Region:Asia

Author(s):Shubham

Product Code:KRAD5496

Pages:88

Published On:December 2025

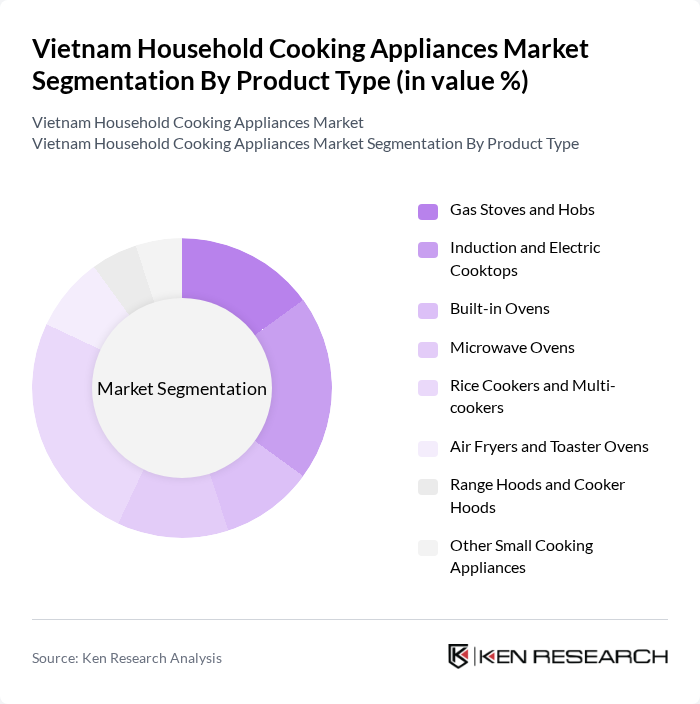

By Product Type:The product type segmentation includes various categories such as Gas Stoves and Hobs, Induction and Electric Cooktops, Built-in Ovens, Microwave Ovens, Rice Cookers and Multi-cookers, Air Fryers and Toaster Ovens, Range Hoods and Cooker Hoods, and Other Small Cooking Appliances. This structure aligns with common segmentation used for kitchen and household cooking appliances in Vietnam, where stoves, ovens, microwave ovens, rice cookers, and air fryers are core categories. Among these, Rice Cookers and Multi-cookers are particularly popular due to their versatility and convenience, fitting well with the traditional emphasis on rice-based meals in Vietnamese households and the long-standing penetration of rice cookers. The growing trend of healthy cooking and interest in oil?reduction has also boosted the demand for Air Fryers and Toaster Ovens, supported by rising sales of air fryers and similar small kitchen appliances across Southeast Asia’s online channels.

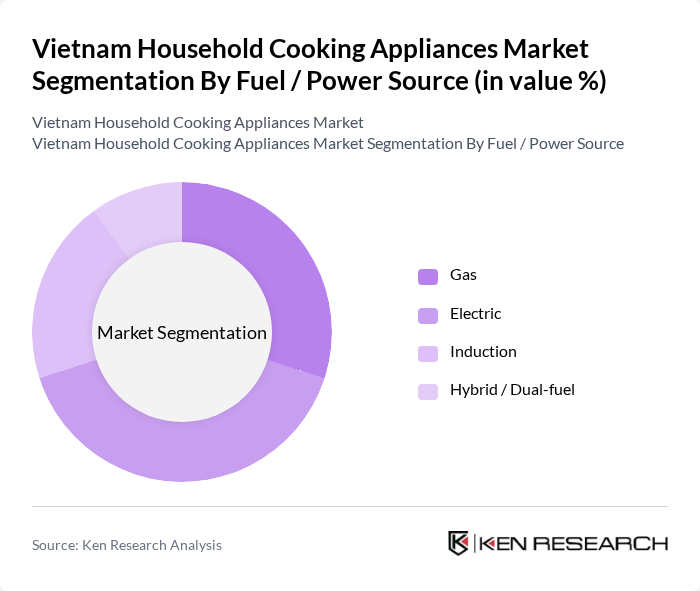

By Fuel / Power Source:The fuel/power source segmentation includes Gas, Electric, Induction, and Hybrid/Dual-fuel appliances. Electric cooking appliances are gaining traction due to their ease of use, compatibility with urban apartment living, and expanding availability of power-efficient electric and induction products. Gas appliances remain popular for their quick heating capabilities and established usage in many Vietnamese kitchens, especially freestanding gas stoves and gas hobs. Induction cooktops are increasingly favored for their energy efficiency, faster cooking, and precise temperature control, aligning with consumer demand for safety and energy savings in modern kitchens, while Hybrid/Dual-fuel options cater to users seeking flexibility between gas and electric/induction sources.

The Vietnam Household Cooking Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Panasonic Vietnam Co., Ltd., Electrolux Vietnam Co., Ltd., LG Electronics Vietnam Hai Phong Co., Ltd., Samsung Electronics Vietnam Co., Ltd., Philips Vietnam Co., Ltd., Sunhouse Group Joint Stock Company (Sunhouse Group JSC), Kangaroo Group (Vietnam), Goldsun Joint Stock Company (Goldsun JSC), Midea Consumer Electric (Vietnam) Co., Ltd., Sharp Vietnam Co., Ltd., Toshiba Consumer Products Vietnam Co., Ltd., Hafele Vietnam LLC, Faber Vietnam (Faber S.p.A.), Tefal Vietnam (Groupe SEB Vietnam), Xiaomi Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam household cooking appliances market is poised for significant transformation driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for smart and multifunctional appliances is expected to rise, with IoT integration becoming a key trend. Additionally, the focus on sustainability will likely lead to increased investments in eco-friendly products. Companies that adapt to these trends and leverage e-commerce platforms will be well-positioned to capture emerging market opportunities and enhance their competitive edge.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Gas Stoves and Hobs Induction and Electric Cooktops Built-in Ovens Microwave Ovens Rice Cookers and Multi-cookers Air Fryers and Toaster Ovens Range Hoods and Cooker Hoods Other Small Cooking Appliances (blenders, food processors, etc.) |

| By Fuel / Power Source | Gas Electric Induction Hybrid / Dual-fuel |

| By Structure | Built-in Appliances Freestanding Appliances |

| By Application | Residential Households Small Foodservice Outlets and Home-based Businesses |

| By Distribution Channel | Supermarkets and Hypermarkets Specialty Appliance and Electronics Stores Exclusive Brand Outlets Online Channels (e-commerce platforms and brand websites) Other Retail Channels |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Household Cooking Appliance Users | 150 | Homeowners, Renters |

| Rural Household Cooking Appliance Users | 100 | Farmers, Local Residents |

| Retailers of Cooking Appliances | 80 | Store Managers, Sales Representatives |

| Manufacturers of Cooking Appliances | 60 | Product Development Managers, Marketing Executives |

| Consumer Electronics Retail Chains | 70 | Category Managers, Procurement Officers |

The Vietnam Household Cooking Appliances Market is valued at approximately USD 1.0 billion, reflecting significant growth driven by rising disposable incomes, urbanization, and a shift towards modern cooking solutions among consumers.