Region:Global

Author(s):Geetanshi

Product Code:KRAA2793

Pages:81

Published On:August 2025

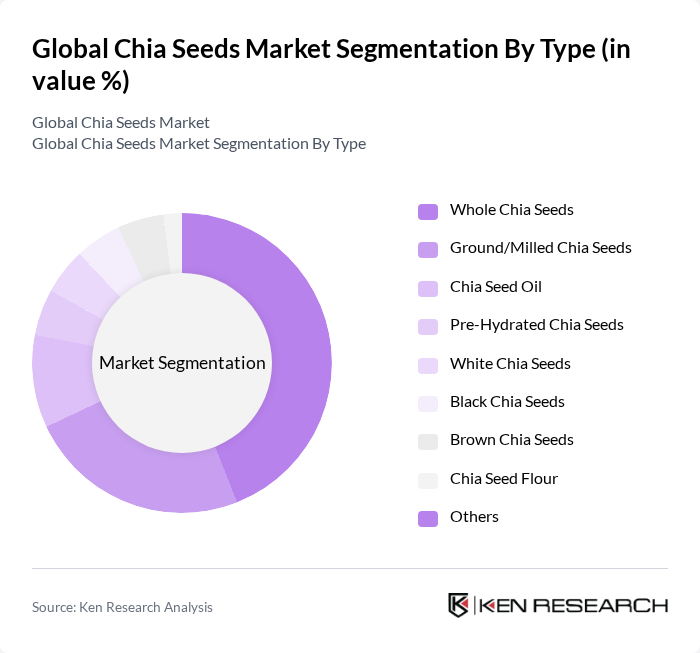

By Type:The chia seeds market is segmented into Whole Chia Seeds, Ground/Milled Chia Seeds, Chia Seed Oil, Pre-Hydrated Chia Seeds, White Chia Seeds, Black Chia Seeds, Brown Chia Seeds, Chia Seed Flour, and Others. Whole Chia Seeds hold the largest market share, attributed to their versatility and ease of use in a variety of food products. Consumers favor whole seeds for their nutritional profile and functionality as a natural thickener. Ground chia seeds are gaining traction, particularly in the health food sector, due to improved digestibility and suitability for smoothies and baked goods. Black chia seeds are particularly prominent in the market, reflecting consumer preference for their nutrient density .

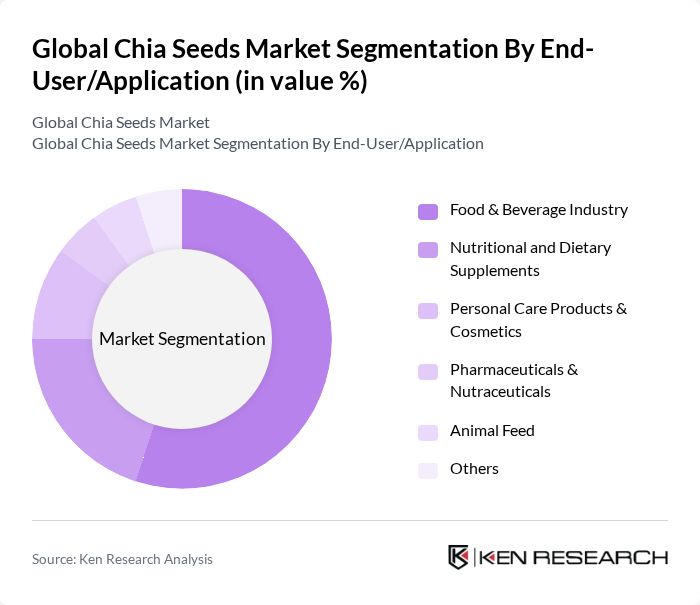

By End-User/Application:The chia seeds market is segmented by application into Food & Beverage Industry, Nutritional and Dietary Supplements, Personal Care Products & Cosmetics, Pharmaceuticals & Nutraceuticals, Animal Feed, and Others. The Food & Beverage Industry is the leading segment, driven by the growing use of chia seeds in health foods, snacks, beverages, and bakery products. The trend toward functional foods and natural ingredients continues to drive demand, making chia seeds a staple in health-conscious diets. Nutritional and dietary supplements represent a significant share, reflecting the growing consumer focus on preventive health and wellness .

The Global Chia Seeds Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nutiva, Inc., Healthworks, The Chia Co., Navitas Organics, BetterBody Foods, Spectrum Organic Products, LLC, Terrasoul Superfoods, Organic Traditions, Sunfood Superfoods, Ancient Harvest, Bioglan, Mamma Chia, Chosen Foods, Sesajal S.A. de C.V., Benexia (Functional Products Trading S.A.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the chia seeds market in None appears promising, driven by increasing health awareness and the demand for plant-based products. As consumers continue to prioritize nutrition, the incorporation of chia seeds into various food categories is expected to rise. Additionally, the trend towards sustainable sourcing and organic products will likely enhance market growth. Companies that innovate and adapt to consumer preferences will be well-positioned to capitalize on these trends in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Chia Seeds Ground/Milled Chia Seeds Chia Seed Oil Pre-Hydrated Chia Seeds White Chia Seeds Black Chia Seeds Brown Chia Seeds Chia Seed Flour Others |

| By End-User/Application | Food & Beverage Industry Nutritional and Dietary Supplements Personal Care Products & Cosmetics Pharmaceuticals & Nutraceuticals Animal Feed Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health Food Stores Direct Sales Specialty Stores |

| By Region | North America (United States, Canada, Mexico) Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa) |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Whole Seeds Powder Oil Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chia Seed Producers | 60 | Farm Owners, Agricultural Managers |

| Health Food Retailers | 50 | Store Managers, Product Buyers |

| Nutritionists and Dietitians | 40 | Health Professionals, Wellness Coaches |

| Consumers of Health Foods | 100 | Health-Conscious Shoppers, Fitness Enthusiasts |

| Food Product Manufacturers | 45 | Product Development Managers, Quality Assurance Officers |

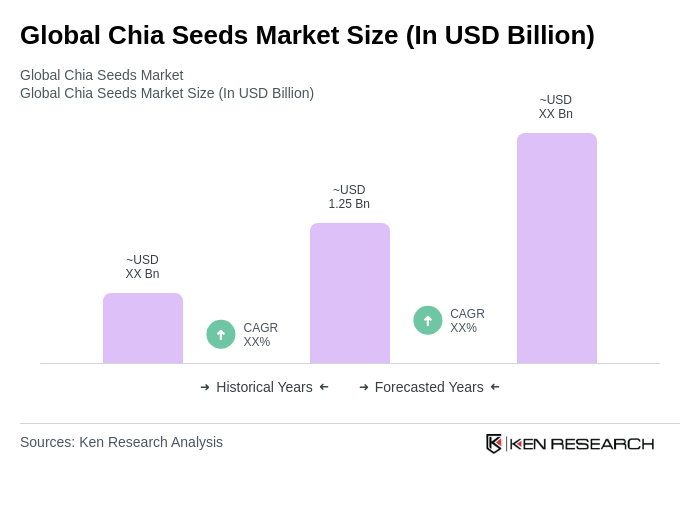

The Global Chia Seeds Market is valued at approximately USD 1.25 billion, reflecting a growing consumer interest in the health benefits of chia seeds, including their high omega-3 fatty acid, fiber, and protein content.