Region:Asia

Author(s):Shubham

Product Code:KRAB1304

Pages:97

Published On:October 2025

By Type:The cold chain market is segmented into various types, including Refrigerated Transport, Cold Storage Facilities, Refrigerated Warehousing, Refrigerated Distribution, Transportation Management Systems, Temperature-Controlled Packaging, Monitoring Systems, Logistics Management Software, and Others. Each of these segments plays a crucial role in ensuring the effective handling and distribution of seafood products. Refrigerated Transport and Cold Storage Facilities remain the most significant contributors to market growth, driven by the need for rapid, temperature-controlled movement of high-value seafood and the expansion of export-oriented cold storage capacity in major urban centers .

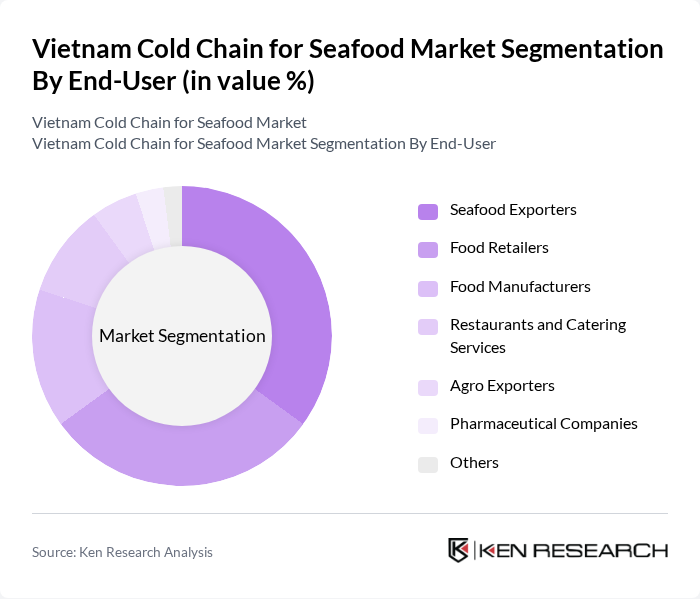

By End-User:The end-user segmentation includes Seafood Exporters, Food Retailers, Food Manufacturers, Restaurants and Catering Services, Agro Exporters, Pharmaceutical Companies, and Others. Seafood Exporters and Food Retailers are the leading segments, driven by the increasing demand for fresh seafood in both domestic and international markets, as well as the growing trend of online food delivery services. Food manufacturers and restaurants also contribute significantly, reflecting the rising consumption of processed and ready-to-eat seafood products in urban centers .

The Vietnam Cold Chain for Seafood Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vinh Hoan Corporation, Minh Phu Seafood Corporation, Thuan An Seafood Processing Company, Camimex Group, Hai Vuong Co., Ltd., Nam Viet Corporation, An Phat Holdings, Quoc Viet Seafood Co., Ltd., Binh An Seafood Joint Stock Company (Bianfishco), Saigon Newport Corporation, Cuu Long Fish Joint Stock Company, Dong Giao Foodstuff Export Joint Stock Company (Doveco), Phu Cuong Seafood Processing and Import-Export Co., Ltd., Tan Thanh Seafood Co., Ltd., Viet Uc Seafood Corporation, VIETPHAT Group, Cold Storage Thang Loi, TransContinental, Vinamilk, CJ Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam cold chain for seafood market appears promising, driven by increasing consumer awareness of food safety and quality. As the demand for fresh and sustainably sourced seafood rises, investments in cold chain infrastructure are expected to grow. Additionally, the integration of advanced technologies, such as IoT and automation, will enhance operational efficiency. The government’s commitment to improving cold chain logistics will further support market growth, ensuring that Vietnam remains a key player in the global seafood export market.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Refrigerated Warehousing Refrigerated Distribution Transportation Management Systems Temperature-Controlled Packaging Monitoring Systems Logistics Management Software Others |

| By End-User | Seafood Exporters Food Retailers Food Manufacturers Restaurants and Catering Services Agro Exporters Pharmaceutical Companies Others |

| By Distribution Mode | Direct Sales Online Sales Wholesale Distribution Retail Distribution Export Distribution Others |

| By Application | Seafood (Shrimp, Pangasius, Tuna, etc.) Fruits and Vegetables Dairy and Frozen Desserts Meat and Poultry Processed Foods Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Sales Channel | B2B B2C E-commerce Others |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seafood Processing Facilities | 100 | Operations Managers, Quality Control Supervisors |

| Cold Storage Providers | 60 | Logistics Managers, Facility Directors |

| Distribution Networks | 50 | Supply Chain Coordinators, Fleet Managers |

| Retail Seafood Outlets | 40 | Store Managers, Procurement Officers |

| Government Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Vietnam Cold Chain for Seafood Market is valued at approximately USD 1.2 billion, driven by increasing demand for seafood exports, consumer preferences for fresh products, and advancements in cold chain logistics technology.