Region:Africa

Author(s):Shubham

Product Code:KRAA1889

Pages:84

Published On:August 2025

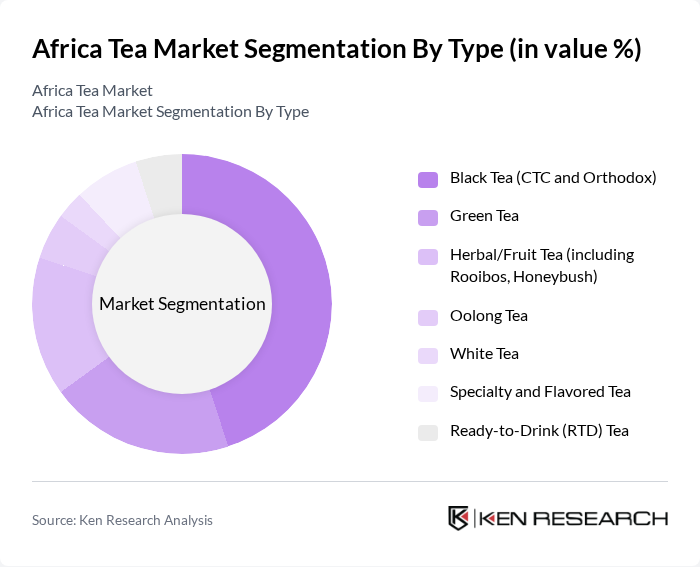

By Type:The tea market in Africa is segmented into various types, including Black Tea (CTC and Orthodox), Green Tea, Herbal/Fruit Tea (including Rooibos, Honeybush), Oolong Tea, White Tea, Specialty and Flavored Tea, and Ready-to-Drink (RTD) Tea. Among these, Black Tea, particularly the CTC variety, dominates due to entrenched production in East/Southern Africa and strong export orientation via Mombasa; leaf tea remains central, while RTD and value-added flavored formats are gaining traction through modern retail and e-commerce. The growing health-conscious consumer base is lifting demand for Green Tea and Herbal/Fruit Tea, including rooibos and functional blends.

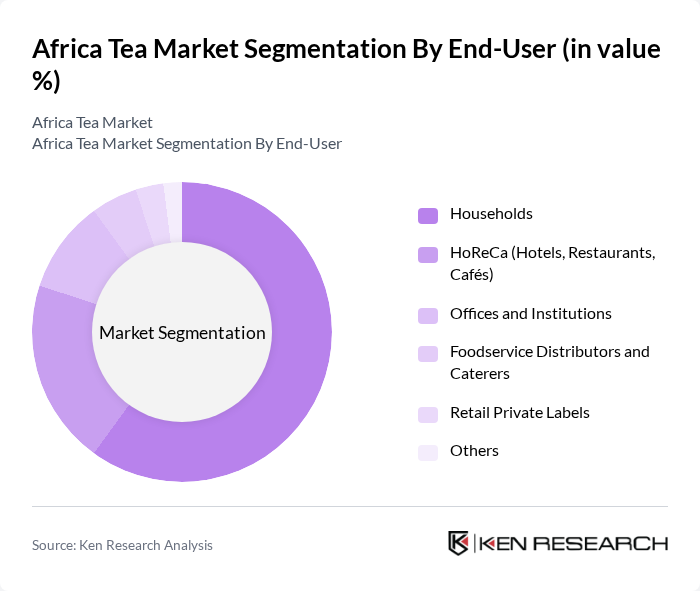

By End-User:The end-user segmentation of the tea market includes Households, HoReCa (Hotels, Restaurants, Cafés), Offices and Institutions, Foodservice Distributors and Caterers, Retail Private Labels, and Others. Households represent the largest segment, driven by daily consumption habits and cultural prevalence across major markets. HoReCa is expanding with premium and specialty offerings, while modern trade growth and online channels support broader availability and private-label development.

The Africa Tea Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lipton Teas and Infusions (formerly Unilever tea business), Kenya Tea Development Agency (KTDA), James Finlay (Africa) Ltd, Ekaterra Kenya Ltd, Ceylon Tea Kenya (Dilmah presence via distribution partners), Taylors of Harrogate (Yorkshire Tea) – Africa sourcing and distribution, Brooke Bond (Unilever heritage brand in East Africa), AVT Natural/AVT Tea (Africa distribution), Joekels Tea Packers (South Africa), Rooibos Limited (South Africa), Pioneer Foods Beverages (Bokomo/Bevco, South Africa) – Five Roses, Freshpak, Ahmad Tea (Egypt/Nigeria distribution), Gold Crown Beverages (Kericho Gold, Kenya), Mzuzu Coffee & Tea (Malawi) – tea estates and processing, Buhler/Metropolitan Tea Co. Africa (distribution and packing) contribute to innovation, geographic expansion, and service delivery in this space.

The Africa tea market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health-consciousness continues to rise, the demand for specialty and organic teas is expected to grow. Additionally, the integration of sustainable practices and digital retail solutions will enhance market accessibility. Collaborations with local farmers will also play a crucial role in ensuring quality and sustainability, positioning the African tea market as a competitive player in the global arena.

| Segment | Sub-Segments |

|---|---|

| By Type | Black Tea Green Tea Herbal/Fruit Tea Oolong Tea White Tea Specialty and Flavored Tea Ready-to-Drink (RTD) Tea |

| By End-User | Households HoReCa Offices and Institutions Foodservice Distributors and Caterers Retail Private Labels Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Tea Stores Convenience and Grocery Stores Foodservice/On-Trade Others |

| By Packaging Type | Loose Leaf Tea Bags RTD Bottles and Cans Bulk Packs Sachets and Pouches Others |

| By Price Range | Premium Mid-Range Budget Value/Private Label |

| By Region | East Africa West Africa Southern Africa North Africa Central Africa Island Markets |

| By Consumer Demographics | Age Group Gender Income Level Lifestyle Preferences Urban vs. Rural |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tea Producers | 95 | Farm Owners, Agricultural Managers |

| Tea Distributors | 80 | Distribution Managers, Sales Executives |

| Retailers | 70 | Store Managers, Category Buyers |

| Tea Consumers | 140 | Regular Tea Drinkers, Health-Conscious Consumers |

| Exporters | 60 | Export Managers, Trade Analysts |

The Africa Tea Market is valued at approximately USD 10 billion, driven by increasing consumer demand for diverse tea varieties and health-conscious choices over sugary beverages. This growth is particularly notable in East and Southern Africa, with Kenya leading in black tea exports.