Region:Middle East

Author(s):Shubham

Product Code:KRAA5453

Pages:87

Published On:September 2025

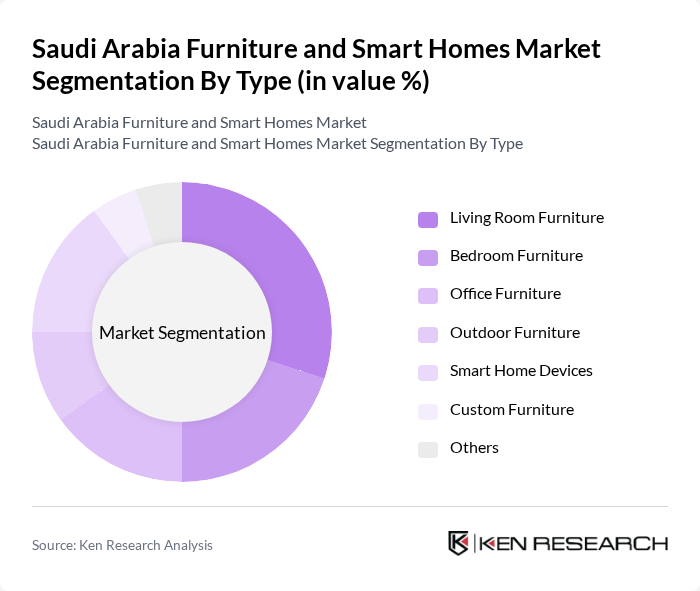

By Type:The market is segmented into various types of furniture and smart home devices, including living room furniture, bedroom furniture, office furniture, outdoor furniture, smart home devices, custom furniture, and others. Among these, living room furniture and smart home devices are particularly prominent due to changing consumer preferences towards multifunctional and technologically integrated solutions. The demand for smart home devices is rapidly increasing as consumers seek convenience and energy efficiency in their homes.

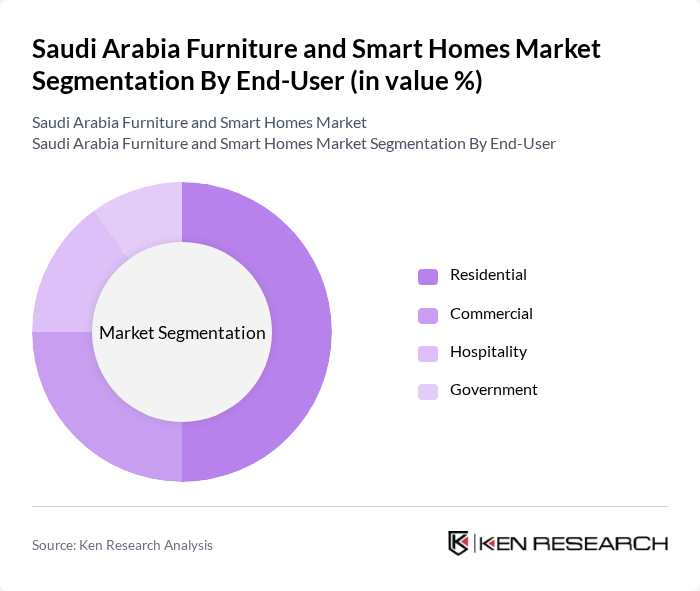

By End-User:The end-user segmentation includes residential, commercial, hospitality, and government sectors. The residential segment is the largest, driven by the increasing number of households and the trend towards home improvement. The commercial sector is also growing, fueled by the expansion of businesses and the need for modern office spaces. The hospitality sector is witnessing a rise in demand for stylish and functional furniture to enhance guest experiences.

The Saudi Arabia Furniture and Smart Homes Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Al-Futtaim Group, Home Centre, Pan Emirates, Abdul Latif Jameel Home, Al-Muhaidib Group, Al-Hokair Group, Landmark Group, Al-Nahda International, Al-Jazira Furniture, Al-Mansour Furniture, Al-Suwaidi Group, Al-Rajhi Group, Al-Faisaliah Group, Al-Muhaidib Furniture contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia furniture and smart homes market is poised for significant transformation as urbanization accelerates and disposable incomes rise. In the future, the integration of advanced technologies in home furnishings will likely become commonplace, driven by consumer demand for convenience and efficiency. Additionally, sustainability trends will shape product offerings, with manufacturers focusing on eco-friendly materials. As e-commerce platforms expand, they will facilitate greater access to innovative products, further enhancing market dynamics and consumer engagement in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture Bedroom Furniture Office Furniture Outdoor Furniture Smart Home Devices Custom Furniture Others |

| By End-User | Residential Commercial Hospitality Government |

| By Sales Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Material | Wood Metal Plastic Fabric |

| By Design Style | Modern Traditional Contemporary Minimalist |

| By Functionality | Multi-functional Furniture Smart Furniture Standard Furniture |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 150 | Homeowners, Interior Designers |

| Smart Home Device Adoption | 100 | Tech-savvy Consumers, Early Adopters |

| Commercial Furniture Solutions | 80 | Office Managers, Facility Coordinators |

| Consumer Preferences in Smart Home Features | 120 | Homeowners, Renters |

| Trends in Sustainable Furniture | 90 | Sustainability Advocates, Eco-conscious Consumers |

The Saudi Arabia Furniture and Smart Homes Market is valued at approximately USD 5 billion, driven by urbanization, rising disposable incomes, and a growing preference for smart home technologies among consumers.