Qatar Pulmonary Drug Delivery Systems Market Overview

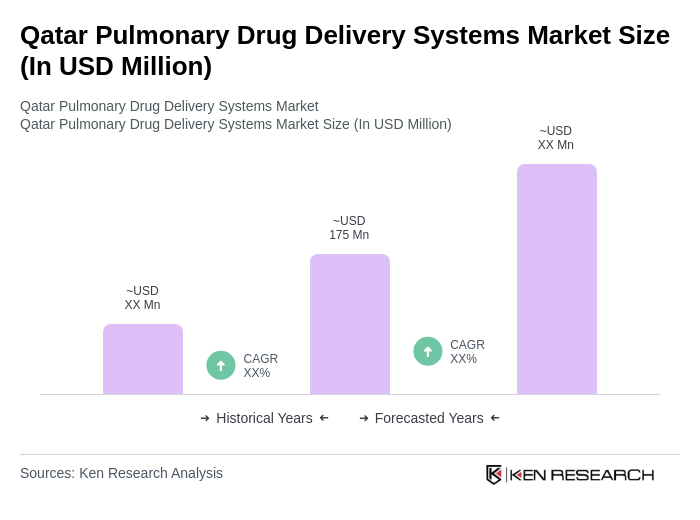

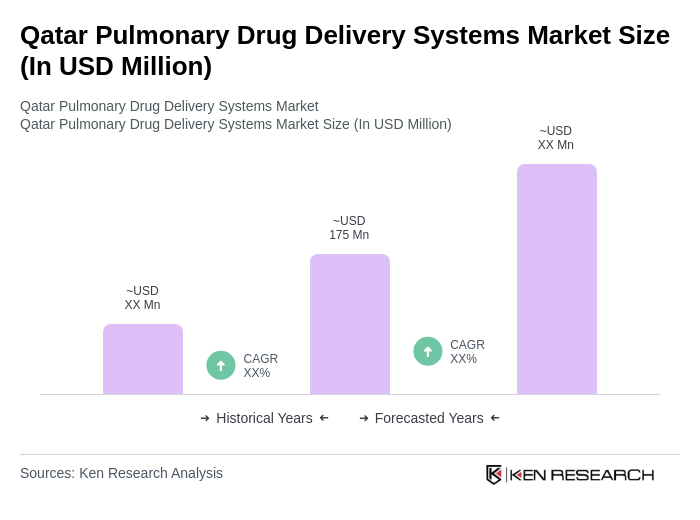

- The Qatar Pulmonary Drug Delivery Systems Market is valued at USD 175 million, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of respiratory diseases such as asthma and Chronic Obstructive Pulmonary Disease (COPD), rising healthcare expenditure across the Middle East region, and advancements in drug delivery technologies. The demand for effective pulmonary drug delivery systems has surged due to the growing awareness of respiratory health and the need for efficient treatment options. Technological innovations including smart connected respiratory health devices and digital inhaler solutions are transforming patient care delivery.

- Key cities such as Doha and Al Rayyan dominate the market due to their advanced healthcare infrastructure and high population density. The concentration of healthcare facilities and specialized clinics in these urban areas facilitates the adoption of innovative pulmonary drug delivery systems, making them pivotal in the overall market landscape. The expansion of home healthcare services and remote patient monitoring capabilities is further accelerating market penetration in urban centers.

- The Ministry of Public Health in Qatar enforces the Healthcare Facilities Licensing Standards, 2021, which mandates comprehensive patient education protocols for respiratory medication devices distributed through licensed healthcare facilities and pharmacies. This regulation requires healthcare providers to implement structured training programs for patients using inhalers, nebulizers, and other pulmonary drug delivery systems, with specific provisions for demonstrating proper device usage techniques, maintenance procedures, and adherence monitoring. The standards establish minimum competency requirements for healthcare professionals dispensing these devices and mandate follow-up assessments to verify patient understanding and compliance.

