Region:Middle East

Author(s):Dev

Product Code:KRAA2219

Pages:80

Published On:August 2025

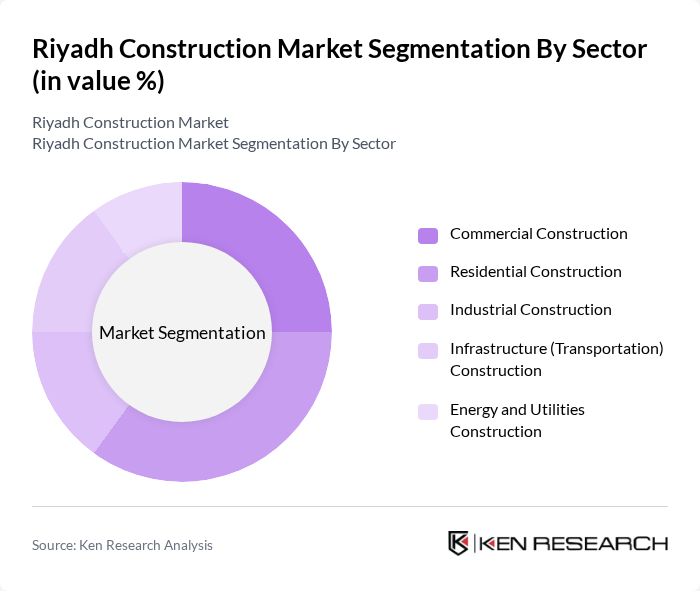

By Sector:The construction market in Riyadh is segmented into various sectors, including Commercial Construction, Residential Construction, Industrial Construction, Infrastructure (Transportation) Construction, and Energy and Utilities Construction. Each sector plays a crucial role in the overall growth of the market, with specific trends and demands influencing their development. TheResidential Constructionsector is currently leading due to the increasing population, urbanization, and government-backed housing initiatives such as the Sakani program and Vision 2030’s homeownership targets. Infrastructure Construction remains significant, driven by ongoing government projects including metro expansion, road networks, and airport upgrades .

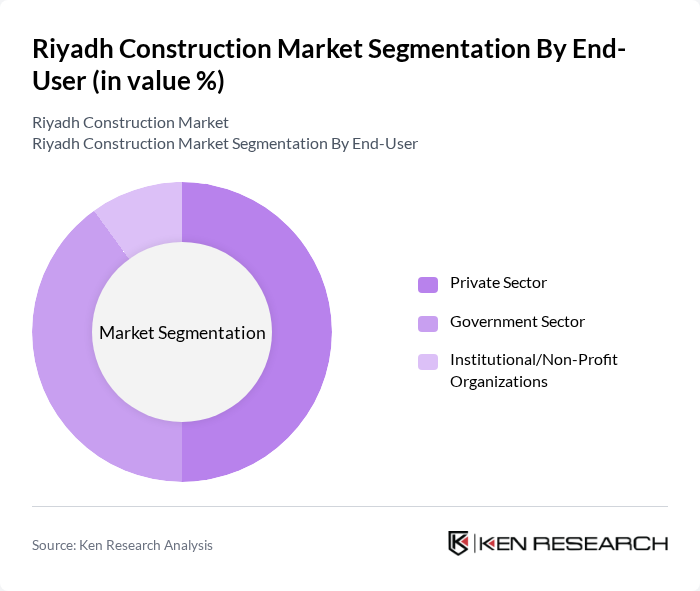

By End-User:The end-user segmentation of the Riyadh construction market includes the Private Sector, Government Sector, and Institutional/Non-Profit Organizations. ThePrivate Sectoris currently the dominant end-user, driven by increasing investments in commercial and residential projects, as well as public-private partnership models promoted under Vision 2030. The Government Sector also plays a significant role, particularly in infrastructure development, while Institutional/Non-Profit Organizations contribute to specialized projects such as educational and healthcare facilities .

The Riyadh Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Binladin Group, El Seif Engineering Contracting Company, Nesma & Partners Contracting Company, Al Arrab Contracting Company, Al Fouzan Trading & General Construction Company, Al Kifah Holding Company, Al Rashid Trading & Contracting Company (RTCC), Bechtel Corporation, Fluor Corporation, Parsons Corporation, KEO International Consultants, Shapoorji Pallonji Mideast LLC, China State Construction Engineering Corporation (CSCEC) Middle East, Al Mabani General Contractors, Rawabi Holding Company contribute to innovation, geographic expansion, and service delivery in this space .

The Riyadh construction market is poised for significant growth driven by urbanization, government investments, and economic diversification. As the population continues to rise, the demand for housing and infrastructure will increase, supported by substantial government funding. Additionally, the focus on sustainable and smart city developments will shape future projects. In future, the integration of advanced technologies and sustainable practices will likely redefine construction methodologies, enhancing efficiency and compliance within the sector.

| Segment | Sub-Segments |

|---|---|

| By Sector | Commercial Construction Residential Construction Industrial Construction Infrastructure (Transportation) Construction Energy and Utilities Construction |

| By End-User | Private Sector Government Sector Institutional/Non-Profit Organizations |

| By Application | Residential Buildings Commercial Spaces Public Infrastructure (e.g., roads, bridges, metro) Industrial Facilities Utilities (power, water, waste management) |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| By Construction Methodology | Traditional Construction Modular/Prefabricated Construction Design-Build EPC (Engineering, Procurement, Construction) |

| By Project Size | Small Scale Projects ( |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Supervisors |

| Commercial Building Developments | 80 | Architects, Construction Executives |

| Infrastructure Projects (Roads, Bridges) | 70 | Civil Engineers, Government Officials |

| Real Estate Development Trends | 50 | Real Estate Analysts, Urban Planners |

| Construction Material Suppliers | 60 | Supply Chain Managers, Procurement Officers |

The Riyadh Construction Market is valued at approximately USD 15 billion, driven by significant investments in infrastructure, urban development, and initiatives like Saudi Arabia's Vision 2030, which aims to diversify the economy and reduce oil dependency.