Region:Asia

Author(s):Shubham

Product Code:KRAD6622

Pages:94

Published On:December 2025

By Product Type:The meal kit delivery services market can be segmented into various product types, including Ready-to-Cook Meal Kits, Ready-to-Eat Meal Kits, Heat-and-Eat / Pre-Cooked Meal Kits, DIY Recipe Boxes, Specialty Diet Meal Kits, Plant-Based / Vegetarian & Vegan Meal Kits, and Others. Among these, Ready-to-Cook Meal Kits have gained significant traction due to their convenience and the growing interest in home cooking.

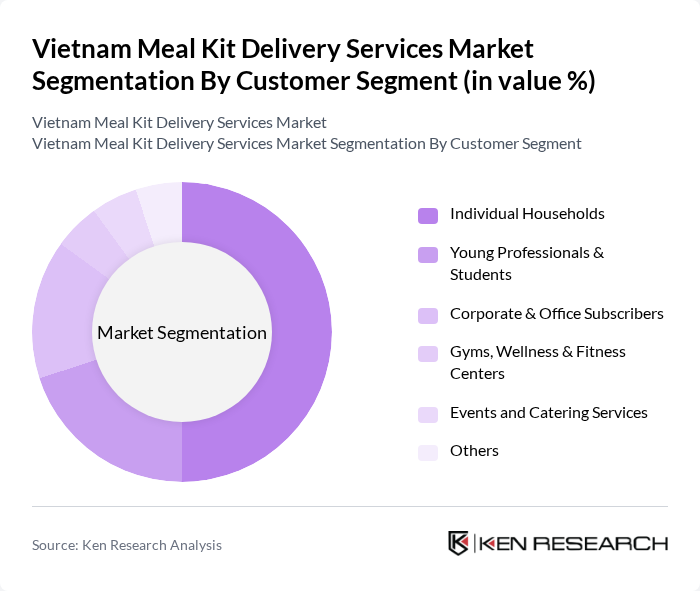

By Customer Segment:The customer segments for meal kit delivery services include Individual Households, Young Professionals & Students, Corporate & Office Subscribers, Gyms, Wellness & Fitness Centers, Events and Catering Services, and Others. The Individual Households segment is the largest, driven by the increasing number of families seeking convenient meal solutions that cater to their dietary preferences.

The Vietnam Meal Kit Delivery Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hello M?m, Chefbox Vietnam, Cooky.vn, Goody Kitchen Vietnam, B?p Gia ?ình (Family Kitchen), MEALBOX Vietnam, Fitfood.vn, Eat Clean Saigon, iVegan Meal Box, The Organik Shop (Meal Kits & Ready Meals), Annam Gourmet (Meal Kits & Recipe Boxes), Organica Vietnam (Organic Meal Kits), KAMEREO (Foodservice Supply & B2B Meal Solutions), ShopeeFood (Meal Kit & Ready-Meal Distribution Partner), GrabFood Vietnam (Meal Kit & Ready-Meal Distribution Partner) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's meal kit delivery services market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, meal kit providers are likely to innovate their offerings, focusing on health and convenience. Additionally, the integration of technology in logistics and customer engagement will enhance service efficiency. Companies that adapt to these trends and address challenges will be well-positioned to capture a larger share of the growing market, particularly among health-conscious consumers seeking convenient meal solutions.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Ready-to-Cook Meal Kits Ready-to-Eat Meal Kits Heat-and-Eat / Pre-Cooked Meal Kits DIY Recipe Boxes (ingredients + recipes) Specialty Diet Meal Kits (e.g., Keto, Gluten-Free, Low-Carb) Plant-Based / Vegetarian & Vegan Meal Kits Others |

| By Customer Segment | Individual Households Young Professionals & Students Corporate & Office Subscribers Gyms, Wellness & Fitness Centers Events and Catering Services Others |

| By Delivery & Service Model | Subscription-Based (Weekly / Monthly Plans) On-Demand / Ad-Hoc Ordering Hybrid Models (Subscription + On-Demand) White-Label / B2B Meal Kit Solutions Others |

| By Packaging Type | Recyclable & Eco-Friendly Packaging Insulated & Temperature-Controlled Packaging Single-Use Plastic Packaging Reusable Containers Others |

| By Distribution Channel | Direct-to-Consumer via Own Website / App Online Food Delivery Platforms (e.g., ShopeeFood, GrabFood, Baemin) Supermarkets & Hypermarkets Convenience Stores & Specialty Stores Corporate & Institutional Contracts Others |

| By Price Positioning | Budget Meal Kits Mass / Mid-Range Meal Kits Premium & Gourmet Meal Kits Others |

| By Region | Hanoi & Northern Key Cities Da Nang & Central Vietnam Ho Chi Minh City & Southern Key Cities Other Provinces & Emerging Urban Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Meal Kits | 150 | Meal Kit Users, Food Enthusiasts |

| Market Insights from Industry Experts | 50 | Chefs, Nutritionists, Food Bloggers |

| Operational Insights from Meal Kit Providers | 40 | CEOs, Operations Managers, Marketing Directors |

| Consumer Behavior Analysis | 100 | Urban Families, Young Professionals |

| Trends in Online Food Delivery | 80 | eCommerce Analysts, Market Researchers |

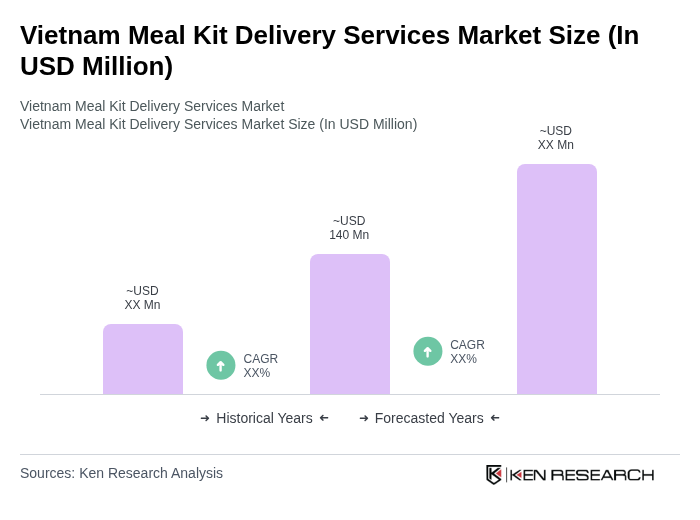

The Vietnam Meal Kit Delivery Services Market is valued at approximately USD 140 million, reflecting a growing demand for convenient meal solutions among urban consumers, driven by trends in healthy eating and home cooking.