Qatar Pulmonary Drug Delivery Systems Market Segmentation

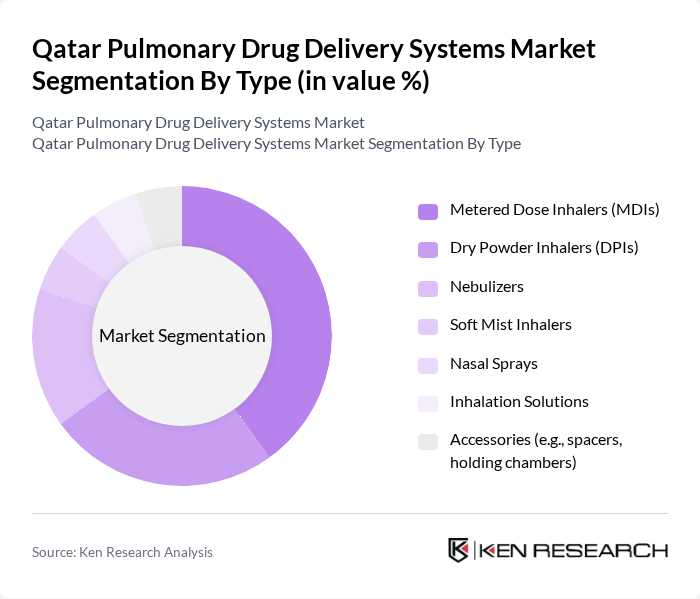

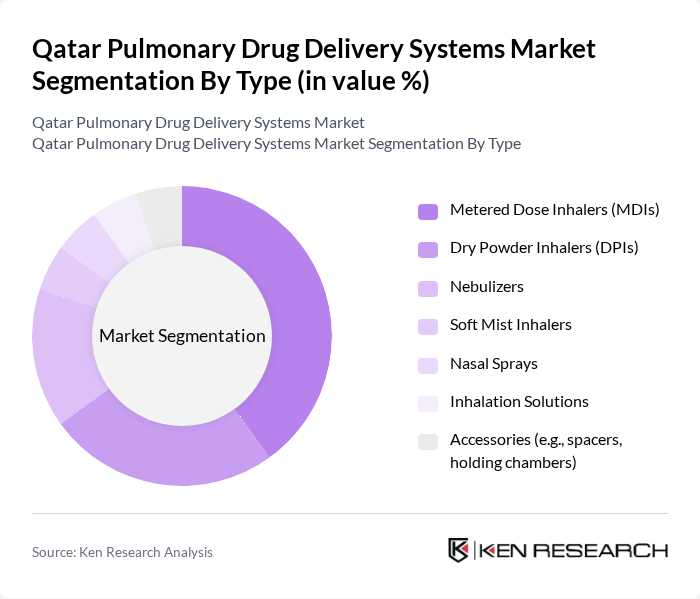

By Type:The market is segmented into various types of pulmonary drug delivery systems, including Metered Dose Inhalers (MDIs), Dry Powder Inhalers (DPIs), Nebulizers, Soft Mist Inhalers, Nasal Sprays, Inhalation Solutions, and Accessories (e.g., spacers, holding chambers). Among these, Metered Dose Inhalers (MDIs) are the most widely used due to their convenience and effectiveness in delivering medication directly to the lungs. The growing prevalence of asthma and Chronic Obstructive Pulmonary Disease (COPD) has further propelled the demand for MDIs, making them a dominant force in the market. The integration of digital tracking capabilities and smart sensors into traditional MDI devices is enhancing medication adherence monitoring and patient outcomes.

By End-User:The end-user segmentation includes Hospitals, Homecare Settings, Clinics, Long-term Care Facilities, Pharmacies, and Others. Hospitals are the leading end-user segment, driven by the high volume of patients requiring respiratory treatments and the availability of advanced medical technologies. The increasing number of hospital admissions for respiratory diseases has significantly contributed to the demand for pulmonary drug delivery systems in this sector. The expansion of homecare settings is experiencing accelerated growth as patients and healthcare systems increasingly adopt remote patient monitoring and telehealth platforms for respiratory therapy management.

