Region:Asia

Author(s):Rebecca

Product Code:KRAD7431

Pages:88

Published On:December 2025

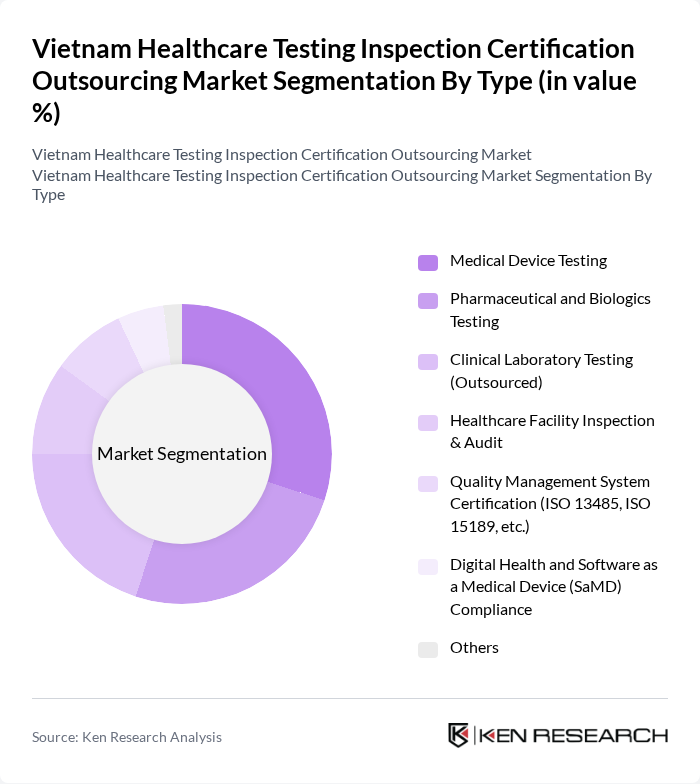

By Type:The market is segmented into various types, including Medical Device Testing, Pharmaceutical and Biologics Testing, Clinical Laboratory Testing (Outsourced), Healthcare Facility Inspection & Audit, Quality Management System Certification (ISO 13485, ISO 15189, etc.), Digital Health and Software as a Medical Device (SaMD) Compliance, and Others. Each of these segments plays a crucial role in ensuring the safety and efficacy of healthcare products and services.

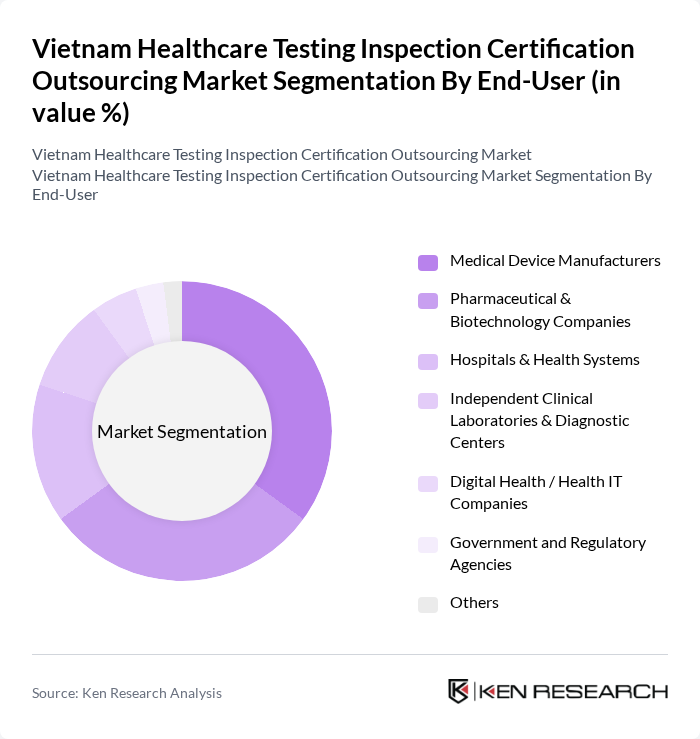

By End-User:The end-user segmentation includes Medical Device Manufacturers, Pharmaceutical & Biotechnology Companies, Hospitals & Health Systems, Independent Clinical Laboratories & Diagnostic Centers, Digital Health / Health IT Companies, Government and Regulatory Agencies, and Others. Each end-user category has distinct requirements and contributes to the overall growth of the market.

