Region:Asia

Author(s):Dev

Product Code:KRAB3024

Pages:93

Published On:October 2025

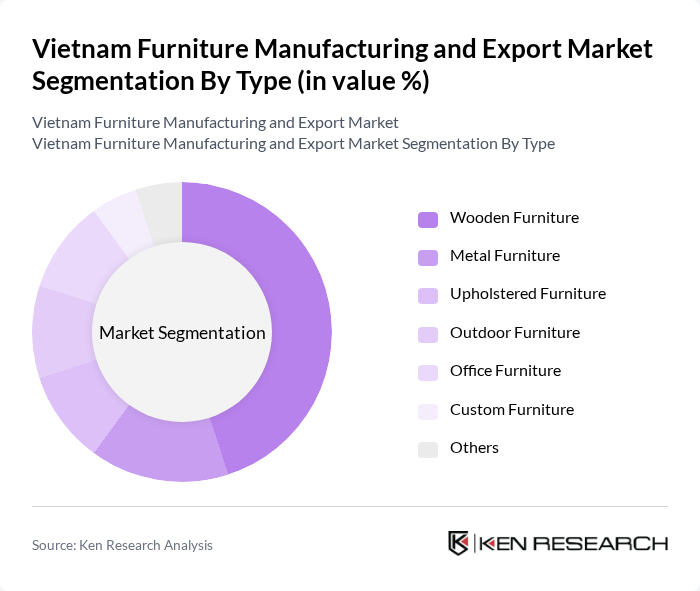

By Type:The furniture manufacturing market is segmented into various types, including Wooden Furniture, Metal Furniture, Upholstered Furniture, Outdoor Furniture, Office Furniture, Custom Furniture, and Others. Among these, Wooden Furniture is the most dominant segment, driven by consumer preferences for natural materials and the aesthetic appeal of wood. The trend towards sustainable and eco-friendly products has further bolstered the demand for wooden furniture, making it a staple in both residential and commercial spaces.

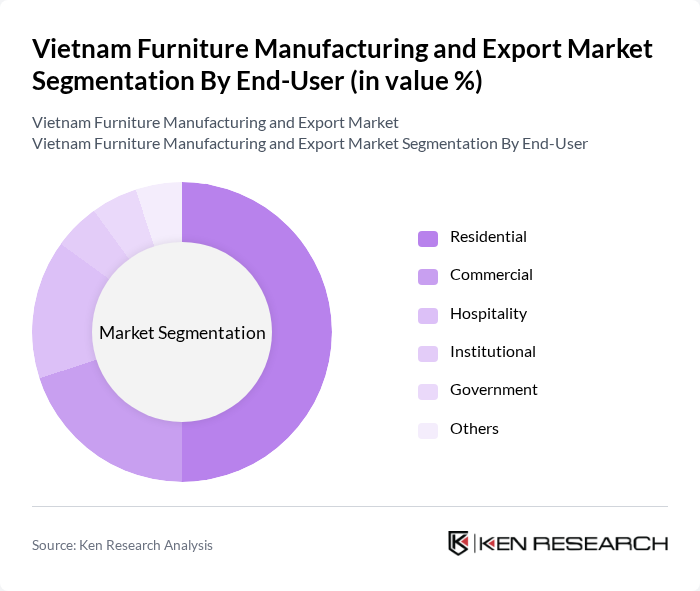

By End-User:The market is also segmented by end-user categories, including Residential, Commercial, Hospitality, Institutional, Government, and Others. The Residential segment leads the market, driven by rising disposable incomes and changing consumer lifestyles that prioritize home aesthetics and comfort. The growing trend of home renovation and interior design has further fueled demand in this segment, making it a key driver of market growth.

The Vietnam Furniture Manufacturing and Export Market is characterized by a dynamic mix of regional and international players. Leading participants such as Scanteak Vietnam, Hòa Phát Furniture, Minh Duong Furniture, An Cuong Wood Working Joint Stock Company, Kuka Home Vietnam, Nha Xinh Furniture, Vietwood, Duy Tan Plastics Corporation, Thien Thanh Furniture, Duy Tan Furniture, Fami Furniture, Xuan Hoa Furniture, Hoang Anh Gia Lai Furniture, Tuan Anh Furniture, Viet Nam Furniture Manufacturing Joint Stock Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's furniture manufacturing and export market appears promising, driven by increasing domestic consumption and expanding international markets. With the government's continued support and investment in technology, manufacturers are likely to enhance production efficiency. Additionally, the growing trend towards sustainable and eco-friendly products will shape consumer preferences, pushing companies to innovate. As e-commerce continues to rise, businesses that adapt to online sales channels will likely capture a larger market share, positioning themselves favorably for future growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Wooden Furniture Metal Furniture Upholstered Furniture Outdoor Furniture Office Furniture Custom Furniture Others |

| By End-User | Residential Commercial Hospitality Institutional Government Others |

| By Distribution Channel | Online Retail Offline Retail Wholesale Direct Sales Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Material | Solid Wood Engineered Wood Metal Plastic Others |

| By Design Style | Modern Traditional Contemporary Rustic Others |

| By Functionality | Multi-functional Space-saving Modular Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wooden Furniture Manufacturers | 100 | Factory Owners, Production Managers |

| Export Logistics Providers | 80 | Logistics Coordinators, Export Managers |

| Retail Furniture Outlets | 70 | Store Managers, Merchandising Directors |

| Market Analysts in Furniture Sector | 50 | Industry Analysts, Economic Researchers |

| Trade Association Representatives | 60 | Policy Makers, Association Leaders |

The Vietnam Furniture Manufacturing and Export Market is valued at approximately USD 15 billion, driven by increasing international demand for high-quality furniture, competitive labor costs, and favorable trade agreements, positioning Vietnam as a preferred sourcing destination.