Region:Asia

Author(s):Rebecca

Product Code:KRAB1694

Pages:87

Published On:October 2025

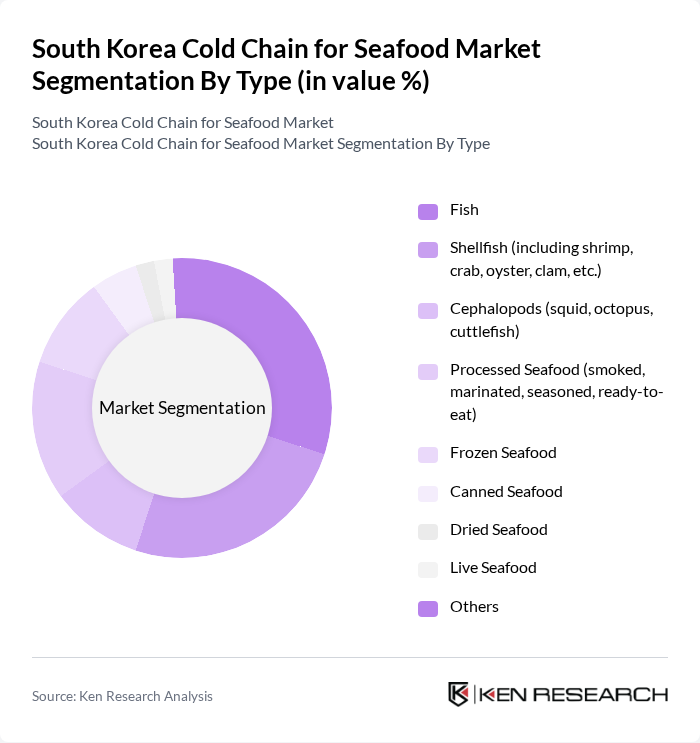

By Type:The market is segmented into various types of seafood products, including fish, shellfish, cephalopods, processed seafood, frozen seafood, canned seafood, dried seafood, live seafood, and others. Among these, fish and shellfish are the most prominent segments, driven by consumer preferences for fresh and diverse seafood options. The frozen and canned seafood segments are gaining significant traction, with frozen/canned products commanding approximately 49.6% of the broader seafood market, reflecting the increasing demand for convenience and ready-to-eat meals among time-conscious urban consumers.

By End-User:The end-user segmentation includes retail, food service, wholesale/distributors, and exporters/importers. The retail segment, comprising supermarkets, hypermarkets, and convenience stores, is the largest due to the growing consumer demand for seafood products. The food service sector is also significant, driven by the increasing number of restaurants and catering services focusing on seafood offerings. Cold chain logistics particularly benefit from the meat, seafood, and poultry category, which retained the largest slice at 26.8% of the food logistics market, reflecting the critical importance of temperature-controlled distribution for these perishable products.

The South Korea Cold Chain for Seafood Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dongwon Industries, Sajo Industries, Jeil Food, Hansung Enterprise, Daewon Fisheries, Samho F&G, Haeundae Suhyup (Haeundae Fisheries Cooperative), Korea Cold Storage Co., Ltd., Seajoy Korea, Hanjin Transportation, CJ Logistics, Lotte Global Logistics, SK Networks, Hyundai Glovis, KCTC (Korea Container Terminal Co., Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The South Korea cold chain for seafood market is poised for significant transformation, driven by technological innovations and evolving consumer preferences. As sustainability becomes a priority, companies are likely to adopt eco-friendly practices in sourcing and distribution. Additionally, the integration of advanced tracking systems will enhance transparency and traceability, fostering consumer trust. The market is expected to see increased collaboration between seafood producers and logistics providers, optimizing supply chain efficiency and ensuring product quality in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fish Shellfish (including shrimp, crab, oyster, clam, etc.) Cephalopods (squid, octopus, cuttlefish) Processed Seafood (smoked, marinated, seasoned, ready-to-eat) Frozen Seafood Canned Seafood Dried Seafood Live Seafood Others |

| By End-User | Retail (supermarkets, hypermarkets, convenience stores) Food Service (restaurants, hotels, catering) Wholesale/Distributors Exporters/Importers |

| By Distribution Channel | Direct Sales Online Sales Supermarkets/Hypermarkets Specialty Seafood Stores Foodservice Distributors |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging (MAP) Bulk Packaging Individual Quick Freezing (IQF) Packaging |

| By Temperature Control | Chilled (0–4°C) Frozen (below -18°C) |

| By Region | Seoul Busan Incheon Jeju Others |

| By Price Range | Premium Mid-range Economy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seafood Processing Facilities | 85 | Operations Managers, Quality Control Supervisors |

| Cold Storage Providers | 65 | Facility Managers, Logistics Coordinators |

| Seafood Retailers | 75 | Store Managers, Supply Chain Analysts |

| Distribution Networks | 60 | Logistics Directors, Fleet Managers |

| Regulatory Bodies | 45 | Policy Makers, Compliance Officers |

The South Korea Cold Chain for Seafood Market is valued at approximately USD 3.7 billion, reflecting a significant growth driven by increasing consumer demand for fresh seafood and advancements in cold chain logistics and technology.