Region:Middle East

Author(s):Rebecca

Product Code:KRAB4140

Pages:81

Published On:October 2025

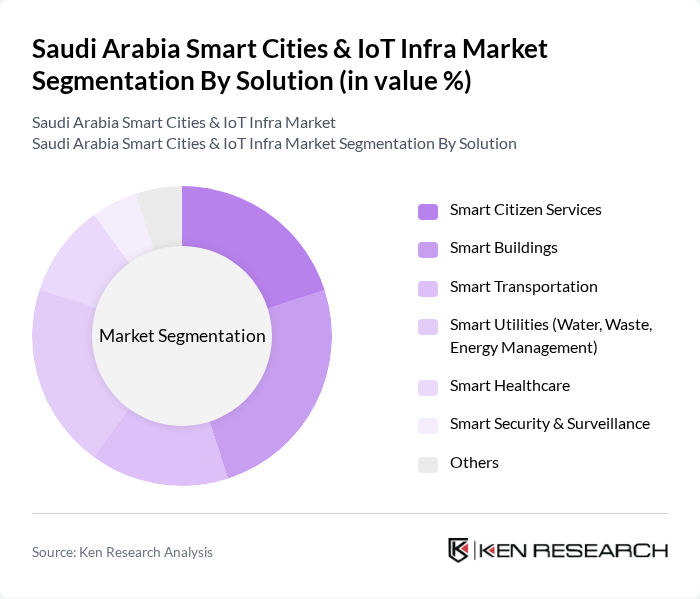

By Solution:The segmentation of the market by solution includes various subsegments such as Smart Citizen Services, Smart Buildings, Smart Transportation, Smart Utilities (Water, Waste, Energy Management), Smart Healthcare, Smart Security & Surveillance, and Others. Each of these subsegments plays a crucial role in enhancing urban living and operational efficiency, with Smart Buildings and Smart Utilities representing the largest shares due to ongoing investments in infrastructure modernization and sustainability initiatives .

By Component:The market is also segmented by component, which includes Hardware (Sensors, Gateways, Devices), Software (Platforms, Analytics, Applications), and Services (Consulting, Integration, Managed Services). Each component is essential for the successful implementation of smart city solutions, with software platforms and analytics accounting for the largest share as cities increasingly rely on integrated data-driven management systems .

The Saudi Arabia Smart Cities & IoT Infra Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Telecom Company (STC), NEOM, Saudi Aramco, Mobily (Etihad Etisalat Company), Zain KSA, Elm Company, Cisco Systems, Inc., IBM Corporation, Schneider Electric SE, Honeywell International Inc., Huawei Technologies Co., Ltd., Ericsson AB, Oracle Corporation, Microsoft Corporation, Accenture plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Smart Cities and IoT Infra market appears promising, driven by ongoing government initiatives and technological advancements. As urbanization accelerates, the demand for smart solutions will likely increase, fostering innovation in infrastructure and services. The integration of AI and machine learning will enhance operational efficiencies, while the expansion of 5G networks will facilitate seamless connectivity. These trends indicate a robust growth trajectory, positioning Saudi Arabia as a leader in smart city development in the region.

| Segment | Sub-Segments |

|---|---|

| By Solution | Smart Citizen Services Smart Buildings Smart Transportation Smart Utilities (Water, Waste, Energy Management) Smart Healthcare Smart Security & Surveillance Others |

| By Component | Hardware (Sensors, Gateways, Devices) Software (Platforms, Analytics, Applications) Services (Consulting, Integration, Managed Services) |

| By Technology | Internet of Things (IoT) Cloud Computing Artificial Intelligence (AI) & Machine Learning (ML) Big Data & Analytics G & Connectivity |

| By End-User | Government & Municipalities Commercial Residential Industrial |

| By Application | Public Safety Traffic Management Environmental Monitoring Energy Management Waste Management Water Management |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Frameworks Incentives for Innovation |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Transportation Systems | 100 | City Transport Officials, Smart Mobility Experts |

| IoT in Public Safety | 80 | Police Department Officials, Emergency Response Coordinators |

| Smart Healthcare Solutions | 60 | Healthcare Administrators, IT Managers in Hospitals |

| Smart Waste Management | 50 | Environmental Officers, Waste Management Supervisors |

| Smart Energy Management | 70 | Energy Sector Executives, Sustainability Managers |

The Saudi Arabia Smart Cities & IoT Infra Market is valued at approximately USD 13.2 billion, driven by rapid urbanization, government initiatives like Saudi Vision 2030, and the increasing adoption of IoT and AI technologies across various sectors.