South America Automotive Industry Market Overview

- The South America Automotive Industry Market is valued at USD 27 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for personal vehicles, rapid urbanization, and the expansion of e-commerce logistics, which has led to a rise in light commercial vehicle sales. Additionally, government initiatives promoting electric vehicles and fuel-efficient technologies have further stimulated market growth, with a gradual shift toward sustainable mobility solutions .

- Brazil and Argentina are the dominant countries in the South American automotive market. Brazil's extensive manufacturing base, large consumer market, and significant investments in automotive R&D position it as a regional leader. Argentina, with its strong automotive heritage and skilled workforce, also plays a significant role, particularly in the production of light vehicles and automotive components. Colombia is emerging as a notable growth market, driven by rising vehicle demand and infrastructure development .

- In 2023, Brazil's government implemented the "PROCONVE L8" regulation (Programa de Controle da Poluição do Ar por Veículos Automotores, Phase L8), issued by the National Council for the Environment (CONAMA) under Resolution No. 492/2018. This regulation mandates that all new vehicles sold must meet stringent emissions standards, targeting reductions in nitrogen oxides (NOx), hydrocarbons, and particulate matter. The regulation aims to reduce air pollution and promote the adoption of electric and hybrid vehicles, reflecting a broader commitment to environmental sustainability and public health .

