahrain to diversify its offerings, catering to a broader demographic seeking holistic health solutions and specialized medical services.

| Segment | Sub-Segments |

|---|---|

| By Type of Treatment | Cosmetic and Plastic Surgery Dental Treatment Cardiovascular Treatment Orthopedic Treatment Fertility and IVF Treatment Oncology and Specialized Care Wellness, Rehabilitation and Spa Services Others |

| By End-User | Individual Self-Pay Patients Corporate and Employer-Sponsored Patients International Insurance and Assistance Companies Government and Public Funding Agencies Others |

| By Origin of Patients | GCC Countries Other Middle East and North Africa South Asia Europe North America Others |

| By Service Provider Type | Private JCI-Accredited Hospitals Other Private Hospitals Public and Military Hospitals Specialized Clinics and Day Surgery Centers Wellness and Rehabilitation Centers Others |

| By Payer / Payment Method | Out-of-Pocket (Self-Pay) International Private Health Insurance Employer-Sponsored and Corporate Plans Government and Public Schemes Others |

| By Duration of Stay | Short-term (1-3 days) Medium-term (4-7 days) Long-term (8+ days) Others |

| By Marketing and Access Channel | Direct Online Channels (Hospital Websites, Portals) International Medical Tourism Facilitators Referral from Physicians and Existing Patients Partnerships with Travel and Hospitality Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| International Patient Experiences | 120 | Patients who traveled to Bahrain for medical procedures |

| Healthcare Provider Insights | 90 | Doctors, Surgeons, and Hospital Administrators |

| Medical Tourism Facilitators | 70 | Travel Agents and Medical Tourism Coordinators |

| Government and Regulatory Bodies | 50 | Policy Makers and Health Ministry Officials |

| Market Analysts and Experts | 40 | Healthcare Market Analysts and Industry Experts |

The Bahrain Medical Tourism Market is valued at approximately USD 350 million, reflecting significant growth driven by investments in healthcare infrastructure, advanced medical technologies, and government initiatives aimed at promoting medical tourism.