Region:Africa

Author(s):Geetanshi

Product Code:KRAA2087

Pages:100

Published On:August 2025

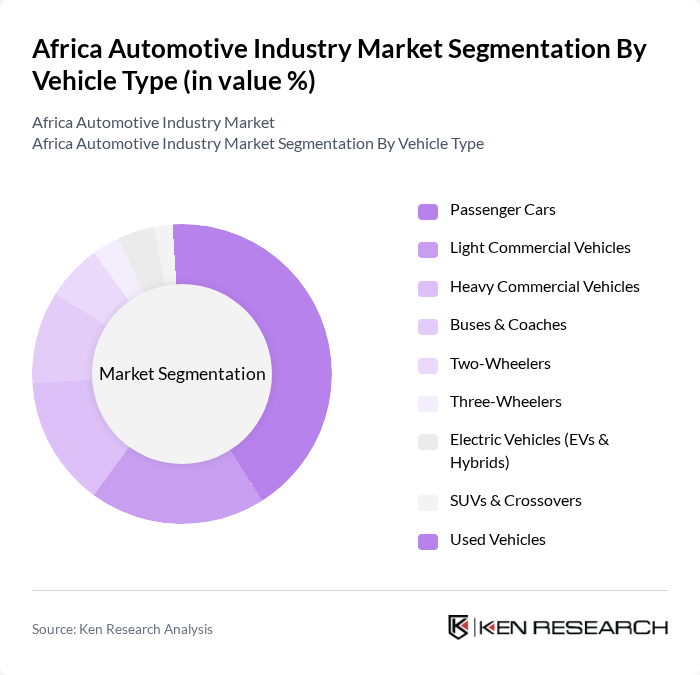

By Vehicle Type:The vehicle type segmentation includes categories such as passenger cars, light commercial vehicles, heavy commercial vehicles, buses & coaches, two-wheelers, three-wheelers, electric vehicles (EVs & hybrids), SUVs & crossovers, and used vehicles. Among these, passenger cars are the most dominant segment, driven by increasing consumer preference for personal mobility and a growing middle class. Demand for SUVs and electric vehicles is also rising, reflecting changing consumer preferences toward larger vehicles and sustainable options .

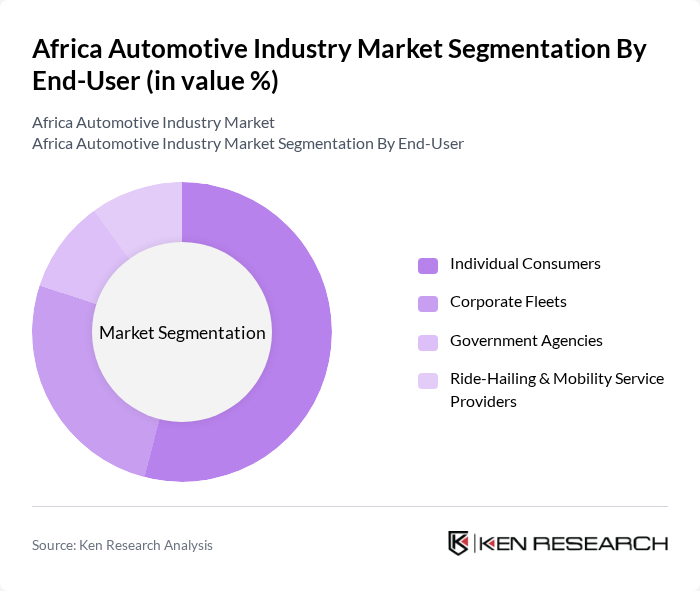

By End-User:The end-user segmentation encompasses individual consumers, corporate fleets, government agencies, and ride-hailing & mobility service providers. Individual consumers represent the largest segment, driven by the increasing demand for personal vehicles and the growing trend of urbanization. Corporate fleets are also significant, as businesses seek to enhance operational efficiency through vehicle acquisition .

The Africa Automotive Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota South Africa Motors (Pty) Ltd, Volkswagen Group South Africa, Ford Motor Company of Southern Africa, BMW South Africa (Pty) Ltd, Mercedes-Benz South Africa Ltd, Nissan South Africa (Pty) Ltd, Isuzu Motors South Africa, Honda Motor Southern Africa (Pty) Ltd, Tata Africa Holdings (South Africa) Pty Ltd, Hyundai Automotive South Africa (Pty) Ltd, Kia South Africa (Pty) Ltd, Renault South Africa (Pty) Ltd, Great Wall Motors (GWM) South Africa, Mahindra South Africa (Pty) Ltd, Peugeot Citroën South Africa, BAIC South Africa (Pty) Ltd, FAW Vehicle Manufacturers South Africa (Pty) Ltd, JAC Motors South Africa, Chery South Africa, UD Trucks Southern Africa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the African automotive industry appears promising, driven by increasing urbanization and a growing middle class. In future, the market is expected to witness a surge in electric vehicle adoption, supported by government incentives and a shift towards sustainable mobility. Additionally, the expansion of ride-sharing services is anticipated to reshape transportation dynamics, providing new avenues for growth. As infrastructure improves, the automotive sector will likely experience enhanced connectivity and efficiency, fostering further development.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles Buses & Coaches Two-Wheelers Three-Wheelers Electric Vehicles (EVs & Hybrids) SUVs & Crossovers Used Vehicles |

| By End-User | Individual Consumers Corporate Fleets Government Agencies Ride-Hailing & Mobility Service Providers |

| By Sales Channel | Authorized Dealerships Independent Dealers Online Platforms Auctions |

| By Distribution Mode | Retail Distribution Wholesale Distribution Direct-to-Consumer |

| By Price Range | Budget Vehicles Mid-Range Vehicles Premium & Luxury Vehicles |

| By Fuel Type | Petrol Diesel Electric Hybrid Alternative Fuels (CNG, LPG, Hydrogen) |

| By Vehicle Size | Compact Midsize Full-Size SUVs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Market | 120 | Sales Managers, Marketing Directors |

| Commercial Vehicle Sector | 90 | Fleet Managers, Procurement Officers |

| Electric Vehicle Adoption | 60 | Product Development Managers, Sustainability Officers |

| Automotive Parts Supply Chain | 50 | Supply Chain Managers, Quality Assurance Heads |

| Aftermarket Services | 70 | Service Center Managers, Customer Experience Leads |

The Africa Automotive Industry Market is valued at approximately USD 20 billion, driven by factors such as urbanization, rising disposable incomes, and a growing middle class, which increases the demand for both personal and commercial vehicles.