Region:Asia

Author(s):Geetanshi

Product Code:KRAA3711

Pages:80

Published On:September 2025

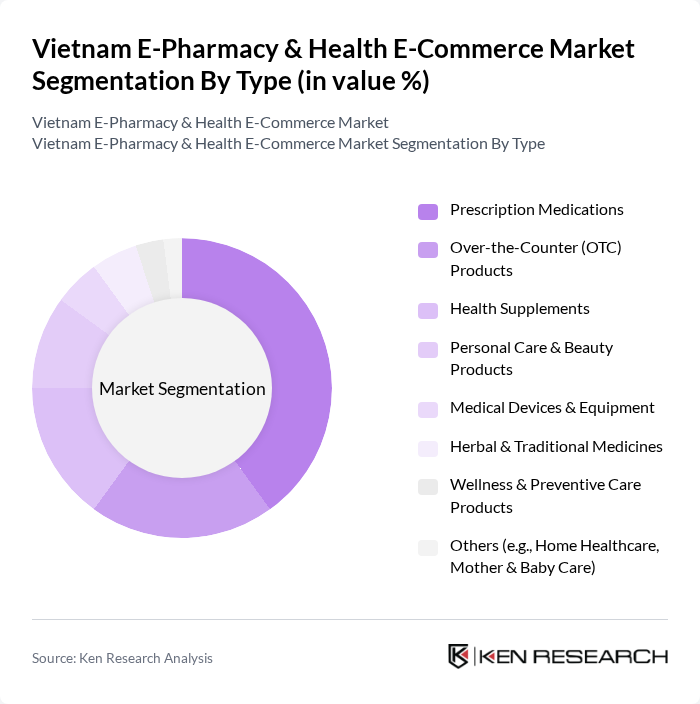

By Type:The market is segmented into various types of products, including Prescription Medications, Over-the-Counter (OTC) Products, Health Supplements, Personal Care & Beauty Products, Medical Devices & Equipment, Herbal & Traditional Medicines, Wellness & Preventive Care Products, and Others (e.g., Home Healthcare, Mother & Baby Care). Among these,Prescription MedicationsandHealth Supplementsare particularly prominent due to increasing health consciousness and the trend of self-medication. E-pharmacies are expanding their product range to include vitamins, dietary supplements, herbal remedies, and wellness products, reflecting consumer demand for preventive and holistic health solutions .

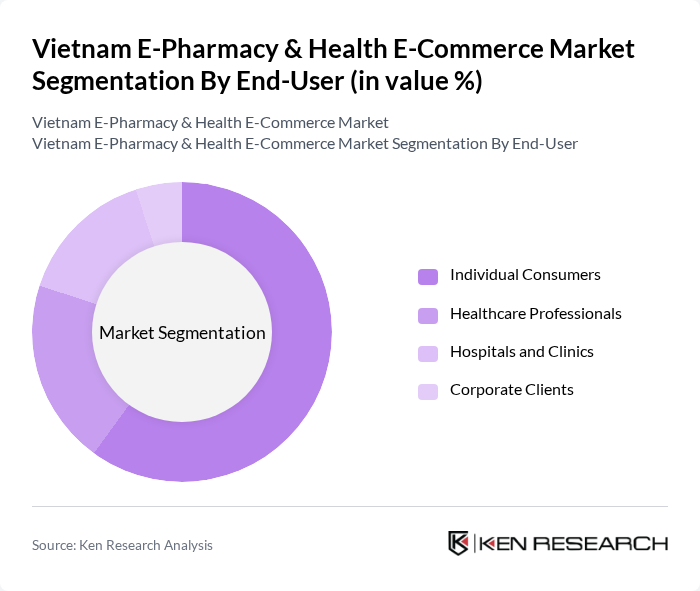

By End-User:The end-user segmentation includes Individual Consumers, Healthcare Professionals, Hospitals and Clinics, and Corporate Clients.Individual Consumersrepresent the largest segment, driven by the increasing trend of online shopping and the convenience of accessing health products from home. Healthcare Professionals and Hospitals also contribute significantly, as they increasingly rely on e-pharmacy services for patient care and medication management. The growing adoption of digital platforms by both consumers and healthcare providers is strengthening the end-user base .

The Vietnam E-Pharmacy & Health E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pharmacity, Long Chau Pharmacy (FPT Retail), An Khang Pharmacy (The Gioi Di Dong), Medigo, MyPharma, Jio Health, Hoan My Medical Corporation, DrugBank, TikiCare (Tiki.vn Health Vertical), Lazada Health, Shopee Health, An Phuoc Pharmacy, Phuoc An Pharmacy, Viettel Media (Viettel Solutions Health), Med247 contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's e-pharmacy and health e-commerce market appears promising, driven by technological advancements and changing consumer behaviors. As digital health solutions become more integrated into everyday life, e-pharmacies are expected to enhance their service offerings, focusing on user experience and personalized care. Additionally, the collaboration between e-pharmacies and healthcare providers will likely expand, creating a more cohesive healthcare ecosystem that prioritizes patient engagement and accessibility in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Medications Over-the-Counter (OTC) Products Health Supplements Personal Care & Beauty Products Medical Devices & Equipment Herbal & Traditional Medicines Wellness & Preventive Care Products Others (e.g., Home Healthcare, Mother & Baby Care) |

| By End-User | Individual Consumers Healthcare Professionals Hospitals and Clinics Corporate Clients |

| By Sales Channel | Direct-to-Consumer (D2C) Platforms Third-Party Marketplaces Mobile Applications Social Commerce (via Social Media) Telemedicine-Integrated E-Pharmacy |

| By Distribution Mode | Home Delivery Click and Collect Pharmacy Pickup |

| By Price Range | Budget Mid-Range Premium |

| By Product Origin | Domestic Products Imported Products |

| By Consumer Demographics | Age Group Gender Income Level Urban vs Rural |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer E-Pharmacy Usage | 120 | Online Shoppers, Health-Conscious Consumers |

| Pharmacy Owners & Managers | 60 | Pharmacy Owners, E-Pharmacy Managers |

| Healthcare Professionals | 50 | Doctors, Pharmacists |

| Logistics Providers for E-Pharmacy | 40 | Logistics Managers, Supply Chain Coordinators |

| Regulatory Bodies & Health Authorities | 40 | Policy Makers, Regulatory Officers |

The Vietnam E-Pharmacy & Health E-Commerce Market is valued at approximately USD 130 million, reflecting significant growth driven by increased digital health adoption and consumer demand for convenient access to medications and health services.