Region:Asia

Author(s):Geetanshi

Product Code:KRAD3932

Pages:88

Published On:November 2025

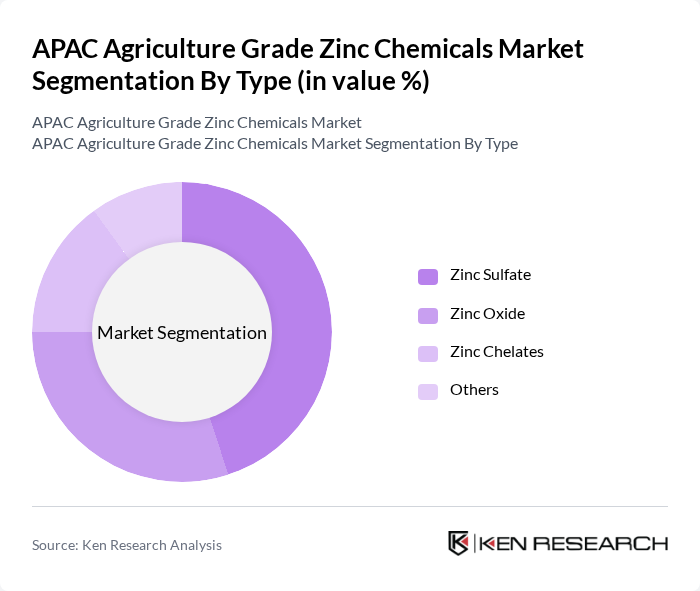

By Type:The market is segmented into various types of zinc chemicals, including Zinc Sulfate, Zinc Oxide, Zinc Chelates, and Others. Among these, Zinc Sulfate remains the most widely used due to its proven effectiveness in correcting zinc deficiencies in crops and its cost efficiency. The increasing adoption of precision farming techniques and the growing awareness of soil health are driving the demand for these products. Zinc Oxide is gaining traction, particularly in the production of fertilizers and animal feed, due to its high zinc content and stability. Zinc Chelates are preferred for their enhanced nutrient absorption capabilities, especially in high-value crops and specialty applications.

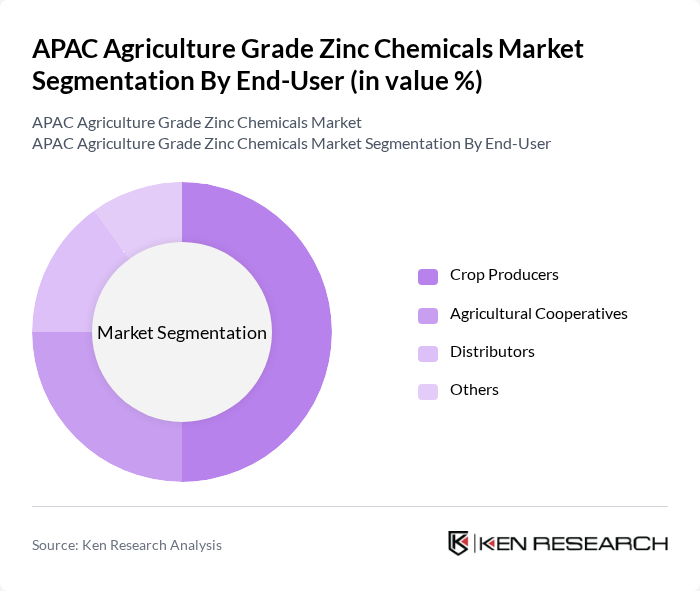

By End-User:The end-user segmentation includes Crop Producers, Agricultural Cooperatives, Distributors, and Others. Crop Producers are the leading end-users, driven by the need for improved crop yields and quality. Agricultural Cooperatives play a significant role in distributing zinc chemicals to farmers, especially in rural and semi-urban regions. Distributors ensure the availability of these products across diverse geographies, supporting last-mile delivery. The increasing focus on sustainable agriculture practices and government-backed micronutrient subsidy programs is also influencing the purchasing decisions of these end-users.

The APAC Agriculture Grade Zinc Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yara International, BASF SE, Nutrien Ltd., Haifa Group, Solvay S.A., UPL Limited, Indian Farmers Fertiliser Cooperative (IFFCO), Zochem, EverZinc, Rubamin, Sulphur Mills, Aries Agro, Prabhat Fertilizer, OldBridge Chemicals, American Chemet, Tiger Sul contribute to innovation, geographic expansion, and service delivery in this space. Major players are investing in research and development to enhance product efficacy, bioavailability, and sustainability, while expanding their distribution networks across Asia-Pacific.

The APAC Agriculture Grade Zinc Chemicals Market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. In the future, the integration of precision agriculture techniques is expected to enhance the efficiency of zinc application, optimizing crop yields. Additionally, the growing focus on organic farming will likely spur innovation in organic zinc fertilizers, catering to environmentally conscious consumers and aligning with global sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Zinc Sulfate Zinc Oxide Zinc Chelates Others |

| By End-User | Crop Producers Agricultural Cooperatives Distributors Others |

| By Region | China India Japan South Korea Southeast Asia (Indonesia, Thailand, Vietnam, Malaysia, Philippines) Australia and New Zealand |

| By Application | Soil Application Foliar Application Fertigation Others |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| By Distribution Channel | Direct Sales Online Sales Retail Outlets Others |

| By Product Form | Granular Powder Liquid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Zinc Chemical Usage in Crop Production | 100 | Agronomists, Crop Consultants |

| Distribution Channels for Zinc Chemicals | 60 | Distributors, Retail Managers |

| Impact of Zinc on Soil Health | 50 | Soil Scientists, Agricultural Researchers |

| Market Trends in APAC Agriculture | 80 | Farmers, Agricultural Policy Makers |

| Regulatory Environment for Zinc Chemicals | 40 | Regulatory Affairs Specialists, Environmental Consultants |

The APAC Agriculture Grade Zinc Chemicals Market is valued at approximately USD 210 million, based on a five-year historical analysis. This valuation reflects the increasing demand for zinc-based fertilizers that enhance crop yield and quality across the region.