Region:Asia

Author(s):Geetanshi

Product Code:KRAD3908

Pages:97

Published On:November 2025

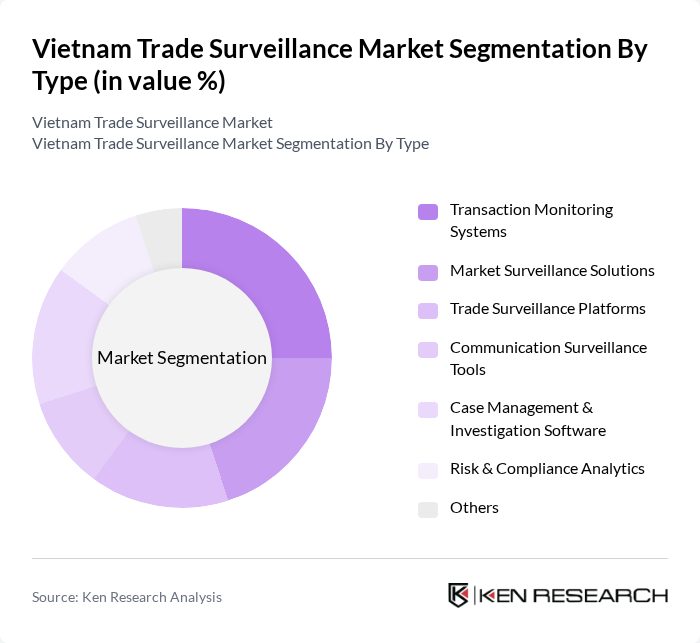

By Type:The market is segmented into various types of surveillance solutions, including Transaction Monitoring Systems, Market Surveillance Solutions, Trade Surveillance Platforms, Communication Surveillance Tools, Case Management & Investigation Software, Risk & Compliance Analytics, and Others. Each of these subsegments plays a crucial role in ensuring compliance and monitoring trading activities effectively.

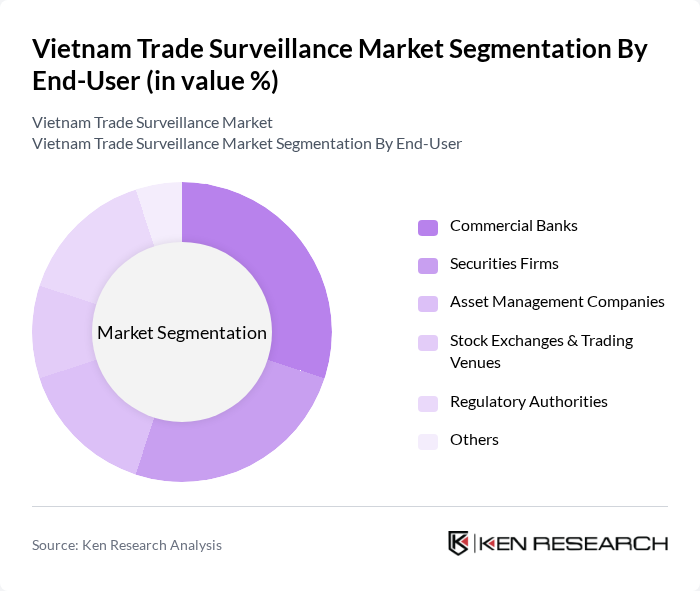

By End-User:The end-user segmentation includes Commercial Banks, Securities Firms, Asset Management Companies, Stock Exchanges & Trading Venues, Regulatory Authorities, and Others. Each of these segments has unique requirements and compliance needs, driving the demand for tailored surveillance solutions.

The Vietnam Trade Surveillance Market is characterized by a dynamic mix of regional and international players. Leading participants such as FIS Global, NICE Actimize, SAS Institute, Amlify, Oracle Financial Services, LSEG (London Stock Exchange Group), Actico, Verafin, ComplyAdvantage, FICO, BAE Systems, Palantir Technologies, Infor, IBM, ACI Worldwide, Viettel Solutions, FPT Information System, Techcom Securities (TCBS), VNDIRECT Securities Corporation, SSI Securities Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam Trade Surveillance Market is poised for significant transformation as regulatory pressures and technological advancements converge. In future, the integration of AI and machine learning will enhance the capabilities of surveillance systems, enabling real-time monitoring and predictive analytics. Financial institutions will increasingly prioritize user-friendly interfaces to facilitate adoption among staff. As the market evolves, collaboration with regulatory bodies will become essential to ensure compliance and foster innovation, ultimately leading to a more secure financial environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Transaction Monitoring Systems Market Surveillance Solutions Trade Surveillance Platforms Communication Surveillance Tools Case Management & Investigation Software Risk & Compliance Analytics Others |

| By End-User | Commercial Banks Securities Firms Asset Management Companies Stock Exchanges & Trading Venues Regulatory Authorities Others |

| By Industry | Banking Securities & Capital Markets Insurance Fintech Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| By Regulatory Compliance Level | Basic Compliance Advanced Compliance Comprehensive Compliance Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Institutions Compliance | 100 | Compliance Officers, Risk Managers |

| Manufacturing Sector Surveillance | 80 | Operations Managers, Quality Assurance Heads |

| Logistics and Supply Chain Monitoring | 70 | Supply Chain Managers, Logistics Coordinators |

| Technology Providers Insights | 60 | Product Managers, Business Development Executives |

| Regulatory Body Perspectives | 50 | Regulatory Analysts, Policy Makers |

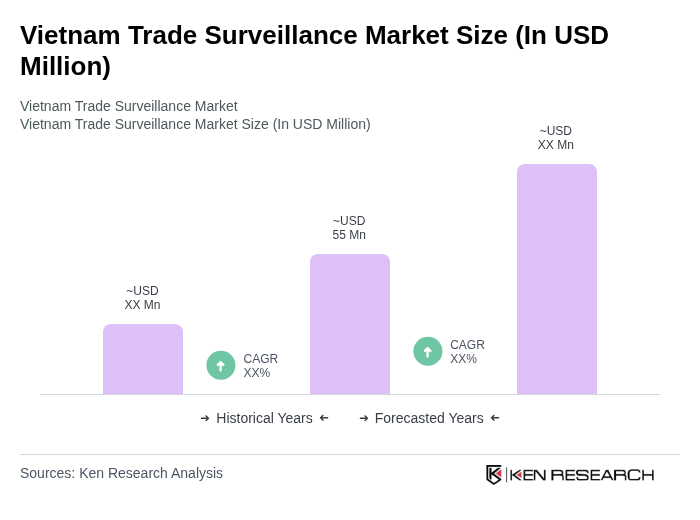

The Vietnam Trade Surveillance Market is valued at approximately USD 55 million, driven by regulatory compliance needs, the rise in digital transactions, and increased fraud awareness among financial institutions.