The Vietnam Healthcare Testing Inspection Certification Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as SGS Vietnam Ltd., TÜV SÜD Vietnam Co., Ltd., Bureau Veritas Vietnam Co., Ltd., Intertek Vietnam Ltd., UL Solutions Vietnam Co., Ltd., DEKRA Vietnam Co., Ltd., QUACERT – Vietnam Certification Centre (under STAMEQ), QUATEST 1 – Quality Assurance and Testing Center 1, QUATEST 3 – Quality Assurance and Testing Center 3, Ho Chi Minh City Center for Quality Control in Medical Laboratory (Center for External Quality Assessment), Pasteur Institute Ho Chi Minh City – Reference Laboratory Services, National Institute for Control of Vaccines and Biologicals (NICVB), Vinmec Healthcare System – Vinmec International General Hospital Laboratory & QC Services, MEDLATEC General Hospital – MEDLATEC Laboratory Network, National Institute of Hygiene and Epidemiology (NIHE) – Reference Testing Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam healthcare testing inspection certification outsourcing market appears promising, driven by ongoing government reforms and increasing healthcare investments. As the country aims to enhance healthcare quality, the demand for reliable testing and certification services will likely rise. Additionally, the integration of digital health solutions and AI technologies will streamline processes, making them more efficient. The focus on preventive healthcare will further encourage partnerships between local providers and international certification bodies, fostering a collaborative environment for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Medical Device Testing Pharmaceutical and Biologics Testing Clinical Laboratory Testing (Outsourced) Healthcare Facility Inspection & Audit Quality Management System Certification (ISO 13485, ISO 15189, etc.) Digital Health and Software as a Medical Device (SaMD) Compliance Others |

| By End-User | Medical Device Manufacturers Pharmaceutical & Biotechnology Companies Hospitals & Health Systems Independent Clinical Laboratories & Diagnostic Centers Digital Health / Health IT Companies Government and Regulatory Agencies Others |

| By Service Type | Testing Services Inspection & Audit Services Certification & Accreditation Services Regulatory & Compliance Consulting Services Validation & Verification Services Training & Documentation Services Others |

| By Technology | Molecular Diagnostics Immunoassays Next-Generation Sequencing In Vitro Diagnostic (IVD) Platforms Medical Device Electrical & Electromagnetic Safety Testing Software Validation & Cybersecurity Testing Others |

| By Application | Infectious Disease Diagnostics Chronic & Non-Communicable Disease Management Medical Device Safety & Performance Biocompatibility & Sterility Assurance Digital Health & Telemedicine Solutions Others |

| By Investment Source | Domestic Private Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Multilateral and Donor-Funded Programs Government Schemes & Budgetary Allocations |

| By Policy Support | Subsidies & Financial Incentives Tax Exemptions & Duty Relief Fast-Track Regulatory & Licensing Support Capacity-Building & Technical Assistance Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Testing Laboratories | 100 | Laboratory Managers, Quality Assurance Officers |

| Healthcare Certification Bodies | 80 | Certification Auditors, Compliance Managers |

| Public Health Institutions | 70 | Public Health Officials, Program Directors |

| Private Healthcare Providers | 90 | Healthcare Administrators, Medical Directors |

| Regulatory Agencies | 60 | Regulatory Affairs Specialists, Policy Makers |

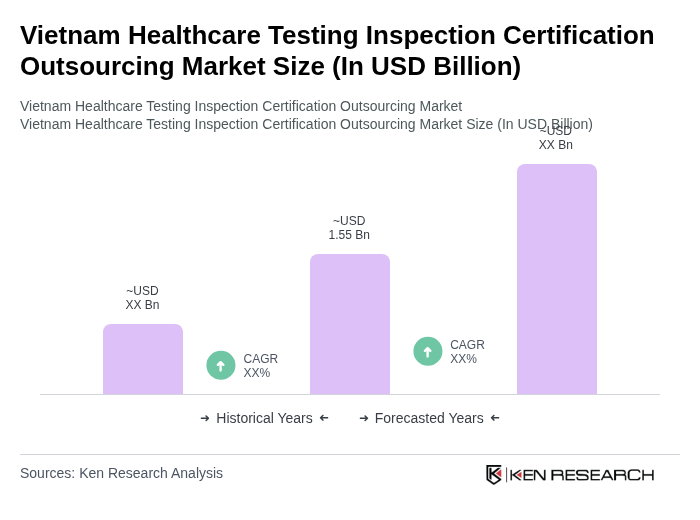

The Vietnam Healthcare Testing Inspection Certification Outsourcing Market is valued at approximately USD 1.55 billion, reflecting significant growth driven by increased demand for quality healthcare services and investments in healthcare infrastructure.