Region:Asia

Author(s):Geetanshi

Product Code:KRAB2744

Pages:96

Published On:October 2025

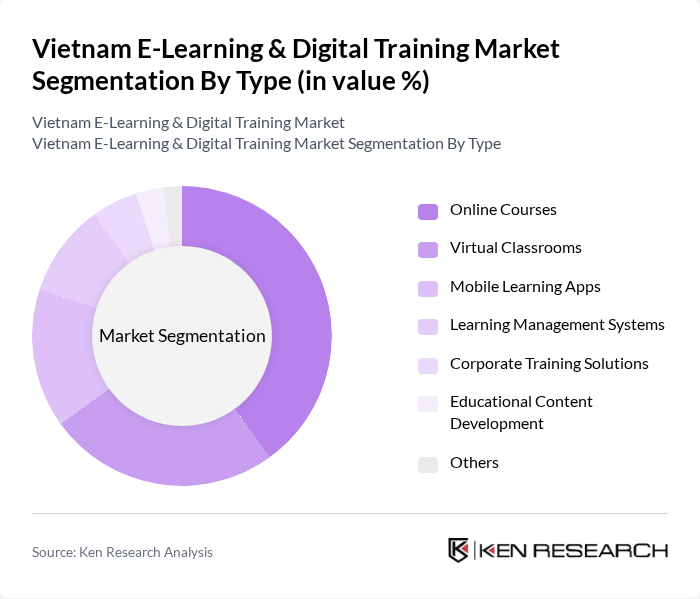

By Type:The e-learning market is segmented into various types, including Online Courses, Virtual Classrooms, Mobile Learning Apps, Learning Management Systems, Corporate Training Solutions, Educational Content Development, and Others. Among these, Online Courses have emerged as the leading sub-segment, driven by the increasing preference for self-paced learning and the convenience of accessing educational content from anywhere. The rise of mobile learning apps has also contributed significantly to this segment, catering to the growing demand for on-the-go education.

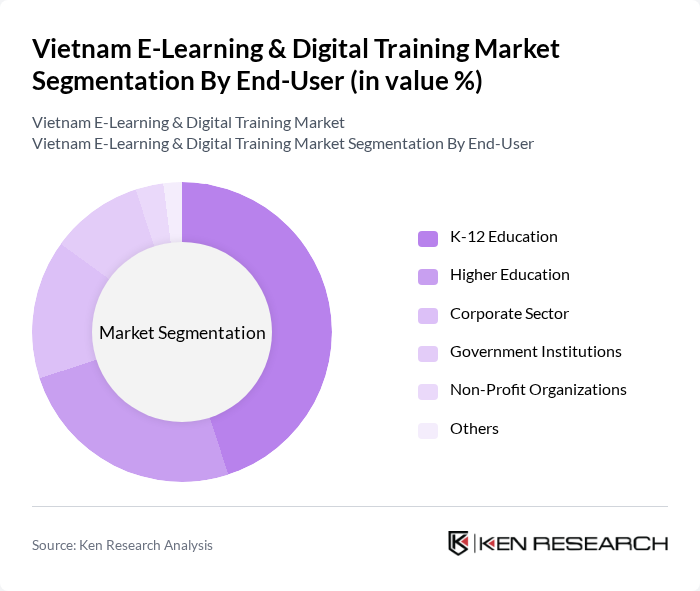

By End-User:The market is also segmented by end-users, which include K-12 Education, Higher Education, Corporate Sector, Government Institutions, Non-Profit Organizations, and Others. The K-12 Education segment is currently the most dominant, as schools increasingly adopt e-learning solutions to enhance teaching and learning experiences. The corporate sector is also witnessing significant growth, as companies invest in digital training programs to upskill their workforce and improve productivity.

The Vietnam E-Learning & Digital Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Topica Edtech Group, Kyna.vn, Edumall, Hocmai.vn, VnEdu (Vietnam Education Publishing House), Unica, MindX, Viettel Group, FPT Corporation, Coursera, Udemy, VTC Academy, HOC247, Edtech Vietnam, Vietnam National University (VNU) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's e-learning and digital training market appears promising, driven by technological advancements and increasing acceptance of online education. As the government continues to invest in digital infrastructure, more learners will gain access to quality educational resources. Additionally, the integration of artificial intelligence and personalized learning experiences will enhance engagement and effectiveness. The focus on lifelong learning will further encourage individuals to pursue continuous education, creating a dynamic and evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Virtual Classrooms Mobile Learning Apps Learning Management Systems Corporate Training Solutions Educational Content Development Others |

| By End-User | K-12 Education Higher Education Corporate Sector Government Institutions Non-Profit Organizations Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Others |

| By Content Type | Video Lectures Interactive Quizzes E-books and Reading Materials Certification Programs Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Others |

| By Geographic Reach | Urban Areas Rural Areas National Reach International Reach |

| By User Demographics | Age Group (Children, Adults) Professional Background (Students, Working Professionals) Learning Preferences (Visual, Auditory, Kinesthetic) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 E-Learning Platforms | 120 | School Administrators, Teachers, Parents |

| Higher Education Online Courses | 100 | University Professors, Course Coordinators, Students |

| Corporate Training Solutions | 80 | HR Managers, Training Coordinators, Employees |

| Mobile Learning Applications | 70 | App Developers, Users, Educational Content Creators |

| Government E-Learning Initiatives | 60 | Policy Makers, Educational Planners, NGO Representatives |

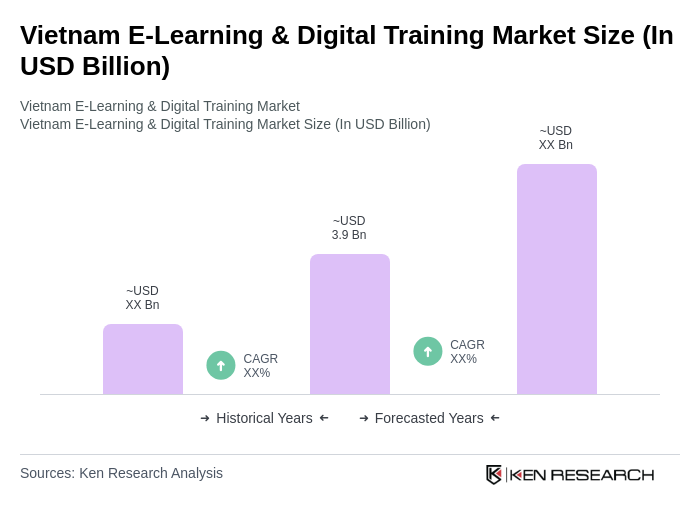

The Vietnam E-Learning & Digital Training Market is valued at approximately USD 3.9 billion, reflecting significant growth driven by increased digital technology adoption, internet penetration, and demand for flexible learning solutions, particularly accelerated by the COVID-19 pandemic.