Region:Asia

Author(s):Rebecca

Product Code:KRAD8479

Pages:88

Published On:December 2025

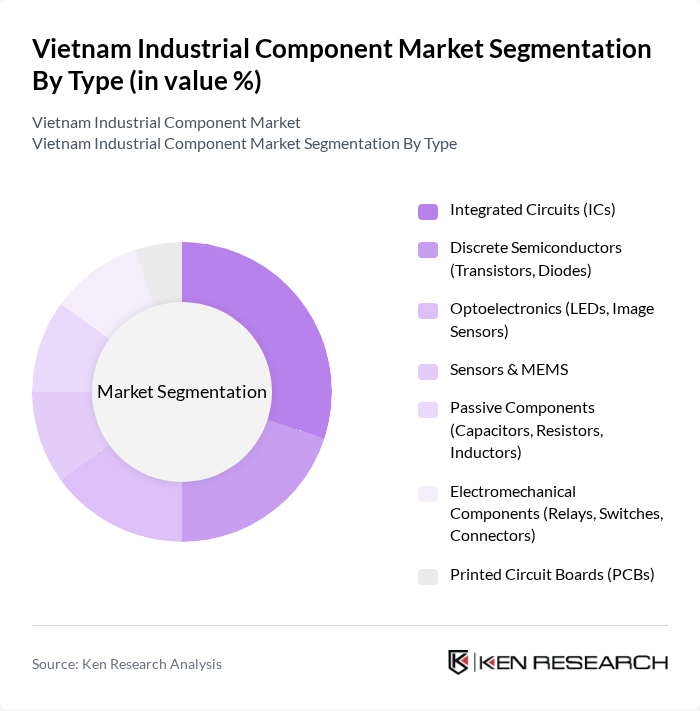

By Type:The market can be segmented into various types of industrial components, including Integrated Circuits (ICs), Discrete Semiconductors, Optoelectronics, Sensors & MEMS, Passive Components, Electromechanical Components, and Printed Circuit Boards (PCBs). Each of these subsegments plays a crucial role in the overall market dynamics, with specific applications across different industries.

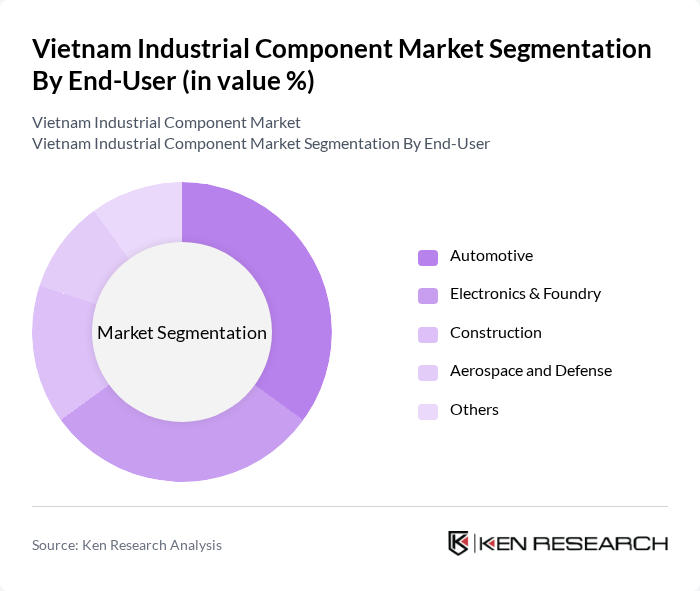

By End-User:The end-user segmentation includes Automotive, Electronics & Foundry, Construction, Aerospace and Defense, and Others. Each of these sectors utilizes industrial components differently, with varying demands based on technological advancements and market trends.

The Vietnam Industrial Component Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intel Vietnam, Samsung Vietnam, Amkor Technology Vietnam, FPT Semiconductor, Viettel High Tech, Marvell Technology Vietnam, Siemens Vietnam, Schneider Electric Vietnam, ABB Vietnam, Bosch Vietnam, Mitsubishi Electric Vietnam, and Rockwell Automation Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam industrial component market appears promising, driven by ongoing industrialization and government support for infrastructure projects. As the country embraces digital transformation, the integration of IoT and smart manufacturing technologies is expected to enhance operational efficiency. Furthermore, the focus on sustainability will likely lead to increased investments in green technologies, positioning Vietnam as a competitive player in the global industrial landscape while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Integrated Circuits (ICs) Discrete Semiconductors (Transistors, Diodes) Optoelectronics (LEDs, Image Sensors) Sensors & MEMS Passive Components (Capacitors, Resistors, Inductors) Electromechanical Components (Relays, Switches, Connectors) Printed Circuit Boards (PCBs) |

| By End-User | Automotive Electronics & Foundry Construction Aerospace and Defense Others |

| By Industry | Manufacturing Energy and Utilities Transportation Agriculture Oil and Gas |

| By Material | Metal Plastic Composite Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Application | Assembly Maintenance Repair Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for R&D Decree 205/2025 Land-Lease and Customs Facilitation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Component Manufacturers | 100 | Production Managers, Quality Control Supervisors |

| Electronics Parts Suppliers | 80 | Supply Chain Managers, Product Development Engineers |

| Construction Material Components | 70 | Procurement Officers, Project Managers |

| Industrial Machinery Parts | 60 | Operations Managers, Maintenance Supervisors |

| Consumer Electronics Components | 90 | R&D Managers, Sales Directors |

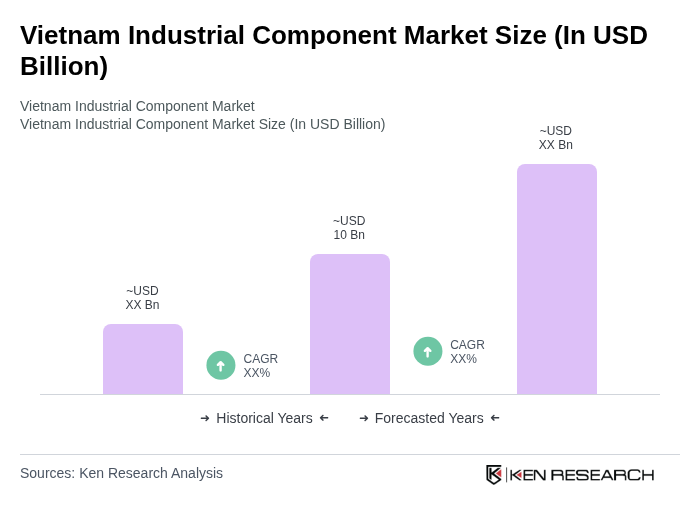

The Vietnam Industrial Component Market is valued at approximately USD 10 billion, driven by the rapid growth of the manufacturing sector, increased foreign direct investment, and rising demand for electronic components across various industries.