Region:Middle East

Author(s):Rebecca

Product Code:KRAD2753

Pages:100

Published On:November 2025

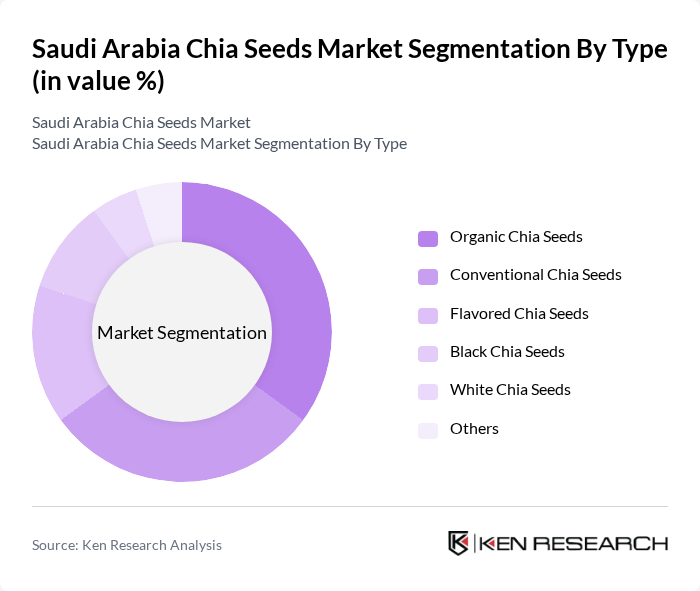

By Type:The chia seeds market can be segmented into various types, including organic, conventional, flavored, black, white, and others. Among these,organic chia seedsare gaining significant traction due to the increasing consumer preference for organic products and regulatory support for organic agriculture. The demand for flavored chia seeds is also on the rise, driven by the trend of incorporating superfoods into everyday diets and the growth of health-focused snack categories. Conventional chia seeds remain popular due to their affordability and widespread availability. Black chia seeds are noted for their higher alpha-linolenic acid content, contributing to their popularity among health-conscious consumers .

By End-User/Application:The chia seeds market serves various end-users, including retail consumers, food and beverage manufacturers, nutraceutical and supplement companies, personal care and cosmetics industries, animal feed and pet food sectors, health and wellness industries, and others.Retail consumersare the largest segment, driven by the increasing trend of health and wellness and the convenience of purchasing chia seeds through supermarkets and online channels. Food and beverage manufacturers are also significant players, utilizing chia seeds in products like bakery items, cereals, and health drinks. Nutraceutical and supplement companies are expanding their product portfolios with chia-based offerings to meet rising demand for functional foods .

The Saudi Arabia Chia Seeds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Watania Agriculture, Almarai, Al-Faisal Food Company, Al-Hokair Group, Al-Muhaidib Group, Al-Jazeera Agricultural Company, Al-Safi Danone, Al-Othaim Holding, Al-Baik Food Systems, Al-Mansour Group, Al-Rajhi Group, Al-Muhaidib Foods, Al-Salam Food Company, Al-Mahmal Group, Al-Muhaidib Agricultural Company, Nabat Farms, Saudi Organic Farming Association, Tamimi Markets, Carrefour Saudi Arabia, BinDawood Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the chia seeds market in Saudi Arabia appears promising, driven by increasing health awareness and a shift towards plant-based diets. As consumers continue to prioritize nutrition, the demand for chia seeds is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate greater access to these products. Innovations in product offerings, such as flavored chia snacks, will likely attract a broader consumer base, enhancing market growth opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Chia Seeds Conventional Chia Seeds Flavored Chia Seeds Black Chia Seeds White Chia Seeds Others |

| By End-User/Application | Retail Consumers Food & Beverage Manufacturers (Bakery, Cereals, Juices) Nutraceutical & Supplement Companies Personal Care & Cosmetics Industry Animal Feed & Pet Food Sector Health and Wellness Industry Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Health Food Stores Direct Sales Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging Others |

| By Region | Central Region (Riyadh) Western Region (Jeddah, Makkah) Eastern Region (Dammam, Khobar) Southern Region |

| By Product Form | Whole Chia Seeds Ground/Milled Chia Seeds Chia Seed Oil Chia Bran Pre-hydrate Chia Others |

| By Consumer Demographics | Age Group (18-30, 31-50, 51+) Income Level (Low, Middle, High) Lifestyle (Active, Sedentary) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Food Retailers | 100 | Store Managers, Product Buyers |

| Chia Seed Importers | 75 | Import Managers, Supply Chain Coordinators |

| Nutritionists and Dieticians | 50 | Health Professionals, Wellness Coaches |

| Online Health Food Platforms | 80 | E-commerce Managers, Marketing Directors |

| Consumer Focus Groups | 60 | Health-Conscious Consumers, Fitness Enthusiasts |

The Saudi Arabia Chia Seeds Market is valued at approximately USD 38 million, reflecting a growing trend driven by health consciousness, demand for plant-based nutrition, and the popularity of superfoods among consumers.