Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4851

Pages:84

Published On:December 2025

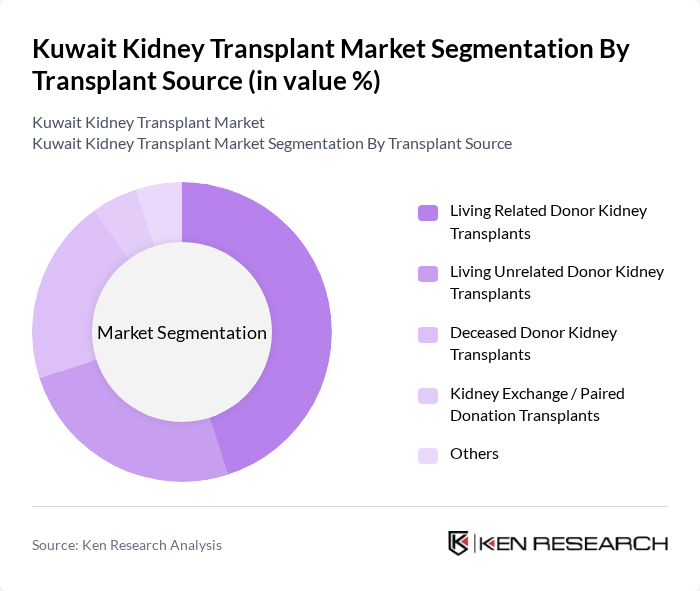

By Transplant Source:The market is segmented into various transplant sources, including Living Related Donor Kidney Transplants, Living Unrelated Donor Kidney Transplants, Deceased Donor Kidney Transplants, Kidney Exchange / Paired Donation Transplants, and Others. In Kuwait and the wider Gulf region, living donor kidney transplantation remains the predominant modality, with a large proportion of grafts sourced from biologically related family members, reflecting strong cultural and familial support for directed donation. This segment is favored for its higher success rates, better graft survival, and shorter waiting times compared to deceased donor transplants, as planned living donor procedures reduce cold ischemia time and allow optimization of both donor and recipient before surgery.

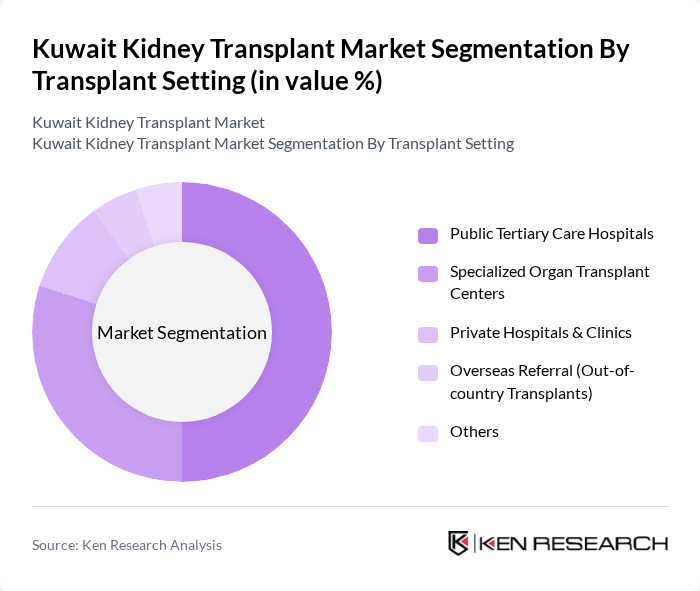

By Transplant Setting:This segment includes Public Tertiary Care Hospitals, Specialized Organ Transplant Centers, Private Hospitals & Clinics, Overseas Referral (Out-of-country Transplants), and Others. Public Tertiary Care Hospitals lead this segment due to their comprehensive facilities, multidisciplinary transplant teams, and experienced nephrology and urology units, which are crucial for performing complex transplant surgeries and managing long-term follow-up. These hospitals are often preferred by patients for their established reputation, coverage under the public health system, and the availability of advanced medical technologies such as high-end imaging, immunological laboratories, and intensive care units tailored to transplant patients.

The Kuwait Kidney Transplant Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Center for Kidney Diseases and Transplants (KCKDT), Al-Sabah Health Zone, Organ Transplantation Department, Jaber Al-Ahmad Al-Sabah Hospital, Mubarak Al-Kabeer Hospital, Al-Amiri Hospital, Farwaniya Hospital, Adan Hospital (Al-Adan Hospital), Al-Sabah Hospital, Al-Jahra Hospital (New Jahra Hospital), Ibn Sina Hospital, Kuwait University – Faculty of Medicine & affiliated nephrology units, Kuwait Cancer Control Center (For oncology-related transplant comanagement), Al-Razi Orthopedic Hospital (Support services & perioperative care), Private Sector: Dar Al Shifa Hospital, Private Sector: Al Salam International Hospital, Private Sector: New Mowasat Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the kidney transplant market in Kuwait appears promising, driven by increasing government investment in healthcare infrastructure and a growing acceptance of living donor transplants. As public awareness campaigns continue to educate citizens about organ donation, the number of registered donors is expected to rise. Furthermore, the integration of telemedicine in post-transplant care will enhance patient monitoring and support, ultimately improving outcomes and patient satisfaction in the transplant process.

| Segment | Sub-Segments |

|---|---|

| By Transplant Source | Living Related Donor Kidney Transplants Living Unrelated Donor Kidney Transplants Deceased Donor Kidney Transplants Kidney Exchange / Paired Donation Transplants Others |

| By Transplant Setting | Public Tertiary Care Hospitals Specialized Organ Transplant Centers Private Hospitals & Clinics Overseas Referral (Out-of-country Transplants) Others |

| By Patient Profile | Adult Patients (?18 years) Pediatric Patients (<18 years) High-Risk / Co-morbid Patients (e.g., diabetes, CVD) Re-transplant / Graft Failure Patients Others |

| By Clinical Indication | Diabetic Nephropathy Hypertensive Nephrosclerosis Glomerulonephritis Polycystic Kidney Disease and Genetic Disorders Other Causes of End-Stage Kidney Disease |

| By Care Pathway | Pre-Transplant Evaluation & Work-Up Transplant Surgery & Perioperative Care Early Post-Transplant Follow-Up (0–12 months) Long-Term Post-Transplant Management (>12 months) Others |

| By Payer / Funding Source | Ministry of Health Funding Government Health Insurance & Social Schemes Private Health Insurance Self-Pay / Out-of-Pocket Others |

| By Supporting Technology & Services | Organ Procurement & Preservation Solutions Surgical & Laparoscopic Transplant Techniques Immunosuppressive Drug Management Laboratory & Imaging Diagnostics for Transplant Tele-nephrology & Remote Monitoring Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nephrologist Insights | 50 | Nephrologists, Kidney Specialists |

| Patient Experience Feedback | 120 | Kidney Transplant Recipients, Caregivers |

| Healthcare Administrator Perspectives | 40 | Hospital Administrators, Transplant Coordinators |

| Policy Maker Interviews | 40 | Health Policy Makers, Regulatory Officials |

| Pharmaceutical Insights | 40 | Pharmaceutical Representatives, Medical Sales Reps |

The Kuwait Kidney Transplant Market is valued at approximately USD 35 million, reflecting a five-year historical analysis. This growth is driven by the rising prevalence of chronic kidney diseases and advancements in transplant technologies.