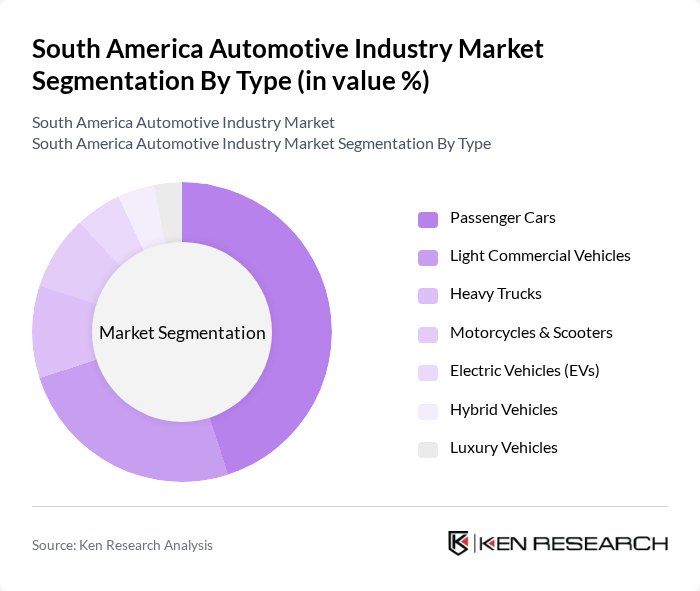

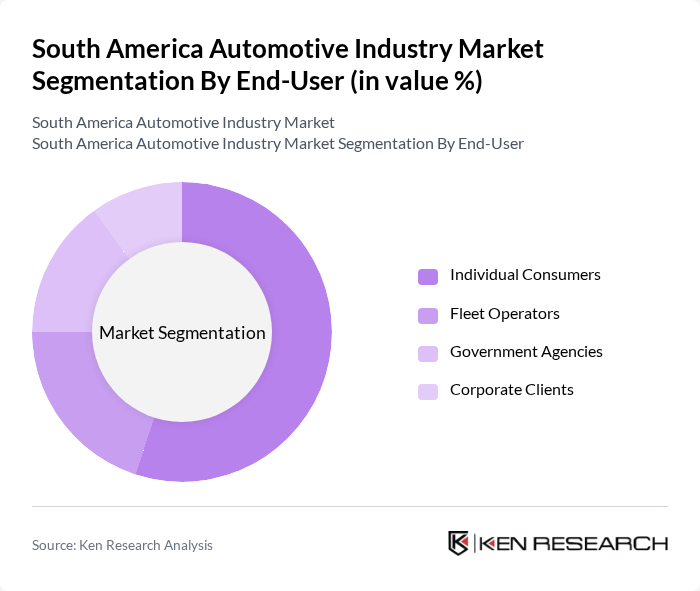

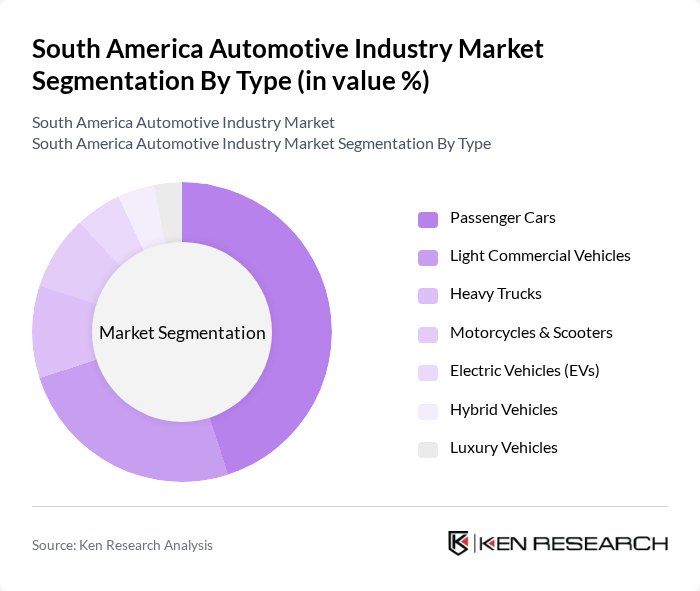

South America Automotive Industry Market Segmentation

By Type:The automotive market in South America is segmented into passenger cars, light commercial vehicles, heavy trucks, motorcycles & scooters, electric vehicles (EVs), hybrid vehicles, and luxury vehicles. Among these, passenger cars dominate the market due to their affordability, versatility, and appeal to a broad consumer base. The increasing urban population, rising disposable incomes, and a growing preference for fuel-efficient and eco-friendly vehicles have further fueled demand for personal vehicles, making this segment a key driver of market growth .

By End-User:The automotive market is also segmented by end-user categories, including individual consumers, fleet operators, government agencies, and corporate clients. Individual consumers represent the largest segment, driven by the growing middle class, increasing urbanization, and greater vehicle affordability. Fleet operators are also significant, as businesses seek to enhance logistics and transportation efficiency. Demand from government agencies and corporate clients is rising, particularly for electric and hybrid vehicles, reflecting a shift toward sustainability and compliance with new emissions regulations .

South America Automotive Industry Market Competitive Landscape

The South America Automotive Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Volkswagen AG, General Motors Company (Chevrolet do Brasil), Ford Motor Company, Toyota Motor Corporation, Stellantis N.V. (Fiat, Peugeot, Citroën, Jeep), Renault S.A., Honda Motor Co., Ltd., Nissan Motor Co., Ltd., Hyundai Motor Company, Kia Corporation, Mercedes-Benz AG, BMW AG, Chery Automobile Co., Ltd., BYD Company Limited, CAOA Group (CAOA Chery, CAOA Hyundai) contribute to innovation, geographic expansion, and service delivery in this space .

South America Automotive Industry Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Urbanization in South America is accelerating, with projections indicating that by future, approximately83%of the population will reside in urban areas. This shift is driving demand for personal vehicles, as urban dwellers seek convenient transportation options. The urban population in Brazil alone is expected to reachapproximately 180 million, contributing to a significant increase in vehicle registrations, which stood atapproximately 46 million, highlighting the growing need for automotive solutions.

- Rising Disposable Incomes:The average disposable income in South America is projected to rise toUSD 7,000–USD 7,500 per capitaby future. This increase is fostering greater consumer spending on automobiles, particularly in countries like Argentina and Chile, where vehicle ownership is becoming more accessible. As more consumers can afford vehicles, the demand for both new and used cars is expected to surge, further stimulating the automotive market.

- Government Initiatives for Electric Vehicles:South American governments are increasingly promoting electric vehicle (EV) adoption through various initiatives. For instance, Brazil's government aims to have1 millionelectric vehicles on the road by future, supported by tax incentives and subsidies. In future, EV sales in the region reachedapproximately 49,000 units, reflecting a growing commitment to sustainable transportation. These initiatives are expected to significantly boost the automotive sector, particularly in the EV segment.

Market Challenges

- Economic Instability:Economic volatility remains a significant challenge for the South American automotive industry. In future, the region is projected to experience GDP growth ofapproximately 2%. This sluggish growth is attributed to inflation rates exceeding8%in several countries, which adversely affects consumer purchasing power and confidence, leading to reduced vehicle sales and investment in the automotive sector.

- Supply Chain Disruptions:The automotive industry in South America faces ongoing supply chain disruptions, exacerbated by global events and local factors. In future, production delays were reported to affect over25%of automotive manufacturers in the region. With future expected to see continued challenges, including semiconductor shortages and logistical issues, manufacturers may struggle to meet consumer demand, impacting overall market growth and profitability.

South America Automotive Industry Market Future Outlook

The South American automotive industry is poised for transformative growth driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for innovative mobility solutions will rise, particularly in electric and autonomous vehicles. Additionally, investments in infrastructure are expected to enhance connectivity and accessibility, further supporting market expansion. The focus on sustainability and safety will shape product offerings, ensuring that manufacturers align with evolving regulatory standards and consumer expectations in the coming years.

Market Opportunities

- Growth in Electric Vehicle Adoption:The electric vehicle market in South America is set to expand significantly, with sales projected to reachapproximately 300,000 unitsby future. This growth is driven by increasing consumer awareness and government incentives, creating a favorable environment for manufacturers to invest in EV technology and infrastructure, ultimately enhancing market competitiveness.

- Development of Autonomous Vehicles:The development of autonomous vehicles presents a substantial opportunity for the South American automotive industry. With investments in research and development expected to exceedUSD 500 millionby future, companies can leverage advancements in AI and connectivity to create innovative solutions that cater to the region's unique mobility challenges, enhancing safety and efficiency.