Region:Middle East

Author(s):Shubham

Product Code:KRAB3193

Pages:99

Published On:October 2025

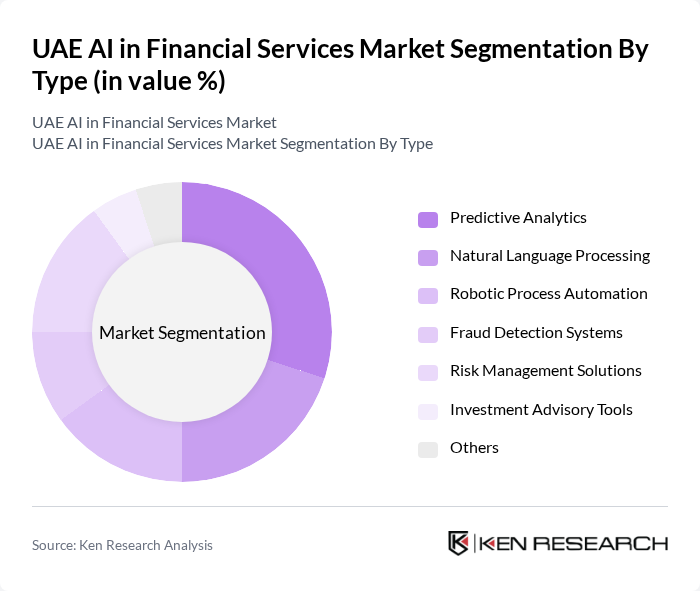

By Type:The market is segmented into various types, including Predictive Analytics, Natural Language Processing, Robotic Process Automation, Fraud Detection Systems, Risk Management Solutions, Investment Advisory Tools, and Others. Each of these segments plays a crucial role in enhancing the efficiency and effectiveness of financial services. Predictive Analytics is particularly dominant due to its ability to analyze vast amounts of data to forecast trends and customer behavior, which is essential for strategic decision-making in financial institutions.

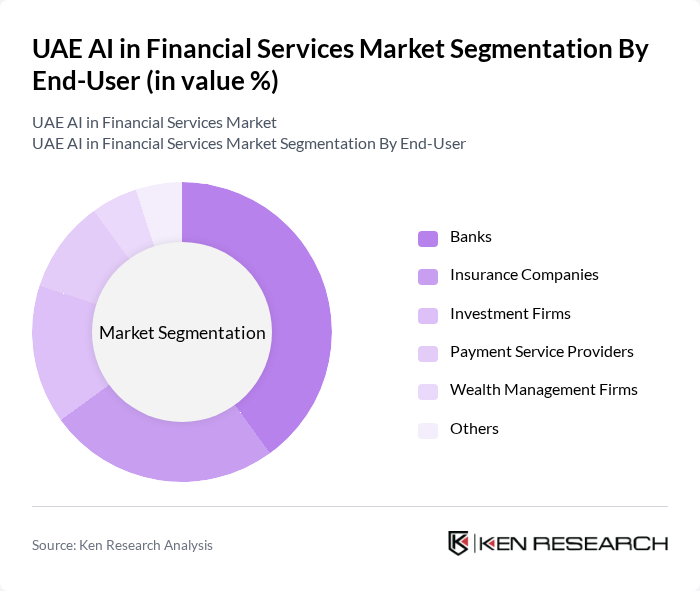

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Payment Service Providers, Wealth Management Firms, and Others. Banks are the leading end-users of AI technologies in financial services, driven by their need to enhance customer service, streamline operations, and improve risk management. The increasing competition in the banking sector has prompted these institutions to adopt AI solutions to stay ahead and meet evolving customer expectations.

The UAE AI in Financial Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates NBD, Abu Dhabi Commercial Bank, First Abu Dhabi Bank, Dubai Islamic Bank, Mashreq Bank, Noor Bank, RAK Bank, DIB Bank, Al Hilal Bank, ADCB, Union National Bank, Emirates Islamic Bank, Abu Dhabi Investment Authority, Dubai Financial Services Authority, Fintech Hive contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in the UAE's financial services market appears promising, driven by technological advancements and a supportive regulatory environment. As institutions increasingly adopt AI solutions, the focus will shift towards enhancing operational efficiency and customer engagement. The collaboration between financial institutions and technology firms is expected to foster innovation, leading to the development of more sophisticated AI applications. Additionally, the emphasis on ethical AI practices will shape the industry's landscape, ensuring responsible use of technology while addressing consumer concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Natural Language Processing Robotic Process Automation Fraud Detection Systems Risk Management Solutions Investment Advisory Tools Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Service Providers Wealth Management Firms Others |

| By Application | Customer Service Automation Credit Scoring Compliance Monitoring Market Analysis Portfolio Management Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Online Sales Distributors Resellers |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Others |

| By Customer Segment | Retail Customers Corporate Clients Government Entities SMEs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector AI Integration | 100 | Chief Technology Officers, AI Project Managers |

| Insurance Industry AI Applications | 80 | Data Analysts, Risk Management Officers |

| Investment Firms Utilizing AI | 70 | Portfolio Managers, Financial Analysts |

| Fintech Startups and AI Solutions | 90 | Founders, Product Development Leads |

| Regulatory Bodies on AI in Finance | 50 | Policy Makers, Compliance Officers |

The UAE AI in Financial Services Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of AI technologies by financial institutions to enhance operational efficiency and customer experience.