Region:Asia

Author(s):Rebecca

Product Code:KRAA4866

Pages:87

Published On:September 2025

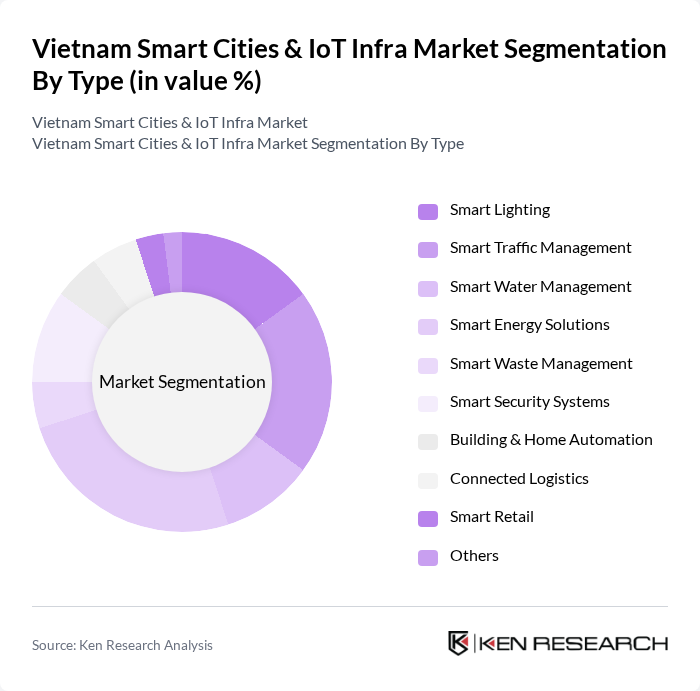

By Type:The market can be segmented into various types, includingSmart Lighting, Smart Traffic Management, Smart Water Management, Smart Energy Solutions, Smart Waste Management, Smart Security Systems, Building & Home Automation, Connected Logistics, Smart Retail, and Others. Each of these segments plays a crucial role in enhancing urban living and operational efficiency. Smart Energy Solutions and Smart Traffic Management are particularly prominent, reflecting Vietnam’s focus on energy efficiency and urban mobility.

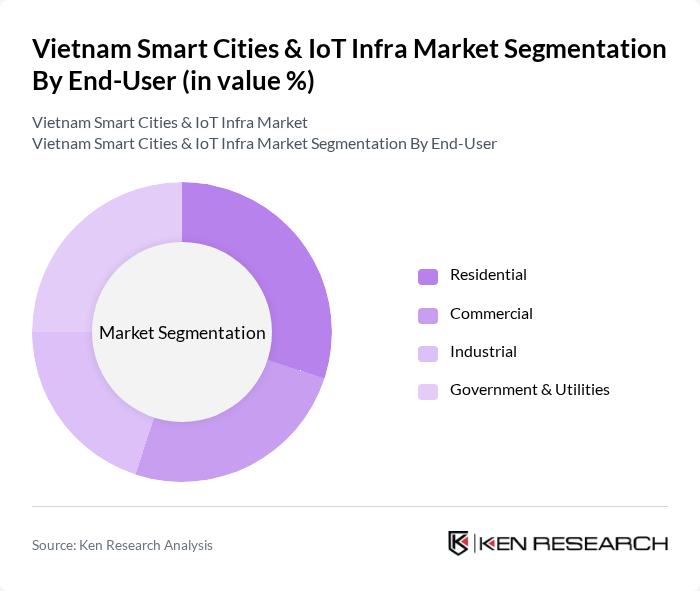

By End-User:The end-user segmentation includesResidential, Commercial, Industrial, and Government & Utilities. Each segment has unique requirements and applications for smart city solutions, contributing to the overall market growth. The government and utilities segment is a major driver, leveraging smart infrastructure for public safety, e-government, and urban services.

The Vietnam Smart Cities & IoT Infra Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viettel Group, FPT Corporation, VNPT (Vietnam Posts and Telecommunications Group), Siemens Vietnam, Schneider Electric Vietnam, Cisco Systems Vietnam, IBM Vietnam, Huawei Technologies Vietnam, Hitachi Asia Ltd., Bosch Vietnam, NEC Vietnam, Ericsson Vietnam, Microsoft Vietnam, Oracle Vietnam, Samsung Electronics Vietnam, CMC Corporation, Advantech Vietnam Technology Co., Ltd., ABB Vietnam, Viettronics Tan Binh JSC, Lumi Vietnam JSC contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's smart cities and IoT infrastructure market appears promising, driven by ongoing urbanization and government support. In future, the integration of AI and machine learning into urban management systems is expected to enhance operational efficiencies significantly. Additionally, the expansion of 5G networks will facilitate faster data transmission, enabling real-time monitoring and management of urban services. As public-private partnerships grow, innovative solutions will emerge, addressing urban challenges and improving the quality of life for citizens.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Lighting Smart Traffic Management Smart Water Management Smart Energy Solutions Smart Waste Management Smart Security Systems Building & Home Automation Connected Logistics Smart Retail Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Urban Mobility Energy Management Public Safety Environmental Monitoring Smart Buildings Citizen Engagement Platforms Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Grants and Funding |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Outlets |

| By Price Range | Low-End Solutions Mid-Range Solutions High-End Solutions |

| By Region | Southern Vietnam Northern Vietnam Central Vietnam |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Transportation Solutions | 100 | City Transport Officials, Smart Mobility Experts |

| IoT in Energy Management | 80 | Energy Sector Managers, Smart Grid Analysts |

| Public Safety and Surveillance Systems | 70 | Security Managers, Urban Safety Coordinators |

| Smart Waste Management Initiatives | 50 | Environmental Officers, Waste Management Managers |

| Community Engagement in Smart City Projects | 90 | Community Leaders, Urban Development Advocates |

The Vietnam Smart Cities & IoT Infra Market is valued at approximately USD 7.1 billion, driven by rapid urbanization, government initiatives, and increasing investments in IoT infrastructure. This growth reflects the rising demand for smart solutions in urban management and public safety.