Region:Middle East

Author(s):Dev

Product Code:KRAC4889

Pages:88

Published On:October 2025

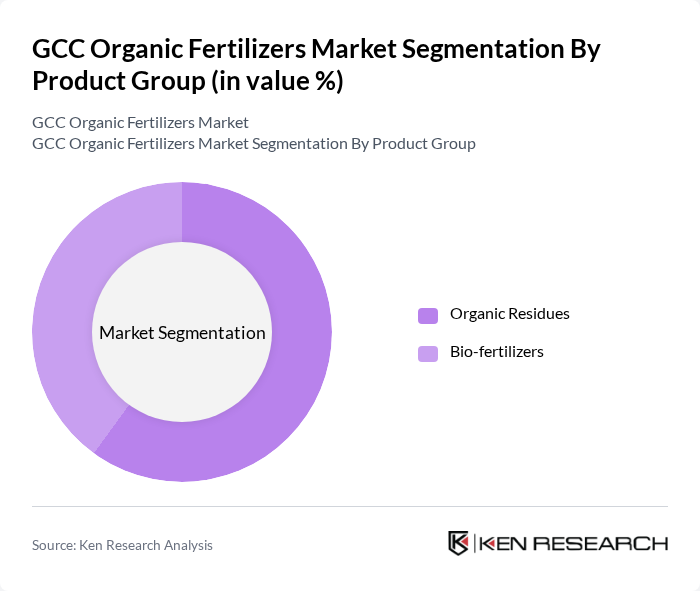

By Product Group:The market is segmented into Organic Residues and Bio-fertilizers. Organic Residues are derived from plant and animal waste, while Bio-fertilizers consist of living microorganisms that enhance soil fertility. The demand for Organic Residues is driven by their cost-effectiveness and availability, whereas Bio-fertilizers are gaining traction due to their ability to improve crop yield and soil health.

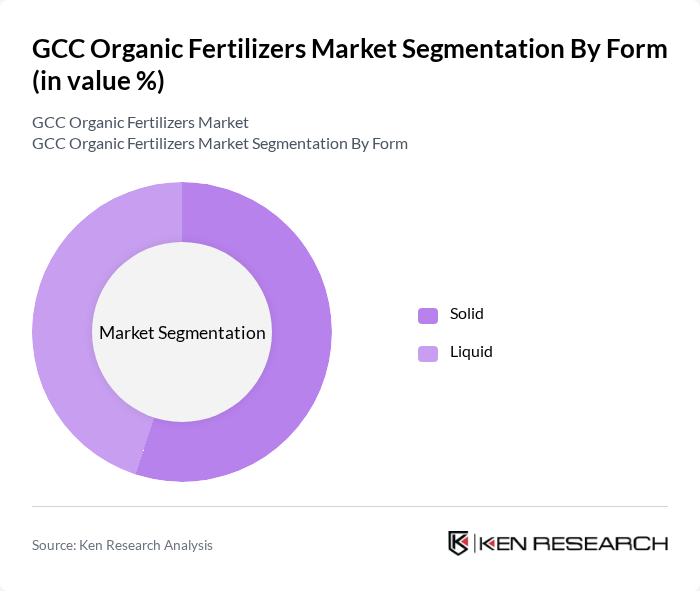

By Form:The market is categorized into Solid and Liquid forms. Solid organic fertilizers are widely used due to their ease of application and long-lasting effects, while Liquid fertilizers are preferred for their quick absorption and effectiveness in nutrient delivery. The trend towards precision agriculture and advanced application technologies is boosting the demand for Liquid fertilizers, as they allow for targeted and efficient nutrient delivery.

The GCC Organic Fertilizers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Agriculture Company, Saudi Bio Fertilizers Co. (Biofert), Emirates Bio Fertilizer Factory, Qatar Fertilizer Company (QAFCO) – Organic Division, Oman Fertilizer Company SAOC (OMIFCO) – Organic Division, Al Yahar Fertilizer Factory, Al Rowad Organic Agriculture Co., Green Coast Fertilizer Company, Al Madina Organic Fertilizer Factory, United Fertilizer Company Ltd., Al Ain Farms – Organic Fertilizer Unit, Al Wathba Marionnet LLC, Gulf Bio Fertilizer Co., Al Jazeera Agriculture Co., Al Dhafra Fertilizer Factory contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC organic fertilizers market appears promising, driven by increasing consumer demand for organic products and supportive government policies. As the region continues to embrace sustainable agricultural practices, the market is expected to see a rise in innovative organic fertilizer solutions. Additionally, the integration of technology in production and application processes will enhance efficiency and effectiveness, further propelling market growth. The focus on environmental sustainability will likely lead to increased investments and collaborations within the sector.

| Segment | Sub-Segments |

|---|---|

| By Product Group | Organic Residues Bio-fertilizers |

| By Form | Solid Liquid |

| By Application | Grains and Cereals Pulses and Oilseeds Fruits and Vegetables Commercial Crops Turf and Ornamental |

| By Geography | Saudi Arabia United Arab Emirates Qatar Oman Kuwait Bahrain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Organic Fertilizer Manufacturers | 60 | Production Managers, R&D Heads |

| Farmers Using Organic Fertilizers | 120 | Crop Farmers, Agricultural Cooperative Members |

| Distributors of Organic Products | 70 | Sales Managers, Supply Chain Coordinators |

| Retailers of Agricultural Inputs | 50 | Store Managers, Product Category Managers |

| Regulatory Bodies and Agricultural Experts | 40 | Policy Makers, Agricultural Scientists |

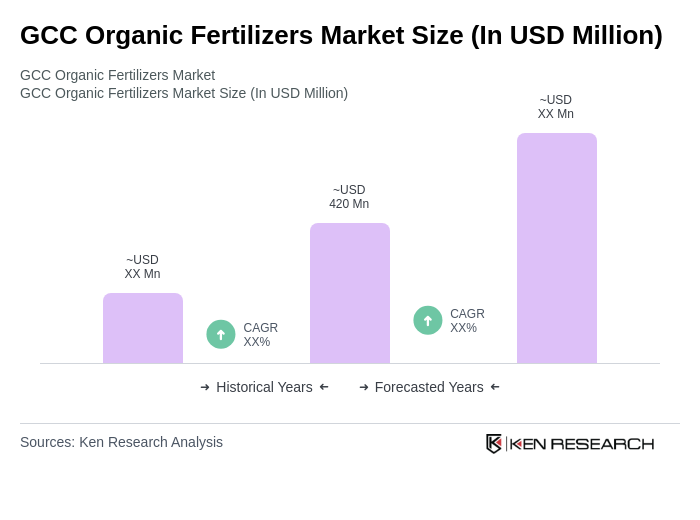

The GCC Organic Fertilizers Market is valued at approximately USD 420 million, reflecting a significant growth trend driven by increasing awareness of sustainable agricultural practices and rising demand for organic produce.