Qatar Pulmonary Drug Delivery Systems Market Competitive Landscape

The Qatar Pulmonary Drug Delivery Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as GlaxoSmithKline plc, AstraZeneca plc, Boehringer Ingelheim GmbH, Novartis AG, Teva Pharmaceutical Industries Ltd., Merck & Co., Inc., Sanofi S.A., Pfizer Inc., Hikma Pharmaceuticals PLC, Viatris Inc., Chiesi Farmaceutici S.p.A., Otsuka Pharmaceutical Co., Ltd., Sun Pharmaceutical Industries Ltd., Cipla Limited, Sandoz International GmbH, AptarGroup, Inc., Philips Respironics (Koninklijke Philips N.V.), PARI GmbH contribute to innovation, geographic expansion, and service delivery in this space.

Qatar Pulmonary Drug Delivery Systems Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Respiratory Diseases:The World Health Organization reported that respiratory diseases affect approximately 1.2 million people in Qatar, with asthma and chronic obstructive pulmonary disease (COPD) being the most common. This rising prevalence drives the demand for effective pulmonary drug delivery systems, as healthcare providers seek innovative solutions to manage these conditions. The increasing burden of respiratory diseases necessitates advanced treatment options, thereby propelling market growth in the region.

- Advancements in Drug Formulation Technologies:In future, the global investment in drug formulation technologies is projected to reach $50 billion, with a significant portion allocated to pulmonary delivery systems. Innovations such as nanotechnology and targeted delivery methods enhance the efficacy of medications, making them more appealing to healthcare providers. These advancements not only improve patient outcomes but also stimulate market growth as pharmaceutical companies invest in developing new formulations tailored for respiratory diseases.

- Rising Demand for Patient-Friendly Drug Delivery Systems:A recent survey indicated that 70% of patients prefer drug delivery systems that are easy to use and enhance adherence to treatment regimens. This trend is particularly evident in Qatar, where the healthcare system emphasizes patient-centered care. The demand for user-friendly inhalers and nebulizers is increasing, prompting manufacturers to innovate and design devices that cater to patient needs, thus driving market expansion in the pulmonary drug delivery sector.

Market Challenges

- High Cost of Advanced Pulmonary Drug Delivery Systems:The average cost of advanced inhalation devices in Qatar can exceed QAR 1,500, which poses a significant barrier to widespread adoption. Many healthcare facilities face budget constraints, limiting their ability to procure these systems. This high cost can deter both healthcare providers and patients from utilizing advanced pulmonary drug delivery options, thereby hindering market growth and accessibility to effective treatments.

- Regulatory Hurdles in Product Approval:The regulatory landscape in Qatar can be complex, with the Ministry of Public Health imposing stringent guidelines for the approval of medical devices. The average time for product approval can extend up to 18 months, delaying market entry for innovative pulmonary drug delivery systems. These regulatory challenges can discourage investment and slow the pace of technological advancements, ultimately impacting the growth of the market.

Qatar Pulmonary Drug Delivery Systems Market Future Outlook

The future of the Qatar pulmonary drug delivery systems market appears promising, driven by technological advancements and a growing focus on patient-centric solutions. As healthcare providers increasingly adopt smart inhalers and integrate digital health technologies, the market is expected to evolve significantly. Additionally, the emphasis on preventive healthcare measures will likely lead to increased investments in innovative drug delivery systems, enhancing treatment efficacy and patient adherence in managing respiratory diseases.

Market Opportunities

- Expansion of Telemedicine and Remote Patient Monitoring:The rise of telemedicine in Qatar, with over 30% of consultations now conducted remotely, presents a unique opportunity for pulmonary drug delivery systems. This trend allows for better patient monitoring and adherence to treatment plans, enhancing the effectiveness of drug delivery systems and improving health outcomes for patients with respiratory conditions.

- Development of Personalized Medicine Approaches:The global market for personalized medicine is projected to reach $2 trillion by future, with significant implications for pulmonary drug delivery systems. Tailoring treatments to individual patient profiles can enhance therapeutic efficacy and minimize side effects, creating a demand for innovative delivery systems that cater to personalized medicine approaches in Qatar's healthcare landscape.