Region:Asia

Author(s):Shubham

Product Code:KRAC0848

Pages:100

Published On:August 2025

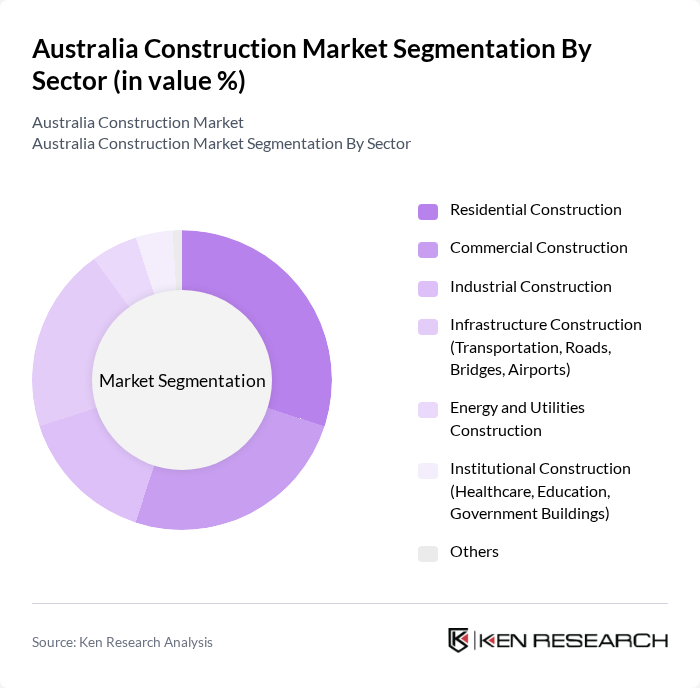

By Sector:The construction market is segmented into various sectors, including Residential Construction, Commercial Construction, Industrial Construction, Infrastructure Construction, Energy and Utilities Construction, Institutional Construction, and Others. Each sector plays a crucial role in the overall market dynamics, with specific trends and consumer demands influencing their growth trajectories. Residential construction faces rising costs and supply chain challenges but is supported by government programs and a shift toward build-to-rent and green housing. Infrastructure construction is propelled by major transport, water, and energy projects, while industrial and commercial sectors are influenced by logistics, warehousing, and advanced manufacturing trends .

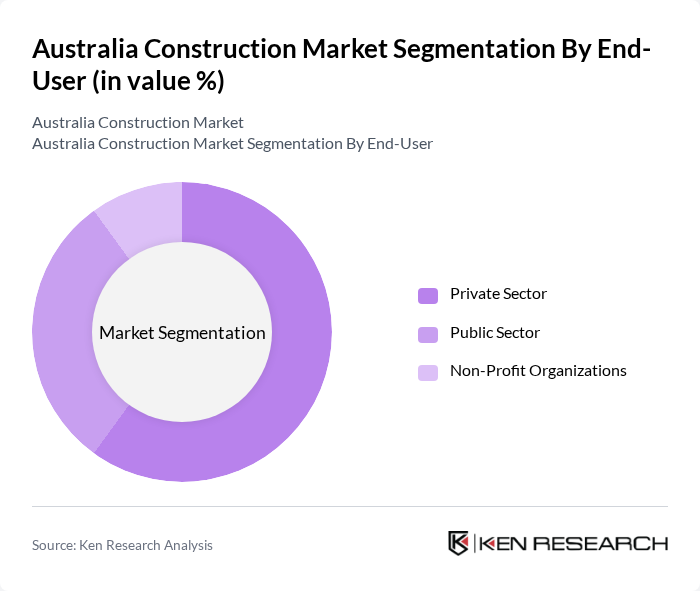

By End-User:The end-user segmentation includes the Private Sector, Public Sector, and Non-Profit Organizations. Each of these segments has distinct requirements and influences on the construction market, with varying levels of investment and project types. The private sector remains the primary driver, accounting for the majority of market activity, while the public sector is focused on infrastructure and social projects. Non-profit organizations contribute mainly to community and institutional developments .

The Australia Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lendlease Group, CIMIC Group Limited, Downer EDI Limited, BGC Contracting, Fulton Hogan, John Holland Group, Mirvac Group, Multiplex, Probuild, Watpac Limited, Hansen Yuncken, Richard Crookes Constructions, ADCO Constructions, Built, Scentre Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian construction market appears promising, driven by ongoing infrastructure investments and urbanization trends. As the government continues to prioritize construction projects, particularly in transportation and housing, the sector is expected to experience robust growth. Additionally, the integration of smart construction technologies and sustainable practices will likely reshape the industry landscape, enhancing efficiency and reducing environmental impact. Overall, the construction market is poised for a dynamic evolution, adapting to emerging challenges and opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Sector | Residential Construction Commercial Construction Industrial Construction Infrastructure Construction (Transportation, Roads, Bridges, Airports) Energy and Utilities Construction Institutional Construction (Healthcare, Education, Government Buildings) Others |

| By End-User | Private Sector Public Sector Non-Profit Organizations |

| By Application | New Construction Renovation Maintenance |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| By Construction Method | Traditional Construction Design-Build Construction Management |

| By Policy Support | Government Subsidies Tax Incentives Grants and Funding Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 120 | Project Managers, Site Supervisors |

| Commercial Building Developments | 90 | Construction Executives, Architects |

| Infrastructure Projects (Roads, Bridges) | 60 | Government Officials, Civil Engineers |

| Green Building Initiatives | 50 | Sustainability Consultants, Project Leads |

| Construction Technology Adoption | 40 | IT Managers, Innovation Officers |

The Australia Construction Market is valued at approximately AUD 320 billion, driven by significant infrastructure investments, urbanization, and a rise in residential and commercial projects. This valuation reflects a robust growth trajectory over the past five years.