Region:Asia

Author(s):Shubham

Product Code:KRAA4980

Pages:95

Published On:September 2025

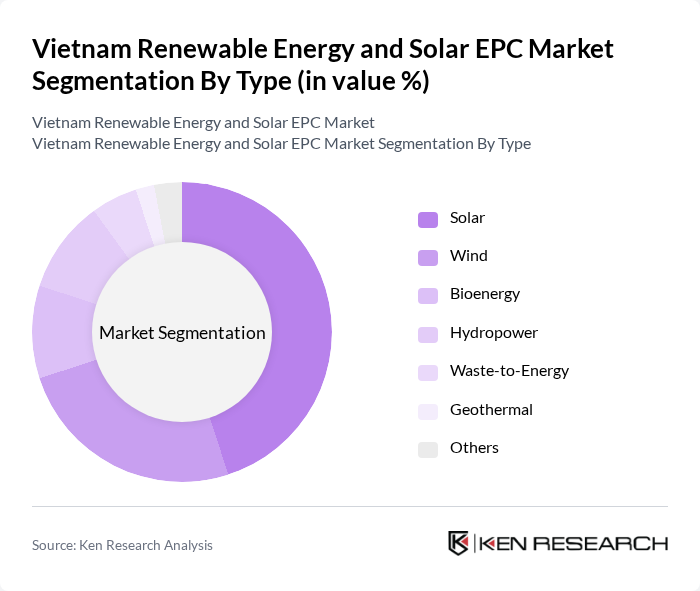

By Type:The market is segmented into various types, including Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, Geothermal, and Others. Among these, solar energy has emerged as the leading segment due to its decreasing costs and increasing efficiency, making it a preferred choice for both residential and commercial applications. Wind energy is also gaining traction, particularly in coastal areas where wind resources are abundant. The growing awareness of environmental sustainability and government incentives further drive the adoption of these renewable energy sources.

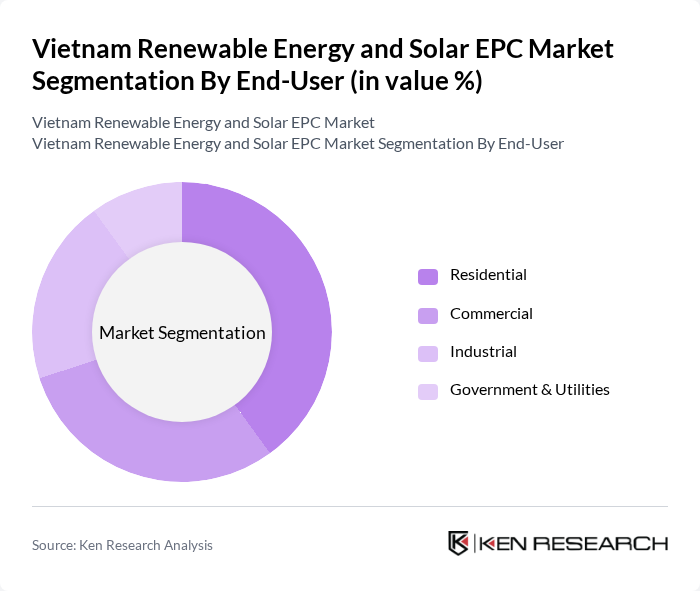

By End-User:The market is categorized into Residential, Commercial, Industrial, and Government & Utilities. The residential segment is currently the largest, driven by increasing consumer awareness and the affordability of solar panels. Commercial and industrial sectors are also significant contributors, as businesses seek to reduce energy costs and enhance sustainability. Government initiatives further support the growth of renewable energy adoption across all end-user categories.

The Vietnam Renewable Energy and Solar EPC Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietnam Electricity (EVN), Trung Nam Group, Sunseap Group, First Solar, JinkoSolar, Siemens Gamesa, Vestas Wind Systems, TGS Holdings, B.Grimm Power, AC Energy, AES Corporation, Engie, TotalEnergies, Orsted, EDL-Generation Public Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's renewable energy and solar EPC market appears promising, driven by increasing energy demands and supportive government policies. In the future, the market is expected to see a significant rise in solar installations, with an estimated 25,000 MW of new capacity added. The integration of smart grid technologies and energy storage solutions will enhance grid reliability and efficiency. Furthermore, international collaborations are likely to foster innovation and investment, positioning Vietnam as a regional leader in renewable energy development.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Wind Bioenergy Hydropower Waste-to-Energy Geothermal Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Investment Source | Domestic FDI PPP Government Schemes |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Technology | Photovoltaic Concentrated Solar Power (CSP) Onshore Wind Offshore Wind |

| By Distribution Mode | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Installations | 100 | Homeowners, Solar Installation Managers |

| Commercial Solar Projects | 80 | Facility Managers, Energy Procurement Officers |

| Utility-Scale Solar Developments | 60 | Project Developers, Regulatory Affairs Specialists |

| Solar Equipment Suppliers | 70 | Sales Managers, Product Development Engineers |

| Government Policy Makers | 50 | Energy Policy Analysts, Government Officials |

The Vietnam Renewable Energy and Solar EPC Market is valued at approximately USD 10 billion, reflecting significant growth driven by government initiatives, rising energy demands, and environmental concerns, particularly in solar and wind energy projects.