Region:Africa

Author(s):Geetanshi

Product Code:KRAC0059

Pages:91

Published On:August 2025

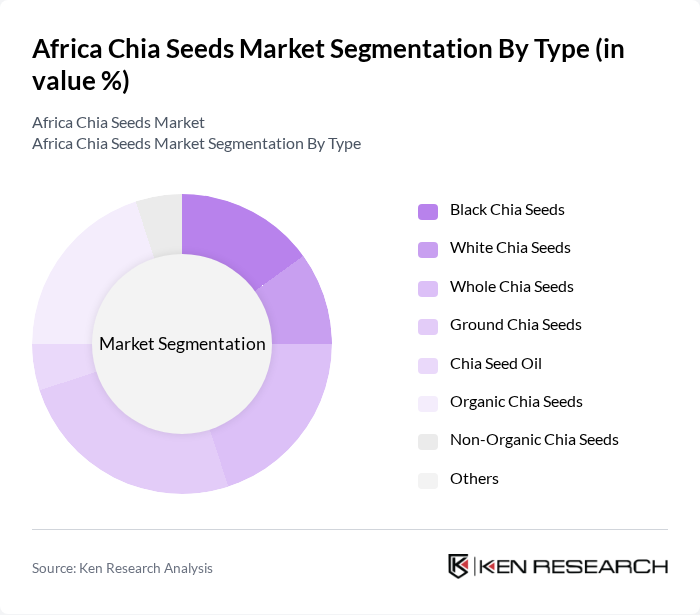

By Type:The chia seeds market is segmented into Black Chia Seeds, White Chia Seeds, Whole Chia Seeds, Ground Chia Seeds, Chia Seed Oil, Organic Chia Seeds, Non-Organic Chia Seeds, and Others. Black Chia Seeds account for a larger share due to higher crop yields and protein content, while Organic Chia Seeds are gaining significant traction as consumers increasingly prefer organic products for health and environmental reasons. The demand for Ground Chia Seeds continues to rise, driven by their widespread use in food products and nutraceuticals .

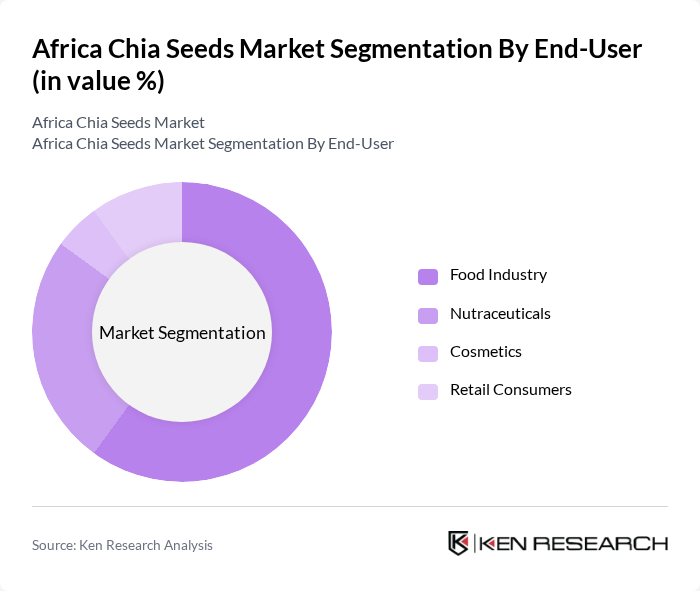

By End-User:The end-user segmentation includes the Food Industry, Nutraceuticals, Cosmetics, and Retail Consumers. The Food Industry remains the leading segment, driven by the incorporation of chia seeds into snacks, beverages, and bakery items. Health and wellness trends have led to increased usage in nutraceuticals, while the cosmetics sector is exploring chia seeds for their skin health benefits. Retail consumer demand is also rising as awareness of chia seeds’ nutritional profile grows .

The Africa Chia Seeds Market is characterized by a dynamic mix of regional and international players. Leading participants such as AgriPure (Kenya), Nature's Power Africa (South Africa), Moringa & Chia Uganda Ltd., Chia Africa (Tanzania), Health Matters Africa (South Africa), Kalahari Chia (Namibia), Chia Seeds Zambia, Chia Growers Ghana, Chia Seed Exporters Nigeria, Chia Farm Zimbabwe, Chia Seed Company Egypt, Chia Organics Morocco, Chia Seed World (South Africa), Chia Bia, The Chia Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the chia seeds market in Africa appears promising, driven by increasing health awareness and the growing trend of plant-based diets. As consumers become more informed about the nutritional benefits of chia seeds, demand is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate access to these products, allowing for greater market penetration. Collaborations with health and wellness brands will further enhance visibility and consumer trust, positioning chia seeds as a staple in health-conscious diets across the continent.

| Segment | Sub-Segments |

|---|---|

| By Type | Black Chia Seeds White Chia Seeds Whole Chia Seeds Ground Chia Seeds Chia Seed Oil Organic Chia Seeds Non-Organic Chia Seeds Others |

| By End-User | Food Industry Nutraceuticals Cosmetics Retail Consumers |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health Food Stores Direct Sales |

| By Region | East Africa (Kenya, Uganda, Tanzania) West Africa (Nigeria, Ghana) Southern Africa (South Africa, Zambia, Zimbabwe) North Africa (Egypt, Morocco) |

| By Application | Food Products Beverages Bakery Products Snacks |

| By Price Range | Budget Mid-Range Premium |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chia Seed Producers | 60 | Farm Owners, Agricultural Managers |

| Health Food Retailers | 50 | Store Managers, Product Buyers |

| Consumers of Health Foods | 100 | Health-Conscious Shoppers, Fitness Enthusiasts |

| Distributors of Superfoods | 40 | Logistics Coordinators, Sales Representatives |

| Agricultural Policy Makers | 40 | Government Officials, Agricultural Advisors |

The Africa Chia Seeds Market is valued at approximately USD 14 billion, reflecting significant growth driven by increasing health consciousness and demand for plant-based protein sources across the continent.