Region:Africa

Author(s):Dev

Product Code:KRAC0467

Pages:81

Published On:August 2025

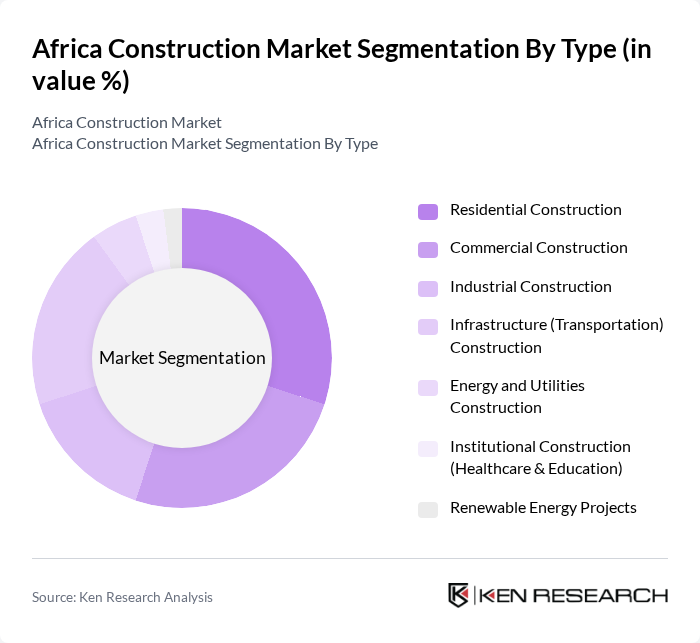

By Type:The construction market can be segmented into various types, including Residential Construction, Commercial Construction, Industrial Construction, Infrastructure (Transportation) Construction, Energy and Utilities Construction, Institutional Construction (Healthcare & Education), and Renewable Energy Projects. Each of these segments plays a crucial role in addressing the diverse needs of the African population and economy.

By End-User:The end-user segmentation includes Government & State-Owned Enterprises, Private Developers & Corporates, Multilateral Agencies & NGOs, and Households/Residential Buyers. Each of these end-users contributes to the construction market in distinct ways, influencing the types of projects undertaken and the overall market dynamics.

The Africa Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as China Communications Construction Company (CCCC), China Railway Construction Corporation (CRCC), China State Construction Engineering Corporation (CSCEC), Vinci SA, Bouygues Construction, Eiffage, Orascom Construction, Arab Contractors (Osman Ahmed Osman & Co.), Elsewedy Electric, Julius Berger Nigeria Plc, Dangote Industries (Cement & Infrastructure), China National Machinery Industry Corporation (Sinomach), Webuild S.p.A. (formerly Salini Impregilo), AECOM, Raubex Group Limited, WBHO Construction (Wilson Bayly Holmes-Ovcon), Aveng Limited, Stefanutti Stocks Holdings Limited, Concor, Power Construction (South Africa), China Gezhouba Group Company (CGGC), Mota-Engil Africa, Groupe Sonatrach (Engineering & Construction), General Nile Company for Roads & Bridges, Dumez Nigeria Plc contribute to innovation, geographic expansion, and service delivery in this space.

The Africa construction market is poised for significant growth, driven by urbanization, government initiatives, and increased foreign investment. As countries prioritize infrastructure development, innovative construction methods and sustainable practices will gain traction. The integration of technology in project management will enhance efficiency, while public-private partnerships will facilitate funding for large-scale projects. Overall, the sector is expected to evolve, addressing challenges and capitalizing on emerging opportunities to foster economic development across the continent.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Construction Commercial Construction Industrial Construction Infrastructure (Transportation) Construction Energy and Utilities Construction Institutional Construction (Healthcare & Education) Renewable Energy Projects |

| By End-User | Government & State-Owned Enterprises Private Developers & Corporates Multilateral Agencies & NGOs Households/Residential Buyers |

| By Application | Building Construction (Residential & Commercial) Transportation Infrastructure (Roads, Rail, Ports, Airports) Energy & Power (Generation, Transmission, Distribution) Water & Waste (Water Supply, Wastewater, Solid Waste) |

| By Investment Source | Domestic Private Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPPs) Government Budget & Sovereign Funds |

| By Policy Support | Affordable Housing & Urban Renewal Programs Tax Incentives & Duty Exemptions on Materials/Equipment Green Building Codes & Incentives National Infrastructure Plans & Regulatory Fast-Tracking |

| By Construction Method | Conventional (On-site) Construction Prefabricated/Precast Construction Modular Construction Sustainable/Low-Carbon Techniques (BIM-enabled) |

| By Project Size | Small Scale Projects Medium Scale Projects Large/Mega Projects |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 150 | Project Managers, Site Supervisors |

| Commercial Building Developments | 100 | Construction Executives, Architects |

| Infrastructure Projects (Roads, Bridges) | 80 | Government Officials, Civil Engineers |

| Green Building Initiatives | 70 | Sustainability Consultants, Project Developers |

| Construction Material Suppliers | 90 | Supply Chain Managers, Procurement Officers |

The Africa Construction Market is valued at approximately USD 220 billion, driven by rapid urbanization, increased government spending on infrastructure, and foreign direct investment in various construction projects across the continent.