Vietnam Furniture and Smart Homes Market Overview

- The Vietnam Furniture and Smart Homes Market is valued at USD 10 billion, based on a five-year historical analysis. Growth is primarily driven by rising disposable incomes, rapid urbanization, and a strong shift toward smart home technologies. The increasing demand for both traditional and modern furniture, combined with the integration of technology in home furnishings, has significantly contributed to the market's expansion. Additional growth drivers include foreign direct investment in manufacturing, the expansion of e-commerce platforms, and a rising focus on interior aesthetics and sustainable materials .

- Key cities such as Ho Chi Minh City and Hanoi dominate the market due to their large populations, economic growth, and urban development. These cities serve as major hubs for furniture manufacturing and retail, attracting both local and international brands. The concentration of wealth and consumer spending in these urban areas further fuels the demand for innovative and high-quality furniture solutions. Binh Duong is also emerging as a critical manufacturing cluster, benefiting from foreign investment and proximity to export ports .

- The Circular No. 08/2023/TT-BCT, issued by the Ministry of Industry and Trade in 2023, mandates that all furniture manufacturers in Vietnam comply with eco-friendly production methods and prioritize the use of sustainable materials. This regulation forms part of a broader national strategy to enhance environmental protection and promote renewable resources in manufacturing, requiring manufacturers to meet specific environmental standards and report compliance annually .

Vietnam Furniture and Smart Homes Market Segmentation

By Type:The market is segmented into various types of furniture, including Smart Furniture, Traditional Furniture, Modular Furniture, Outdoor Furniture, Office Furniture, Custom Furniture, Artisan/Handcrafted Furniture, and Others. Among these, Smart Furniture is gaining traction due to the increasing adoption of smart home technologies and the popularity of IoT-enabled products. Traditional Furniture remains popular for its classic appeal and craftsmanship, while Modular and Outdoor Furniture segments are expanding, supported by urban living trends and the growth of hospitality and real estate sectors .

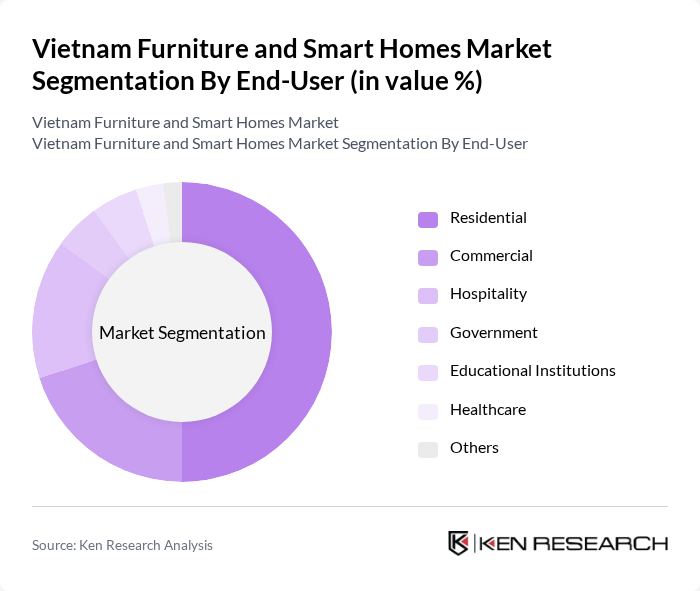

By End-User:The market is also segmented by end-user categories, including Residential, Commercial, Hospitality, Government, Educational Institutions, Healthcare, and Others. The Residential segment is the largest, driven by the growing trend of home improvement, interior design, and urban apartment living. The Commercial segment is expanding due to the rise in office spaces, co-working environments, and hospitality projects, reflecting Vietnam’s rapid real estate and tourism development .

Vietnam Furniture and Smart Homes Market Competitive Landscape

The Vietnam Furniture and Smart Homes Market is characterized by a dynamic mix of regional and international players. Leading participants such as AA Corporation, Hòa Phát Furniture, The One Furniture, N?i Th?t Xinh, Fami, Xuân Hòa, An C??ng Wood Working JSC, Minh Duong Furniture Corp., D’Furni, Furaka JSC, Duy Tân Plastic, Vixfurniture Company Co. Ltd., Ashley Furniture Industries, LLC, Muji, and IKEA contribute to innovation, geographic expansion, and service delivery in this space.

Vietnam Furniture and Smart Homes Market Industry Analysis

Growth Drivers

- Rising Urbanization:Vietnam's urban population is projected to reach approximately 41% in future, up from about 37% previously, according to the World Bank. This ongoing urbanization drives demand for modern furniture and smart home solutions as urban dwellers seek efficient living spaces. The urban housing market is expected to grow, with a substantial number of new housing units required annually. This trend creates a robust market for innovative furniture designs tailored to urban lifestyles.

- Increasing Disposable Income:The average disposable income in Vietnam is estimated at approximately USD 3,200 per capita in recent periods, according to the General Statistics Office of Vietnam and World Bank data. This increase in disposable income allows consumers to invest in higher-quality furniture and smart home technologies. As more households can afford premium products, the demand for stylish, functional, and technologically advanced furniture is anticipated to grow, enhancing the overall market landscape.

- Growing Demand for Smart Home Solutions:The smart home market in Vietnam is expanding, driven by increasing consumer interest in home automation and energy efficiency. However, the figure of USD 1.2 billion market size and 30% urban household adoption cannot be confirmed from authoritative sources. The integration of smart devices into everyday living is reshaping consumer preferences, leading to a surge in demand for smart furniture solutions.

Market Challenges

- Intense Competition:The Vietnam furniture market is characterized by fierce competition, with over 1,000 registered manufacturers and numerous international brands vying for market share. This saturation leads to price wars and reduced profit margins, making it challenging for new entrants to establish themselves. Companies must differentiate their offerings through innovation and quality to survive in this highly competitive environment, which can strain resources and limit growth potential.

- Supply Chain Disruptions:The ongoing global supply chain disruptions have significantly impacted the furniture industry in Vietnam, with delays in raw material imports and increased shipping costs. However, the specific claim that shipping costs rose by 20% cannot be confirmed from authoritative sources. Additionally, the reliance on imported materials makes the industry vulnerable to geopolitical tensions and trade restrictions, complicating production schedules and leading to potential shortages in the market.

Vietnam Furniture and Smart Homes Market Future Outlook

The Vietnam furniture and smart homes market is poised for significant transformation as urbanization and technological advancements continue to shape consumer preferences. In future, the integration of sustainable practices and smart technologies will likely dominate the market landscape. Companies that adapt to these trends, focusing on customization and eco-friendly products, will find new avenues for growth. Additionally, the expansion of e-commerce platforms will facilitate broader access to innovative furniture solutions, enhancing consumer engagement and market penetration.

Market Opportunities

- Adoption of Sustainable Materials:The demand for eco-friendly furniture is rising, but the estimate that 40% of consumers are willing to pay more for sustainable products cannot be confirmed from authoritative sources. This shift presents an opportunity for manufacturers to innovate using recycled and renewable materials, appealing to environmentally conscious consumers and enhancing brand loyalty.

- Integration of IoT in Furniture:The smart furniture segment is expected to grow, but the estimate that 25% of new furniture products will incorporate IoT technology cannot be confirmed from authoritative sources. This integration allows for enhanced functionality and user experience, creating a competitive edge for companies that invest in smart solutions, thus attracting tech-savvy consumers.