Region:Middle East

Author(s):Dev

Product Code:KRAD5161

Pages:80

Published On:December 2025

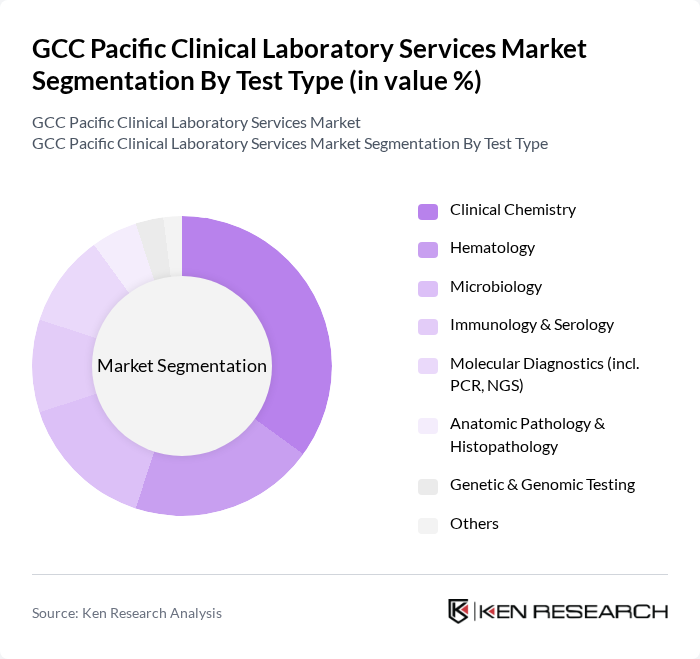

By Test Type:The test type segmentation includes various categories such as Clinical Chemistry, Hematology, Microbiology, Immunology & Serology, Molecular Diagnostics (including PCR and NGS), Anatomic Pathology & Histopathology, Genetic & Genomic Testing, and Others. This structure aligns with global clinical laboratory services segmentation, where test menus are commonly grouped into these core areas. Among these, Clinical Chemistry is the leading sub-segment, supported by strong demand for routine blood tests, liver and renal panels, lipid profiles, and metabolic panels, consistent with global trends where clinical chemistry accounts for the largest share of test volume and revenue. The increasing prevalence of lifestyle-related diseases, especially diabetes, dyslipidemia, and obesity in GCC populations, has further propelled the growth of this segment, making it a critical component of laboratory services.

