Region:Asia

Author(s):Geetanshi

Product Code:KRAC2419

Pages:88

Published On:October 2025

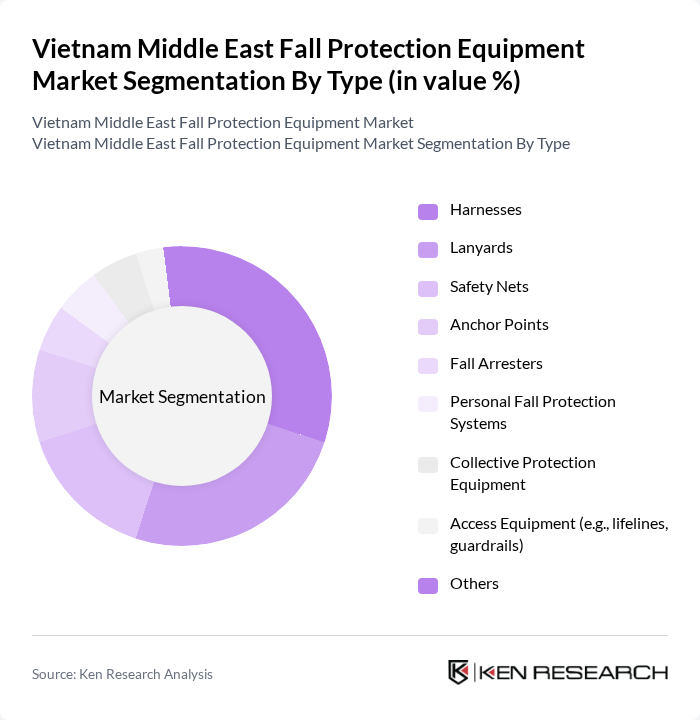

By Type:The market is segmented into harnesses, lanyards, safety nets, anchor points, fall arresters, personal fall protection systems, collective protection equipment, access equipment (e.g., lifelines, guardrails), and others. Harnesses and lanyards remain the most widely used products, reflecting their essential role in worker safety at heights. The segment is further strengthened by the increasing adoption of full-body harnesses and ergonomic designs, driven by regulatory compliance and the expanding construction sector .

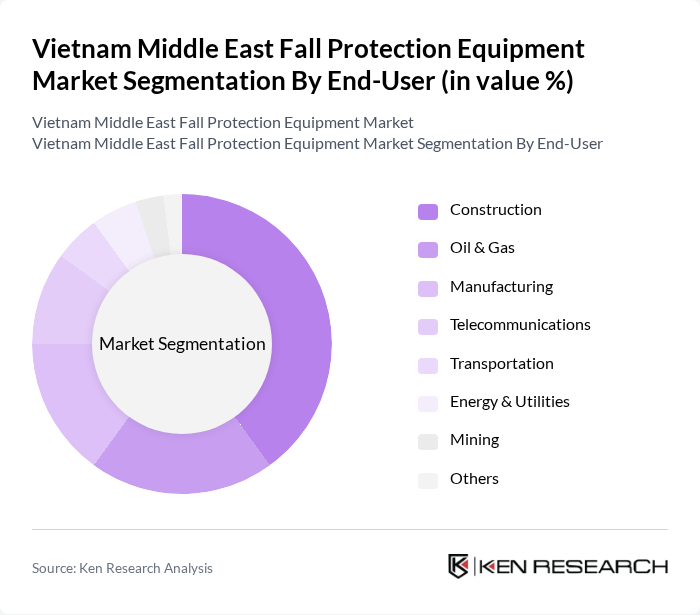

By End-User:End-user segmentation includes construction, oil & gas, manufacturing, telecommunications, transportation, energy & utilities, mining, and others. The construction sector is the dominant end-user, propelled by rapid infrastructure growth and stringent safety regulations. Oil & gas and manufacturing sectors also contribute significantly due to hazardous working environments and regulatory mandates for worker safety. The energy & utilities sector is experiencing increased demand for fall protection equipment, reflecting broader adoption across high-risk industries .

The Vietnam Middle East Fall Protection Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Honeywell International Inc., MSA Safety Incorporated, Capital Safety (DBI-SALA, now part of 3M), FallTech, Petzl, Guardian Fall Protection, SKYLOTEC GmbH, Kee Safety Inc., Tritech Fall Protection Equipment, PIP (Protective Industrial Products), Altec Industries, WernerCo, RUD Group, Safewell Safety Products contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam Middle East fall protection equipment market is poised for significant growth, driven by increasing construction activities and stringent safety regulations. As companies prioritize workplace safety, the demand for advanced fall protection systems is expected to rise. Additionally, the integration of smart technologies and IoT in safety equipment will enhance functionality and user experience. The market is likely to see innovations that cater to specific industry needs, further solidifying its growth trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Harnesses Lanyards Safety Nets Anchor Points Fall Arresters Personal Fall Protection Systems Collective Protection Equipment Access Equipment (e.g., lifelines, guardrails) Others |

| By End-User | Construction Oil & Gas Manufacturing Telecommunications Transportation Energy & Utilities Mining Others |

| By Application | Industrial Worksites Commercial Buildings Residential Projects Infrastructure Development Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Stores Others |

| By Price Range | Low-End Mid-Range High-End |

| By Brand | Local Brands International Brands |

| By Certification Type | ANSI Certified OSHA Compliant ISO Certified EN Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Safety Managers | 60 | Site Safety Officers, Project Managers |

| Manufacturing Industry Safety Compliance | 50 | Health and Safety Managers, Operations Directors |

| Oil & Gas Industry Equipment Procurement | 45 | Procurement Managers, Safety Engineers |

| Retail Sector Fall Protection Equipment Usage | 40 | Store Managers, Safety Coordinators |

| Training Providers for Safety Equipment | 45 | Training Coordinators, Safety Instructors |

The Vietnam Middle East Fall Protection Equipment Market is valued at approximately USD 120 million, reflecting a significant growth driven by stricter safety regulations and increased awareness of workplace safety among employers and employees.