Region:Asia

Author(s):Shubham

Product Code:KRAD5327

Pages:95

Published On:December 2025

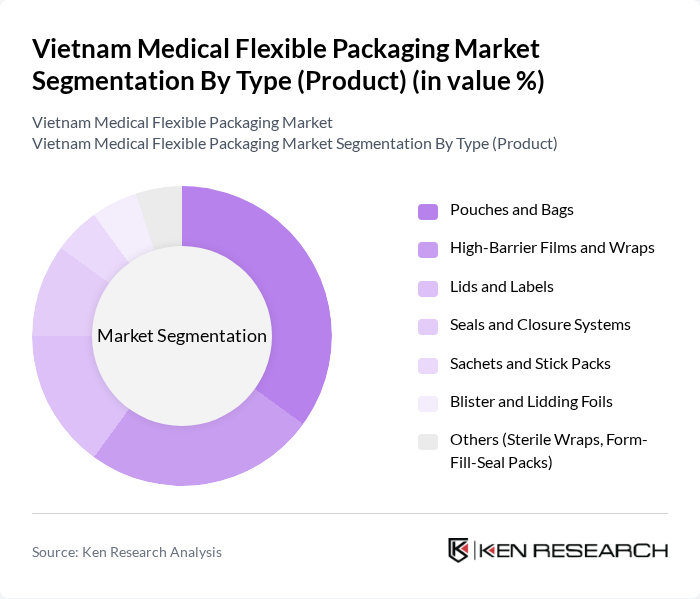

By Type (Product):The market is segmented into various types of products, including pouches and bags, high-barrier films and wraps, lids and labels, seals and closure systems, sachets and stick packs, blister and lidding foils, and others such as sterile wraps and form-fill-seal packs. Among these, pouches and bags are the most dominant due to their versatility, ease of use, light weight, and ability to provide effective barrier properties against moisture, oxygen, and contaminants across a wide range of sterile and non-sterile medical products. The growing trend towards single-use medical devices, pre-sterilized kits, and unit-dose pharmaceutical formats has further propelled the demand for pouches and bags, making them a preferred choice for both domestic manufacturers and contract packers serving export markets.

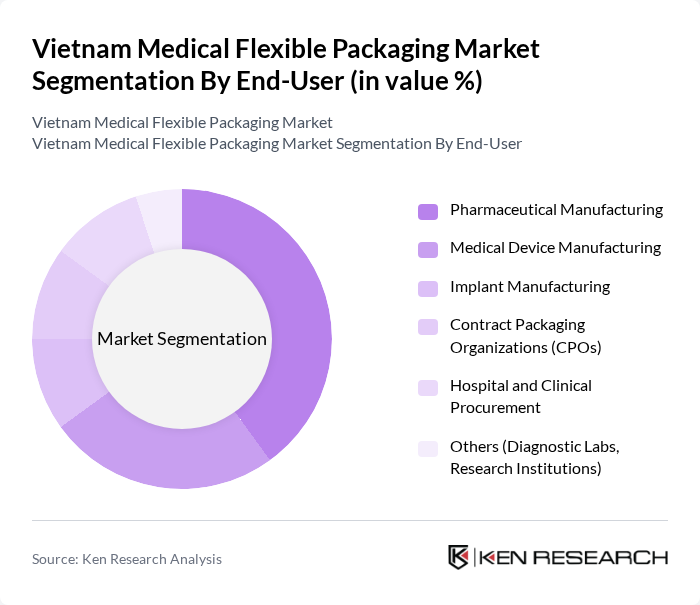

By End-User:The end-user segmentation includes pharmaceutical manufacturing, medical device manufacturing, implant manufacturing, contract packaging organizations (CPOs), hospital and clinical procurement, and others such as diagnostic labs and research institutions. The pharmaceutical manufacturing segment leads the market, driven by the increasing production of branded and generic medications in Vietnam, rising demand for sterile barrier pouches, sachets, and high-barrier laminates, and the need for secure and compliant packaging solutions that support stability, tamper evidence, and traceability. The rise in chronic diseases, expansion of injectable and oral solid dosage forms, and the adoption of innovative drug delivery systems, including unit-dose and ready-to-administer formats, have further solidified the pharmaceutical sector's position as the primary consumer of medical flexible packaging, alongside accelerating demand from medical device and implant manufacturers.