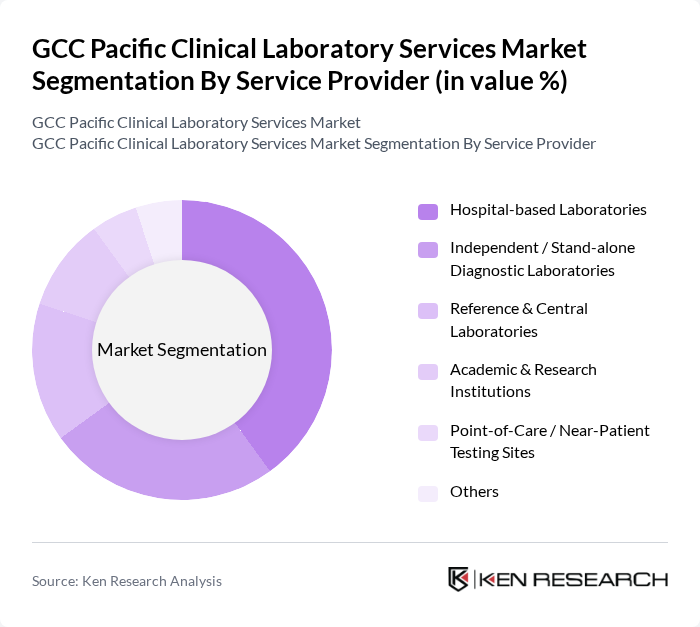

By Service Provider:The service provider segmentation encompasses Hospital-based Laboratories, Independent / Stand-alone Diagnostic Laboratories, Reference & Central Laboratories, Academic & Research Institutions, Point-of-Care / Near-Patient Testing Sites, and Others. This structure is consistent with global categorization of clinical laboratory service providers. Hospital-based Laboratories dominate this segment due to their integration with inpatient and outpatient care, providing immediate access to diagnostic services for emergency, surgical, and complex medical cases; globally, hospital-based laboratories hold the largest share of clinical laboratory revenue. In the GCC region, sustained investment in public and private hospitals, tertiary care centers, and specialized facilities, combined with mandatory health insurance and rising procedure volumes, has further solidified the position of hospital-based laboratories as key providers, while independent and reference laboratories are expanding through networked collection centers and outsourced testing partnerships.

The GCC Pacific Clinical Laboratory Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Borg Diagnostics (Saudi Arabia), Al Borg Medical Laboratories (United Arab Emirates), AlMokhtabar Medical Labs (Integrated Diagnostics Holdings – GCC Operations), Biolab Arabia (Saudi Arabia), Saudi German Health – Laboratory Services, Dr. Sulaiman Al Habib Medical Group – Laboratory Division, National Reference Laboratory (NRL) – Mubadala Health (UAE), Cleveland Clinic Abu Dhabi – Clinical Laboratory, Pure Health – Laboratory Services (UAE), SEHA (Abu Dhabi Health Services Company) – Central Laboratories, Ministry of Health Central Public Health Laboratories (Saudi Arabia), Dubai Health Authority (DHA) – Central Laboratory Services, Life Diagnostics (UAE), New Medical Centre (NMC) Healthcare – Laboratory Services, Aster DM Healthcare – GCC Diagnostic & Laboratory Services contribute to innovation, geographic expansion, adoption of advanced testing technologies, and integrated digital platforms for test ordering and reporting in this space.

The future of the GCC Pacific Clinical Laboratory Services market appears promising, driven by ongoing advancements in technology and a shift towards personalized medicine. As healthcare systems increasingly adopt artificial intelligence and automation, efficiency and accuracy in laboratory services will improve. Additionally, the expansion of telehealth services is expected to facilitate remote diagnostics, enhancing access to healthcare. These trends will likely shape the market landscape, fostering innovation and improving patient outcomes in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Test Type | Clinical Chemistry Hematology Microbiology Immunology & Serology Molecular Diagnostics (incl. PCR, NGS) Anatomic Pathology & Histopathology Genetic & Genomic Testing Others |

| By Service Provider | Hospital-based Laboratories Independent / Stand-alone Diagnostic Laboratories Reference & Central Laboratories Academic & Research Institutions Point-of-Care / Near-Patient Testing Sites Others |

| By Service Type | Routine Testing (Chemistry, Hematology, Coagulation) Specialized & Esoteric Testing Preventive & Wellness Screening Pre-employment & Occupational Health Testing Home & Remote Sample Collection Services Others |

| By Sample Type | Blood Samples Urine Samples Tissue & Biopsy Samples Saliva & Buccal Swab Samples Other Body Fluids (CSF, Synovial, etc.) |

| By Technology | High-throughput Automated Analyzers Semi-automated & Manual Systems Point-of-Care Testing Devices Molecular Diagnostics Platforms Digital Pathology & AI-enabled Systems Others |

| By Geography (Within GCC) | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Payer & Contracting Model | Public Sector & Government-funded Contracts Private Insurance-funded Testing Self-pay / Out-of-pocket Testing Public–Private Partnership (PPP) Models Corporate & Institutional Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Diagnostic Testing Services | 120 | Laboratory Managers, Clinical Pathologists |

| Molecular Testing Services | 100 | Geneticists, Laboratory Technicians |

| Pathology Services | 80 | Pathologists, Medical Directors |

| Point-of-Care Testing | 70 | Healthcare Providers, Clinic Managers |

| Laboratory Equipment Suppliers | 60 | Sales Managers, Product Specialists |

The GCC Pacific Clinical Laboratory Services Market is valued at approximately USD 5.5 billion, reflecting a significant growth driven by the increasing prevalence of chronic diseases and advancements in diagnostic technologies across the region.