Region:Asia

Author(s):Geetanshi

Product Code:KRAD6062

Pages:88

Published On:December 2025

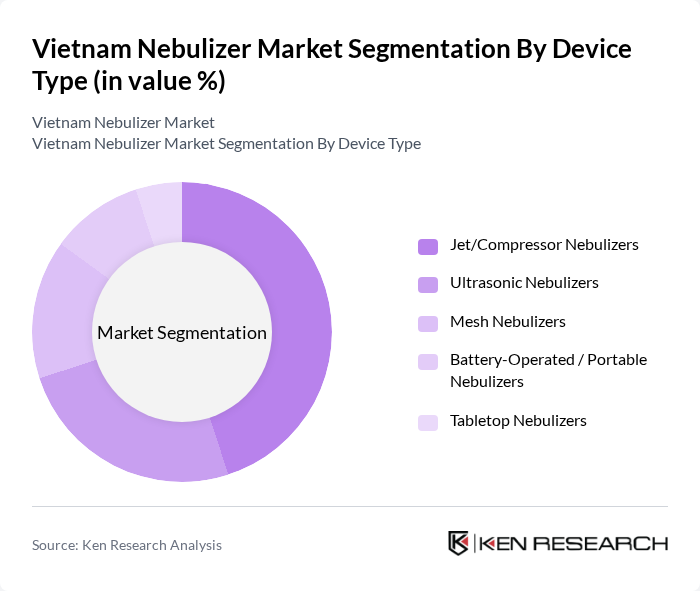

By Device Type:The device type segmentation includes various nebulizer types, each catering to different patient needs and preferences. The dominant sub-segment is Jet/Compressor Nebulizers, which are widely used in hospitals and home care settings due to their effectiveness and affordability. Ultrasonic Nebulizers are gaining traction for their quieter operation and portability, particularly in urban home-care environments, while Mesh Nebulizers are preferred for their compact design, faster treatment times, and high drug delivery efficiency, supporting use in pediatric and chronic disease management. Battery-operated and portable nebulizers are increasingly popular among patients seeking convenience for out-of-home and travel use, reflecting a broader shift toward mobile and home-based respiratory care. Tabletop nebulizers remain relevant for stationary use in clinical settings and in home environments where stable power supply and routine, scheduled therapy are required.

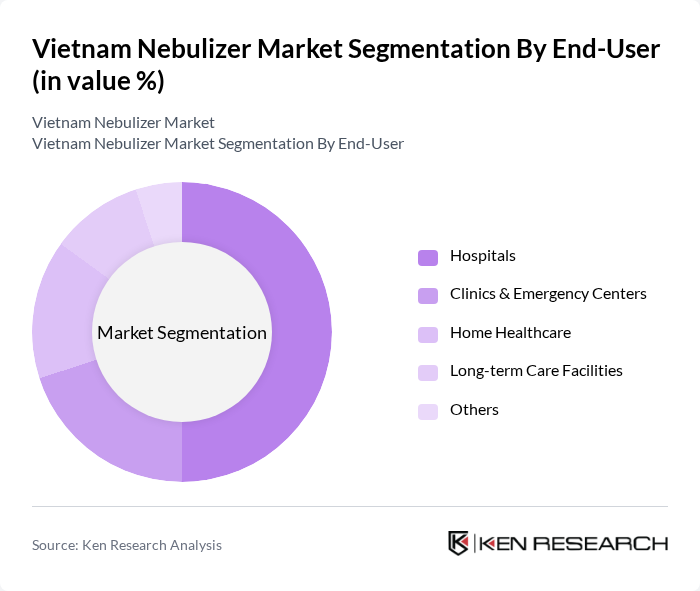

By End-User:The end-user segmentation highlights the various settings where nebulizers are utilized. Hospitals represent the largest segment due to the high volume of patients requiring respiratory treatments and the role of institutional care as the primary access point for acute and severe respiratory episodes. Clinics and emergency centers also contribute significantly, as they provide immediate care for acute respiratory conditions and follow-up management of asthma and COPD. Home healthcare is rapidly growing, driven by the trend towards patient-centered care, telemedicine adoption, and the convenience of at-home treatments, especially for chronic respiratory patients and elderly populations. Long-term care facilities are increasingly adopting nebulizers to manage chronic conditions among elderly patients, integrating inhalation therapy into routine care protocols, while other settings include outpatient services and rehabilitation centers that use nebulizers as part of pulmonary rehabilitation and post-hospital discharge programs.

The Vietnam Nebulizer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Respironics (Philips Vietnam), Omron Healthcare Vietnam Co., Ltd., PARI GmbH, Drive DeVilbiss Healthcare, Microlife Corporation, Yuwell (Jiangsu Yuyue Medical Equipment), Medtronic plc, GE HealthCare Technologies Inc., B. Braun Melsungen AG (B. Braun Vietnam), Mindray Medical International (Shenzhen Mindray), Trudell Medical International, Invacare Corporation, ResMed, A&D Company, Limited, Vyaire Medical, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam nebulizer market is poised for significant growth, driven by increasing healthcare investments and a shift towards home healthcare solutions. As the government continues to enhance healthcare infrastructure, the accessibility of nebulizers will improve, particularly in underserved areas. Additionally, the integration of smart technology in medical devices is expected to attract tech-savvy consumers, further propelling market growth. The focus on preventive healthcare will also encourage more individuals to seek nebulizers for early management of respiratory conditions.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Jet/Compressor Nebulizers Ultrasonic Nebulizers Mesh Nebulizers Battery-Operated / Portable Nebulizers Tabletop Nebulizers |

| By End-User | Hospitals Clinics & Emergency Centers Home Healthcare Long-term Care Facilities Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies & Medical Device Stores Online Pharmacies & E-commerce Platforms Direct Tenders / Institutional Sales Others |

| By Patient Age Group | Pediatric Adult Geriatric Others |

| By Clinical Application | Asthma Management COPD Treatment Cystic Fibrosis Treatment Other Respiratory Diseases (e.g., Bronchitis, RSV) |

| By Technology | Pneumatic Nebulizers Electronic / Vibrating Mesh Nebulizers Ultrasonic Nebulizers Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 120 | Pulmonologists, General Practitioners |

| Pharmacy Distributors | 100 | Pharmacy Owners, Supply Chain Managers |

| Patients Using Nebulizers | 100 | Chronic Respiratory Disease Patients |

| Medical Device Retailers | 80 | Store Managers, Sales Representatives |

| Health Insurance Providers | 70 | Policy Analysts, Claims Managers |

The Vietnam Nebulizer Market is valued at approximately USD 5 million, driven by the rising prevalence of respiratory diseases, increased healthcare expenditure, and growing awareness of home healthcare solutions among patients and caregivers.