The Vietnam Medical Flexible Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc (Vietnam Operations), Huhtamaki Vietnam Co., Ltd., Constantia Flexibles (Vietnam), Tetra Pak Vietnam JSC, SCG Packaging Public Company Limited (SCGP Vietnam), Oji GS Packaging Co., Ltd. (Vietnam), Thanh Phu Plastic Packaging Co., Ltd., Liksin Corporation (Vietnam Packaging Corporation), Bao Bì Nh?a Tân Ti?n (Tan Tien Plastic Packaging JSC), An Phat Holdings JSC (An Phat Bioplastics and Packaging), Inoue Rubber Vietnam Co., Ltd. (Medical and Industrial Packaging), Khang Thanh Co., Ltd. (Khang Thanh Packaging), Saigon Packaging Joint Stock Company (SAPACO), Kieu Phong Plastic Packaging Co., Ltd., UFP Technologies, Inc. (Healthcare and Medical Packaging Solutions) contribute to innovation, geographic expansion, and service delivery in this space, with several of these companies investing in high-cleanliness production environments, multi-layer co-extrusion, and printing technologies to serve regulated healthcare customers.

The future of the Vietnam medical flexible packaging market appears promising, driven by increasing healthcare demands and technological advancements. As the government invests in healthcare infrastructure, the market is expected to see a rise in innovative packaging solutions that prioritize sustainability and safety. Additionally, the growing trend towards e-commerce in healthcare will likely create new avenues for flexible packaging, enhancing accessibility and convenience for consumers while fostering market growth and diversification.

| Segment | Sub-Segments |

|---|---|

| By Type (Product) | Pouches and Bags High-Barrier Films and Wraps Lids and Labels Seals and Closure Systems Sachets and Stick Packs Blister and Lidding Foils Others (Sterile Wraps, Form-Fill-Seal Packs) |

| By End-User | Pharmaceutical Manufacturing Medical Device Manufacturing Implant Manufacturing Contract Packaging Organizations (CPOs) Hospital and Clinical Procurement Others (Diagnostic Labs, Research Institutions) |

| By Material | Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Ethylene Vinyl Alcohol (EVOH) Aluminum Foil and Laminates Paper and Paper-Based Laminates Bioplastics and Other Specialty Polymers |

| By Application | Sterile Medical Device Packaging Pharmaceutical and Biologic Packaging Diagnostic and IV Solution Packaging Temperature-Sensitive and Cold-Chain Packaging Child-Resistant and Tamper-Evident Packaging Others (Single-Use and Disposable Medical Supplies) |

| By Distribution/Channel Partner Type | Direct Sales to Pharma and Medical Device OEMs Contract Packagers and Converters Distributors and Trading Companies International Export Channels Others (E-Procurement Platforms, Tenders) |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others (Border and Export-Oriented Zones) |

| By Regulatory and Quality Compliance | ISO 13485 and ISO 11607 Compliance FDA and EU GMP-Related Packaging Requirements CE Marking and MDR-Linked Packaging Standards Vietnamese MOH and Local Regulatory Approvals |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Packaging | 80 | Procurement Managers, Quality Assurance Officers |

| Medical Device Packaging | 70 | Product Managers, Regulatory Affairs Specialists |

| Hospital Supply Chain Management | 60 | Supply Chain Directors, Inventory Managers |

| Research & Development in Packaging | 50 | R&D Managers, Packaging Engineers |

| Healthcare Facility Operations | 80 | Operations Managers, Facility Administrators |

The Vietnam Medical Flexible Packaging Market is valued at approximately USD 150 million, reflecting a significant growth driven by increasing healthcare demands, advancements in medical technology, and a focus on patient safety and product integrity.