Region:Global

Author(s):Dev

Product Code:KRAC5142

Pages:80

Published On:January 2026

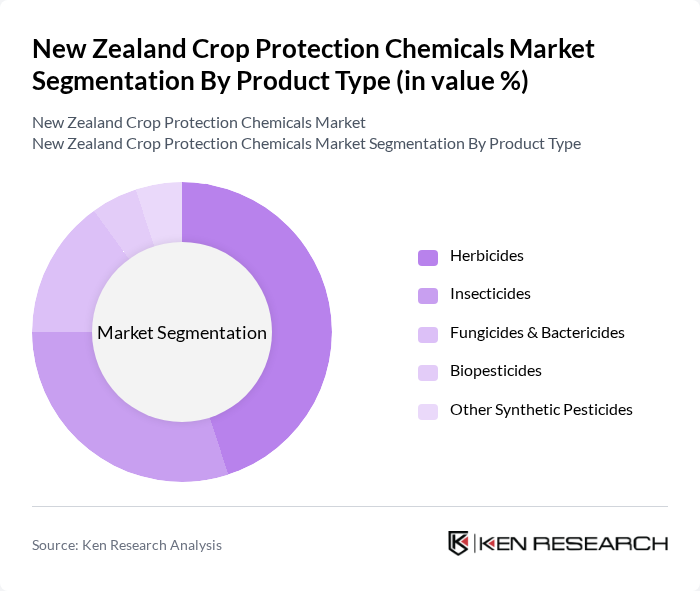

By Product Type:The product type segmentation includes various categories such as herbicides, insecticides, fungicides & bactericides, biopesticides, and other synthetic pesticides. Herbicides account for the largest share of crop protection use in New Zealand, reflecting the dominance of pasture, cereals, and broadacre crops and the need to control competitive weeds in intensive livestock and arable systems. Insecticides follow, driven by the need to manage pasture pests and insects affecting horticultural and arable crops, while fungicides & bactericides are important in high-value horticulture, seeds, and cereals. The biopesticides segment is gaining traction as farmers and exporters respond to market pressure for lower residues and as regulatory and industry programs encourage integrated pest management and the use of biological and reduced-risk products.

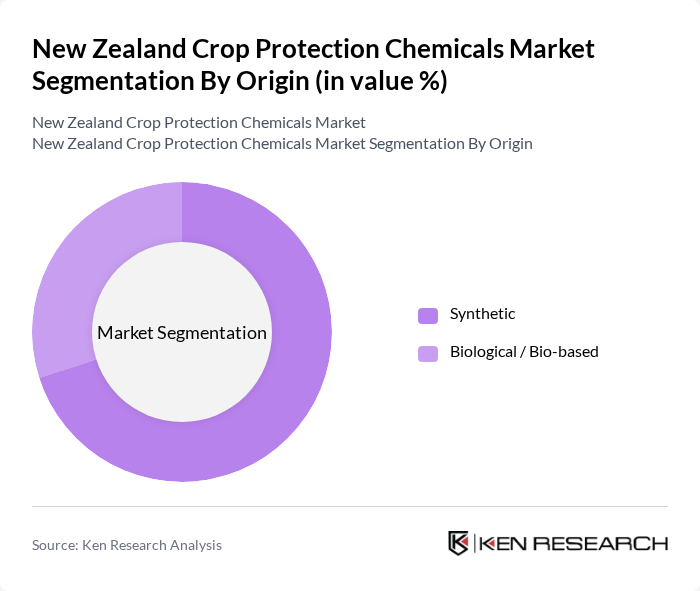

By Origin:The origin segmentation is categorized into synthetic and biological/bio-based products. Synthetic products dominate the market due to their broad-spectrum efficacy, cost-effectiveness, and well-established distribution networks across pastoral, arable, and horticultural sectors. However, there is a growing trend towards biological and bio-based products as consumers and export markets place greater emphasis on sustainability credentials, residue reduction, and alignment with integrated pest management systems. This shift is driven by the increasing demand for certified organic and low-residue production, retailer and processor programs encouraging greener inputs, and ongoing innovation in microbial and botanical crop protection solutions.

The New Zealand Crop Protection Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as FMC Corporation, Syngenta AG, BASF SE, Bayer CropScience AG, Corteva Agriscience, Nufarm Limited, ADAMA Agricultural Solutions Ltd., UPL Limited, Sumitomo Chemical Co., Ltd., Nippon Soda Co., Ltd., Mitsui Chemicals Agro, Inc., Isagro S.p.A., Valent BioSciences LLC, Land O'Lakes, Inc. (including WinField United), Key Local / Regional Players (e.g., New Zealand-based formulators and distributors) contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand crop protection chemicals market is poised for transformation as sustainability and technological advancements shape its future. With increasing investments in biopesticides and precision agriculture, the market is likely to see a shift towards environmentally friendly solutions. Additionally, the integration of digital tools in farming practices will enhance efficiency and crop management, creating a more resilient agricultural sector. These trends indicate a promising future for innovation and sustainable practices in crop protection.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Herbicides Insecticides Fungicides & Bactericides Biopesticides Other Synthetic Pesticides |

| By Origin | Synthetic Biological / Bio-based |

| By Crop Type | Cereals and Grains (e.g., wheat, barley, maize) Fruits Vegetables Pasture & Forage Crops Horticulture & Ornamentals Others |

| By Application Method | Foliar Application / Spray Soil Treatment Seed Treatment Chemigation & Fumigation Others |

| By Formulation Type | Liquid Granular Powder / Wettable Powders Suspension Concentrates & Emulsifiable Concentrates Others |

| By Distribution Channel | Direct Sales to Growers Agri-retailers & Cooperatives Distributors & Wholesalers Online & Digital Platforms Others |

| By Region | North Island – Upper (e.g., Northland, Auckland, Waikato, Bay of Plenty) North Island – Lower (e.g., Taranaki, Manawatu-Whanganui, Hawke’s Bay, Wellington) South Island – Northern & Central (e.g., Tasman, Nelson, Marlborough, Canterbury) South Island – Southern (e.g., Otago, Southland) Others (including smaller offshore islands) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Herbicide Usage in Crop Production | 120 | Farm Owners, Agronomists |

| Fungicide Application Practices | 100 | Crop Protection Managers, Agricultural Scientists |

| Insecticide Market Trends | 80 | Retailers, Distributors |

| Organic vs Conventional Chemical Use | 70 | Farmers, Sustainability Officers |

| Regulatory Impact on Chemical Usage | 90 | Policy Makers, Industry Experts |

The New Zealand Crop Protection Chemicals Market is valued at approximately USD 1.1 billion, reflecting a comprehensive analysis of agricultural chemical usage and wholesaling trends over the past five years.