Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3102

Pages:82

Published On:October 2025

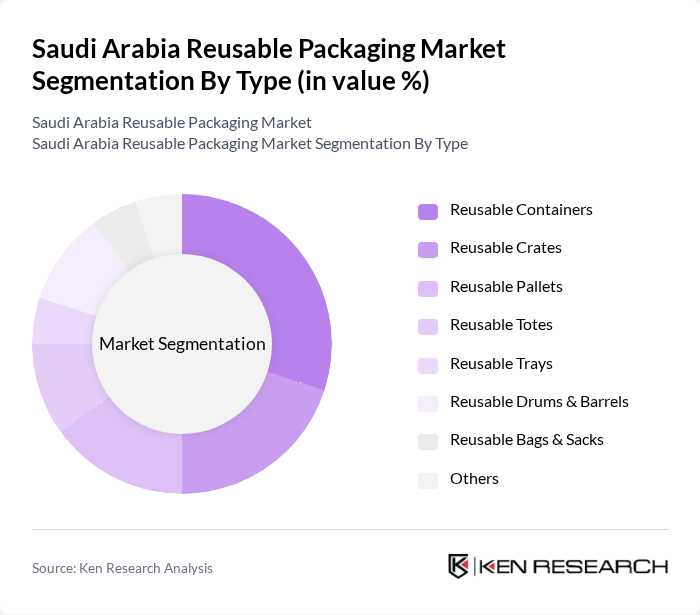

By Type:The reusable packaging market can be segmented into various types, including Reusable Containers, Reusable Crates, Reusable Pallets, Reusable Totes, Reusable Trays, Reusable Drums & Barrels, Reusable Bags & Sacks, and Others. Among these, Reusable Containers are gaining significant traction due to their versatility and widespread application across multiple industries. The growing trend of e-commerce and the need for efficient logistics solutions are further propelling the demand for these containers.

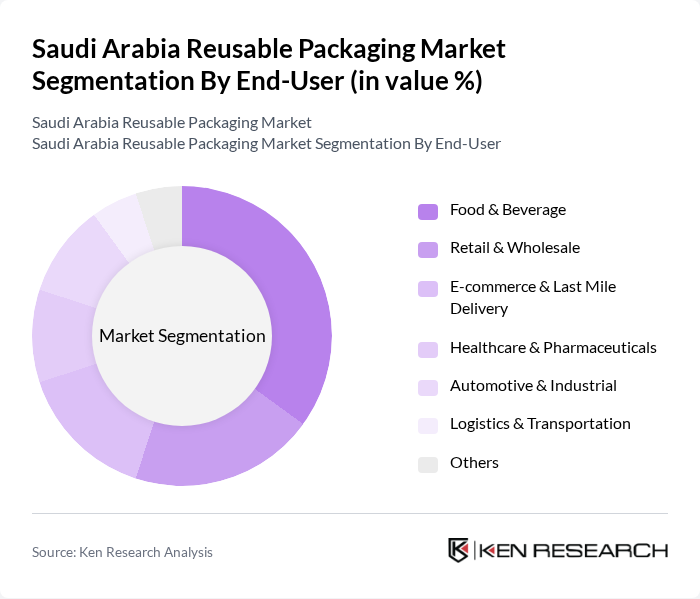

By End-User:The end-user segmentation includes Food & Beverage, Retail & Wholesale, E-commerce & Last Mile Delivery, Healthcare & Pharmaceuticals, Automotive & Industrial, Logistics & Transportation, and Others. The Food & Beverage sector is the leading end-user, driven by stringent regulations on packaging waste and the increasing consumer preference for sustainable products. This sector's growth is further supported by the rising demand for convenience and ready-to-eat meals.

The Saudi Arabia Reusable Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Bayader International, Napco National, Takween Advanced Industries, Greif, Inc., Amcor plc, Sealed Air Corporation, Berry Global, Inc., Huhtamaki Group, DS Smith Plc, Mondi Group, Tetra Pak International S.A., ORBIS Corporation, International Paper Company, WestRock Company, Sanpac contribute to innovation, geographic expansion, and service delivery in this space.

The future of the reusable packaging market in Saudi Arabia appears promising, driven by a combination of government support and evolving consumer preferences. As sustainability becomes a core value for both consumers and businesses, the market is likely to witness increased innovation in packaging solutions. Additionally, the integration of smart technologies in packaging is expected to enhance supply chain efficiency, further solidifying the role of reusable packaging in the retail and e-commerce sectors, fostering sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Reusable Containers Reusable Crates Reusable Pallets Reusable Totes Reusable Trays Reusable Drums & Barrels Reusable Bags & Sacks Others |

| By End-User | Food & Beverage Retail & Wholesale E-commerce & Last Mile Delivery Healthcare & Pharmaceuticals Automotive & Industrial Logistics & Transportation Others |

| By Application | Primary Packaging Secondary Packaging Tertiary/Industrial Packaging Consumer Goods Packaging Others |

| By Distribution Channel | Direct Sales Online Retail Wholesale Distribution Retail Outlets Others |

| By Material Type | Plastic Wood Metal Glass Others |

| By Price Range | Low Price Mid Price High Price |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Sector | 75 | Packaging Managers, Sustainability Coordinators |

| Retail Industry Insights | 65 | Store Managers, Supply Chain Analysts |

| Manufacturing Sector Feedback | 60 | Production Supervisors, Quality Control Managers |

| Environmental Impact Studies | 50 | Environmental Compliance Officers, Policy Makers |

| Consumer Behavior Analysis | 70 | End Consumers, Market Research Participants |

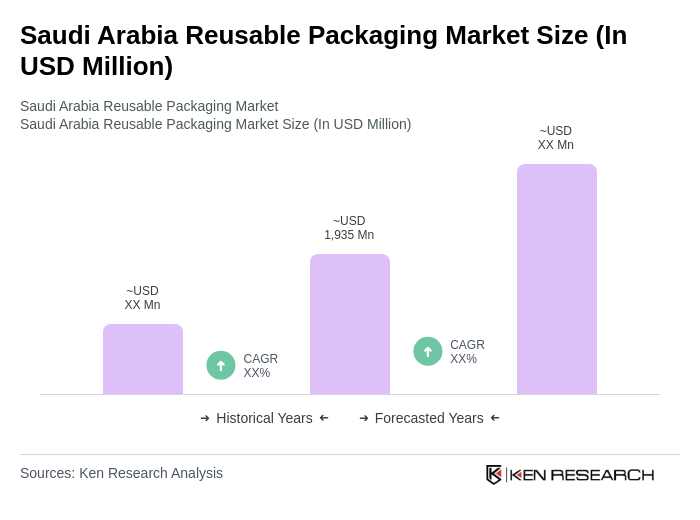

The Saudi Arabia Reusable Packaging Market is valued at approximately USD 1,935 million. This growth is attributed to increasing environmental awareness, government sustainability initiatives, and the rising demand for efficient packaging solutions across various industries.