Region:Asia

Author(s):Rebecca

Product Code:KRAD8418

Pages:87

Published On:December 2025

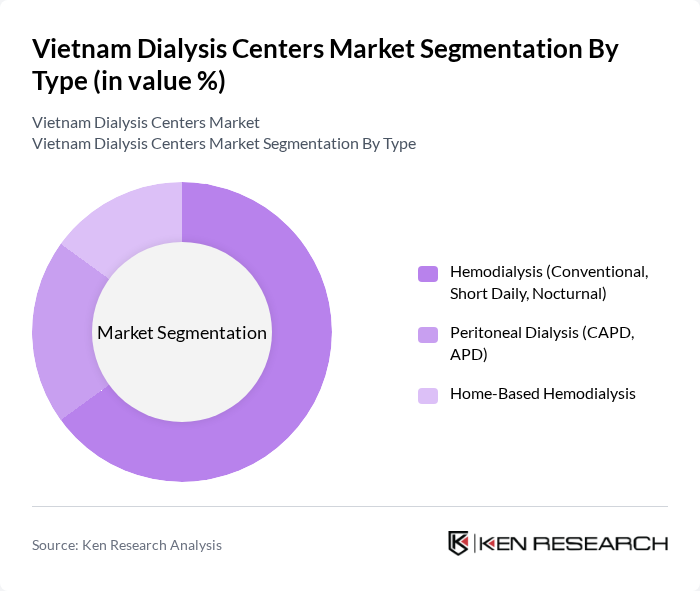

By Type:The market is segmented into Hemodialysis (Conventional, Short Daily, Nocturnal), Peritoneal Dialysis (CAPD, APD), and Home-Based Hemodialysis. Hemodialysis remains the dominant segment due to its widespread acceptance and established protocols in clinical settings. The increasing number of patients opting for home-based solutions is also notable, driven by the desire for convenience and flexibility.

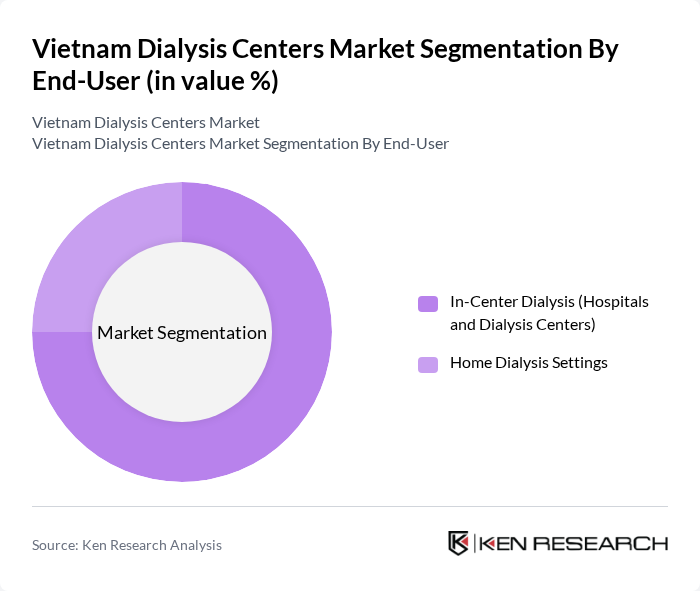

By End-User:The market is divided into In-Center Dialysis (Hospitals and Dialysis Centers) and Home Dialysis Settings. In-Center Dialysis is the leading segment, primarily due to the availability of specialized medical staff and advanced equipment. However, the trend towards home dialysis is gaining traction as patients seek more autonomy and comfort in their treatment regimens.

The Vietnam Dialysis Centers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fresenius Medical Care, DaVita Inc., Medtronic, Baxter International, B. Braun Melsungen AG, Nipro Corporation, Asahi Kasei Medical, Renal Care Group, Dialysis Clinic, Inc., Vietnam National Kidney Foundation, Ho Chi Minh City Dialysis Center, Hanoi Dialysis Center contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam dialysis centers market is poised for significant transformation, driven by technological advancements and demographic shifts. As the prevalence of chronic kidney diseases continues to rise, the demand for accessible and efficient dialysis services will increase. The integration of telemedicine and home dialysis solutions is expected to enhance patient care, particularly in rural areas. Additionally, partnerships with international healthcare providers may facilitate knowledge transfer and improve service quality, ultimately benefiting the overall healthcare landscape in Vietnam.

| Segment | Sub-Segments |

|---|---|

| By Type | Hemodialysis (Conventional, Short Daily, Nocturnal) Peritoneal Dialysis (CAPD, APD) Home-Based Hemodialysis |

| By End-User | In-Center Dialysis (Hospitals and Dialysis Centers) Home Dialysis Settings |

| By Product and Services | Equipment (Dialysis Machines, Water Treatment Systems) Consumables (Dialyzers, Catheters) Dialysis Drugs Services |

| By Geographic Distribution | Northern Vietnam Central Vietnam Southern Vietnam |

| By Insurance Coverage | Public Insurance/Reimbursement Private Insurance Out-of-Pocket |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Patient Experience in Dialysis Centers | 140 | Dialysis Patients, Caregivers |

| Healthcare Provider Insights | 120 | Nephrologists, Dialysis Nurses |

| Operational Challenges in Dialysis Centers | 100 | Hospital Administrators, Center Managers |

| Market Trends and Innovations | 80 | Healthcare Analysts, Industry Experts |

| Government Policy Impact on Dialysis Services | 60 | Health Policy Makers, Regulatory Officials |

The Vietnam Dialysis Centers Market is valued at approximately USD 20 million, driven by the increasing prevalence of chronic kidney diseases, advancements in dialysis technology, and a growing aging population. This market is expected to expand further as healthcare access improves.