Region:Asia

Author(s):Shubham

Product Code:KRAE0016

Pages:92

Published On:December 2025

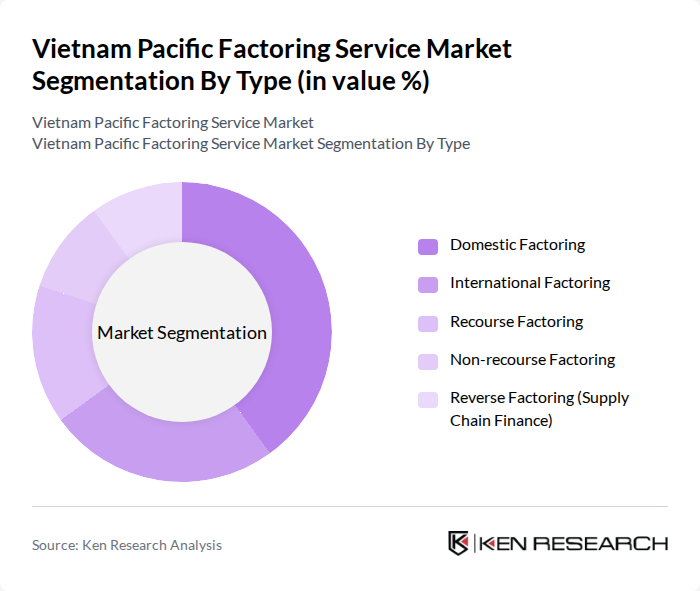

By Type:The market is segmented into various types of factoring services, including Domestic Factoring, International Factoring, Recourse Factoring, Non-recourse Factoring, and Reverse Factoring (Supply Chain Finance). Each type serves different business needs and risk profiles, catering to a diverse clientele, with domestic and international factoring recognized as the core categories in Vietnam’s market structure. Recourse and non-recourse arrangements are widely used to tailor risk allocation between factors and clients, while reverse factoring and broader supply chain finance programs are gaining traction among large buyers and their SME suppliers in manufacturing, transportation, and retail value chains.

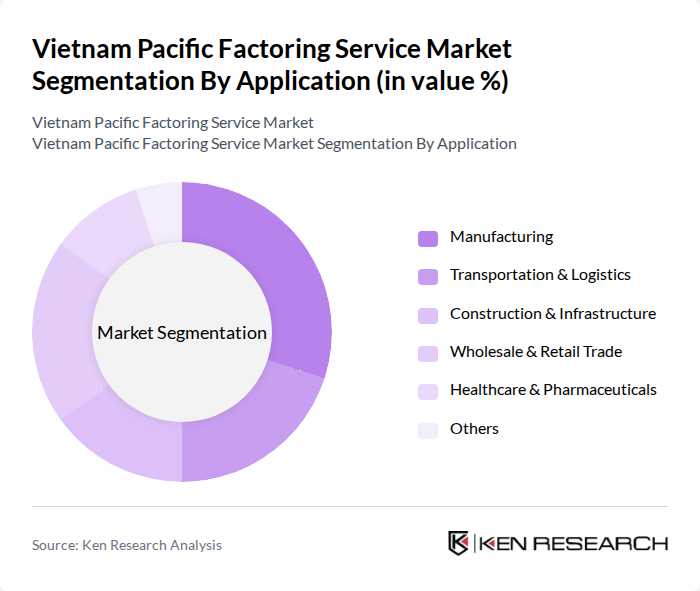

By Application:The applications of factoring services span across various industries, including Manufacturing, Transportation & Logistics, Construction & Infrastructure, Wholesale & Retail Trade, Healthcare & Pharmaceuticals, and Others. Each sector utilizes factoring to enhance cash flow and manage receivables effectively, with manufacturing, construction, transportation, and healthcare all cited as key application areas for factoring in Vietnam and globally.

The Vietnam Pacific Factoring Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as VietinBank (Vietnam Joint Stock Commercial Bank for Industry and Trade), BIDV (Bank for Investment and Development of Vietnam), Vietcombank (Joint Stock Commercial Bank for Foreign Trade of Vietnam), Agribank (Vietnam Bank for Agriculture and Rural Development), MB Bank (Military Commercial Joint Stock Bank), Techcombank (Vietnam Technological and Commercial Joint Stock Bank), VPBank (Vietnam Prosperity Joint Stock Commercial Bank), HDBank (Ho Chi Minh City Development Joint Stock Commercial Bank), Sacombank (Saigon Thuong Tin Commercial Joint Stock Bank), SHB (Saigon–Hanoi Commercial Joint Stock Bank), LienVietPostBank (Lien Viet Post Joint Stock Commercial Bank), SeABank (Southeast Asia Commercial Joint Stock Bank), Shinhan Bank Vietnam Limited, Standard Chartered Bank (Vietnam) Limited, HSBC Bank (Vietnam) Ltd. contribute to innovation, geographic expansion, and service delivery in this space, with a focus on digital onboarding, automated risk assessment, and cross-border trade finance solutions.

The Vietnam Pacific factoring service market is poised for significant growth, driven by the increasing digitization of financial services and the rising demand for innovative financing solutions. As SMEs continue to expand, the need for efficient cash flow management will become more pronounced. Additionally, partnerships with fintech companies are likely to enhance service delivery and customer experience, positioning the market for robust development in the coming years. The focus on sustainable financing will also shape future offerings, aligning with global trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Factoring International Factoring Recourse Factoring Non-recourse Factoring Reverse Factoring (Supply Chain Finance) |

| By Application | Manufacturing Transportation & Logistics Construction & Infrastructure Wholesale & Retail Trade Healthcare & Pharmaceuticals Others |

| By Organization Size | Micro Enterprises Small Enterprises Medium Enterprises Large Enterprises |

| By Client Segment | Exporters Importers Domestic Trade-Oriented Firms E-commerce & Digital Businesses |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| By Service Model | Full-Service Factoring (With Collection & Credit Protection) Bulk/Agency Factoring Invoice Discounting Maturity Factoring Others |

| By Tenor | Short-Term Financing (< 90 Days) Medium-Term Financing (90–180 Days) Long-Term Financing (> 180 Days) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Factoring Utilization | 120 | Business Owners, Financial Managers |

| Corporate Factoring Services | 90 | CFOs, Treasury Managers |

| Industry-Specific Factoring Insights | 70 | Sector Analysts, Industry Consultants |

| Regulatory Impact on Factoring | 50 | Legal Advisors, Compliance Officers |

| Market Trends and Future Outlook | 80 | Market Researchers, Economic Analysts |

The Vietnam Pacific Factoring Service Market is valued at approximately USD 16 billion, driven by the increasing demand for liquidity among businesses, particularly small and medium enterprises (SMEs), which utilize factoring services to manage cash flow and mitigate credit risk.