Region:Middle East

Author(s):Dev

Product Code:KRAC2664

Pages:80

Published On:October 2025

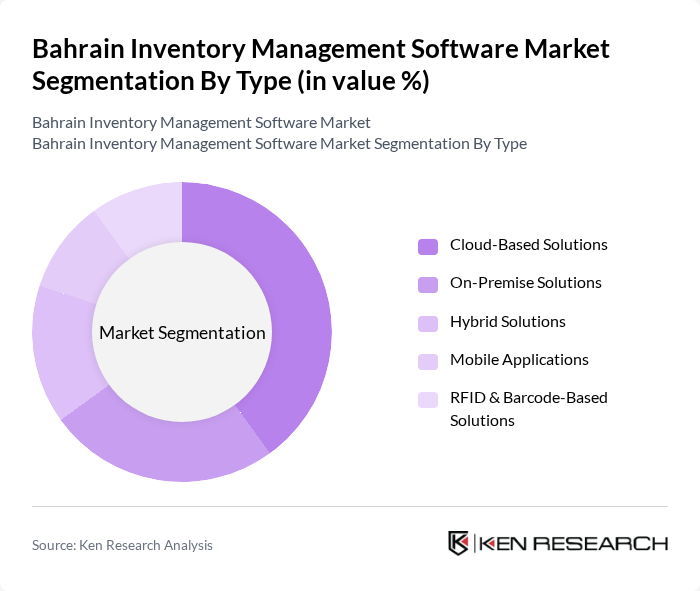

By Type:The market is segmented into Cloud-Based Solutions, On-Premise Solutions, Hybrid Solutions, Mobile Applications, and RFID & Barcode-Based Solutions. Cloud-based solutions are gaining significant traction due to their flexibility, scalability, and ability to provide real-time data access. On-premise solutions remain popular among large enterprises requiring greater control and security, while hybrid models offer a blend of both for businesses seeking flexibility. Mobile applications and RFID/barcode-based solutions are increasingly adopted for their ease of use and automation capabilities, supporting efficient inventory tracking and management.

The Cloud-Based Solutions segment leads the market, driven by its ability to deliver real-time inventory visibility, scalability, and lower upfront costs compared to traditional on-premise solutions. Businesses increasingly prefer cloud solutions for their flexibility, seamless integration with other digital tools, and support for remote work environments. The adoption of mobile technology and automation is also accelerating, with approximately 60% of businesses now utilizing mobile devices for inventory management.

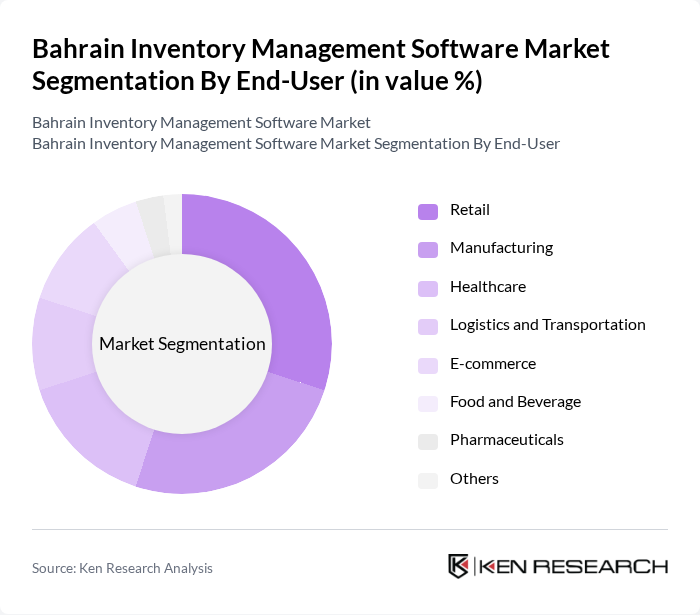

By End-User:The inventory management software market is segmented by end-user industries, including Retail, Manufacturing, Healthcare, Logistics and Transportation, E-commerce, Food and Beverage, Pharmaceuticals, and Others. Each sector has distinct requirements, with retail and manufacturing leading adoption due to their need for efficient inventory tracking, order fulfillment, and supply chain optimization. The rapid growth of e-commerce and third-party logistics is also driving demand for advanced inventory solutions tailored to complex, multi-channel environments.

The Retail segment holds the largest market share, propelled by the need for accurate inventory tracking and management to meet dynamic consumer demand. Retailers are adopting inventory management software to optimize stock levels, minimize waste, and enhance customer satisfaction. The expansion of e-commerce and omnichannel retailing further amplifies this trend, as online and offline retailers require robust solutions for inventory synchronization and order fulfillment.

The Bahrain Inventory Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Microsoft Corporation, Infor, Zoho Corporation, Fishbowl Inventory, NetSuite Inc., Epicor Software Corporation, Odoo S.A., SkuVault, Cin7, Brightpearl, Unleashed Software, QuickBooks Commerce, Manhattan Associates, Inc., Blue Yonder (formerly JDA Software Group, Inc.), IBM Corporation, Körber AG, Tecsys Inc., Logiwa, 3PL Central contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain inventory management software market appears promising, driven by technological advancements and increasing digitalization across various sectors. As businesses continue to recognize the importance of efficient inventory management, the adoption of innovative solutions is expected to rise. Additionally, the growing emphasis on data-driven decision-making will likely propel the integration of artificial intelligence and machine learning into inventory systems, enhancing operational efficiency and accuracy in inventory tracking.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions Mobile Applications RFID & Barcode-Based Solutions |

| By End-User | Retail Manufacturing Healthcare Logistics and Transportation E-commerce Food and Beverage Pharmaceuticals Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Industry Vertical | Food and Beverage Pharmaceuticals Electronics Automotive Consumer Goods Others |

| By Functionality | Inventory Tracking Order Management Reporting and Analytics Supply Chain Management Warehouse Management Transportation Management Others |

| By Sales Channel | Direct Sales Online Sales Resellers and Distributors |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-per-Use Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 60 | Store Managers, Inventory Control Specialists |

| Manufacturing Supply Chain Solutions | 50 | Production Managers, Supply Chain Analysts |

| E-commerce Inventory Systems | 40 | eCommerce Operations Managers, IT Directors |

| Logistics and Distribution Management | 45 | Logistics Coordinators, Warehouse Managers |

| Software Vendors and Developers | 40 | Product Managers, Software Engineers |

The Bahrain Inventory Management Software Market is valued at approximately USD 38 million, reflecting a five-year historical analysis and normalization from regional enterprise software market data, driven by the adoption of digital inventory solutions and e-commerce expansion.