Region:Asia

Author(s):Shubham

Product Code:KRAC4901

Pages:86

Published On:October 2025

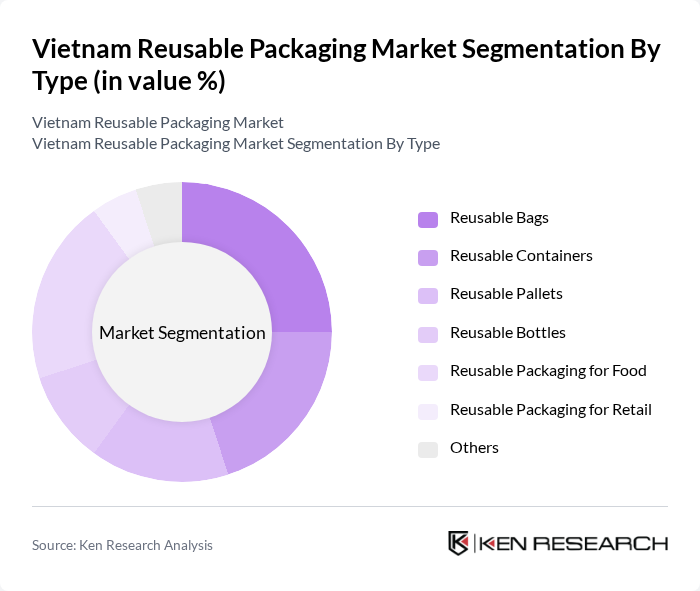

By Type:The reusable packaging market can be segmented into various types, including reusable bags, reusable containers, reusable pallets, reusable bottles, reusable packaging for food, reusable packaging for retail, and others. Each of these subsegments plays a crucial role in catering to different consumer needs and preferences.

The reusable containers segment represents a significant portion of the market, driven by the growing demand from food and beverage sectors and e-commerce logistics. Reusable bags continue to maintain strong market presence due to their versatility, convenience, and increasing consumer preference for eco-friendly options. As consumers become more environmentally conscious, the demand for reusable bags has surged, particularly in urban areas where single-use plastic bags are being phased out. Retailers are also promoting reusable bags as part of their sustainability initiatives, further driving their adoption. This trend is expected to continue as more consumers seek sustainable alternatives to traditional packaging.

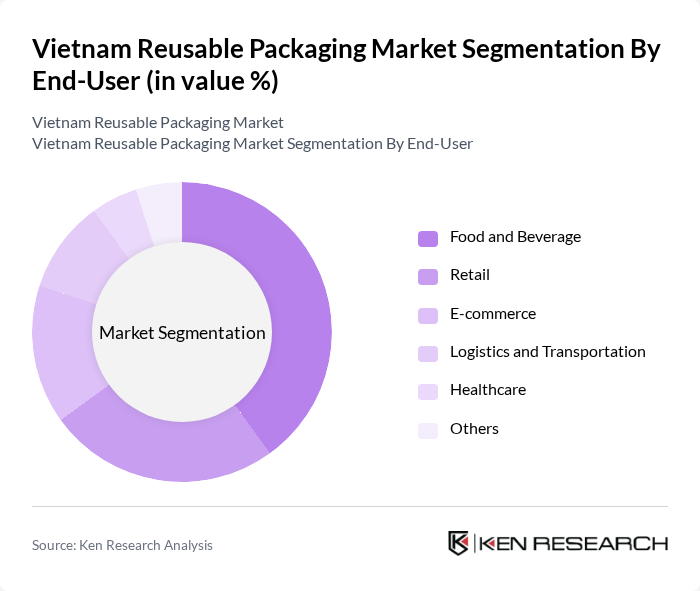

By End-User:The market can also be segmented based on end-users, including food and beverage, retail, e-commerce, logistics and transportation, healthcare, and others. Each end-user segment has unique requirements and preferences for reusable packaging solutions.

The food and beverage segment is the leading end-user in the reusable packaging market, driven by the increasing demand for sustainable packaging solutions in the industry. Vietnam's food-and-beverage sector recorded 7.4% sales growth, reaching USD 79.3 billion, solidifying its role as the single largest stimulus for reusable packaging adoption. As consumers become more health-conscious and environmentally aware, food and beverage companies are adopting reusable packaging to enhance their brand image and meet regulatory requirements. This trend is further supported by the growing popularity of takeout and delivery services, which require efficient and sustainable packaging solutions. The e-commerce sector is also emerging as a significant growth driver, with rapid expansion in urban delivery models across Ho Chi Minh City, Hanoi, and Da Nang.

The Vietnam Reusable Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tetra Pak, Amcor, Smurfit Kappa, Mondi Group, DS Smith, Huhtamaki, Berry Global, Sealed Air, WestRock, Novolex, RPC Group, International Paper, Sonoco Products, Graphic Packaging, Klabin, Vinamilk, Masan Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam reusable packaging market appears promising, driven by increasing environmental awareness and supportive government policies. As consumer preferences continue to shift towards sustainability, businesses are likely to innovate and adopt eco-friendly practices. The expansion of e-commerce and food delivery services will further accelerate the demand for reusable packaging solutions. Additionally, collaborations between manufacturers and retailers can enhance market penetration, creating a more sustainable packaging ecosystem in Vietnam.

| Segment | Sub-Segments |

|---|---|

| By Type | Reusable Bags Reusable Containers Reusable Pallets Reusable Bottles Reusable Packaging for Food Reusable Packaging for Retail Others |

| By End-User | Food and Beverage Retail E-commerce Logistics and Transportation Healthcare Others |

| By Application | Food Packaging Beverage Packaging Industrial Packaging Consumer Goods Packaging Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Specialty Stores Direct Sales Others |

| By Material Type | Plastic Glass Metal Paper Others |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies for Reusable Packaging Tax Incentives Grants for Sustainable Practices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Sector | 60 | Product Managers, Sustainability Coordinators |

| Retail Industry Insights | 50 | Store Managers, Supply Chain Analysts |

| E-commerce Packaging Solutions | 45 | Logistics Managers, E-commerce Operations Managers |

| Consumer Attitudes towards Reusables | 120 | General Consumers, Eco-conscious Shoppers |

| Government Policy Impact | 40 | Policy Makers, Environmental Consultants |

The Vietnam Reusable Packaging Market is valued at approximately USD 121.8 billion, reflecting significant growth driven by environmental awareness, government initiatives, and a shift towards eco-friendly consumer preferences across various sectors, including food and beverage, retail, and e-commerce.