Region:Africa

Author(s):Rebecca

Product Code:KRAA2100

Pages:92

Published On:August 2025

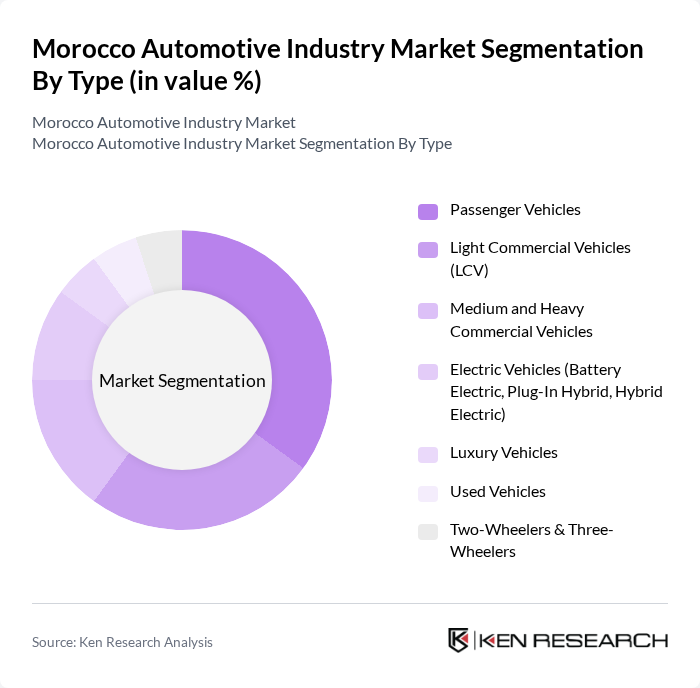

By Type:The automotive market is segmented into Passenger Vehicles, Light Commercial Vehicles (LCV), Medium and Heavy Commercial Vehicles, Electric Vehicles (Battery Electric, Plug-In Hybrid, Hybrid Electric), Luxury Vehicles, Used Vehicles, and Two-Wheelers & Three-Wheelers. These segments address varying consumer needs, from urban mobility and commercial logistics to premium and sustainable transport solutions. The market’s diversity reflects Morocco’s evolving automotive landscape, with electric vehicles gaining traction due to supportive government policies and expanding charging infrastructure .

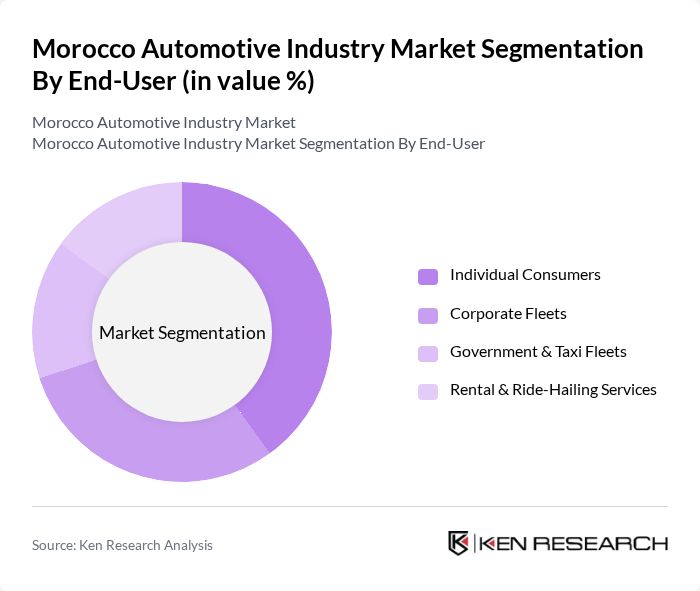

By End-User:The end-user segmentation includes Individual Consumers, Corporate Fleets, Government & Taxi Fleets, and Rental & Ride-Hailing Services. Individual consumers are the largest segment, driven by rising disposable incomes and favorable financing options. Corporate fleets and government/taxi fleets benefit from Morocco’s expanding logistics and public transport initiatives, while rental and ride-hailing services are supported by urbanization and tourism growth .

The Morocco Automotive Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Renault Maroc, Dacia Maroc, Peugeot Maroc, Citroën Maroc, Volkswagen Maroc, Hyundai Maroc, BYD Maroc, Toyota Maroc, Kia Maroc, Nissan Maroc, Fiat Maroc, Mercedes-Benz Maroc, BMW Maroc, Audi Maroc, Isuzu Maroc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Moroccan automotive industry appears promising, driven by a strong focus on electric vehicle (EV) adoption and sustainable practices. With the government aiming for30%of new vehicle sales to be electric in future, investments in EV infrastructure are expected to rise significantly. Additionally, the development of automotive clusters will enhance collaboration among manufacturers, suppliers, and research institutions, fostering innovation and improving competitiveness in the global market.

| Segment | Sub-Segments |

|---|---|

| By Type | Passenger Vehicles Light Commercial Vehicles (LCV) Medium and Heavy Commercial Vehicles Electric Vehicles (Battery Electric, Plug-In Hybrid, Hybrid Electric) Luxury Vehicles Used Vehicles Two-Wheelers & Three-Wheelers |

| By End-User | Individual Consumers Corporate Fleets Government & Taxi Fleets Rental & Ride-Hailing Services |

| By Sales Channel | OEM-Authorized Dealerships Independent Dealers Online Direct Sales Platforms Auctions |

| By Distribution Mode | Urban Distribution Rural Distribution Export Distribution |

| By Price Range | Budget Vehicles Mid-Range Vehicles Premium Vehicles |

| By Component | Engine Components Electrical Systems Chassis and Body Safety Features |

| By Application | Personal Use Commercial Use Government Use Fleet Management |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 100 | Production Managers, Marketing Directors |

| Commercial Vehicle Suppliers | 80 | Supply Chain Managers, Procurement Officers |

| Electric Vehicle Startups | 50 | Founders, R&D Managers |

| Automotive Component Manufacturers | 90 | Operations Managers, Quality Assurance Heads |

| Government Regulatory Bodies | 40 | Policy Makers, Industry Analysts |

The Morocco automotive industry market is valued at approximately USD 5 billion, driven by increasing domestic demand, government incentives for local manufacturing, and expanding export markets. The sector significantly contributes to the country's GDP and employment.