Region:Middle East

Author(s):Dev

Product Code:KRAC3368

Pages:89

Published On:October 2025

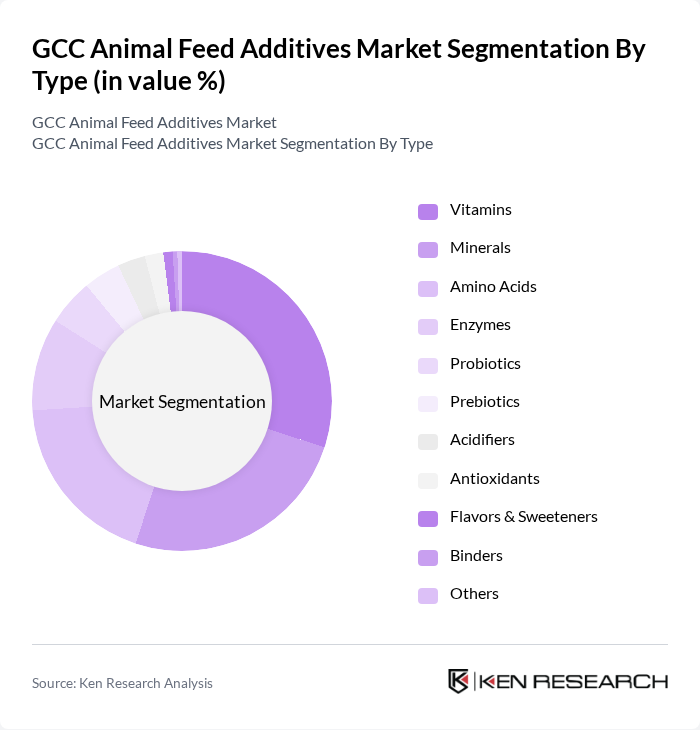

By Type:The market is segmented into various types of additives, including vitamins, minerals, amino acids, enzymes, probiotics, prebiotics, acidifiers, antioxidants, flavors & sweeteners, binders, and others. Among these, vitamins and minerals are the most widely used due to their essential roles in animal health and growth. The increasing focus on animal nutrition and health has led to a surge in the demand for these additives, particularly in poultry and ruminant sectors. Amino acids also constitute a significant share, reflecting the region’s emphasis on feed efficiency and productivity .

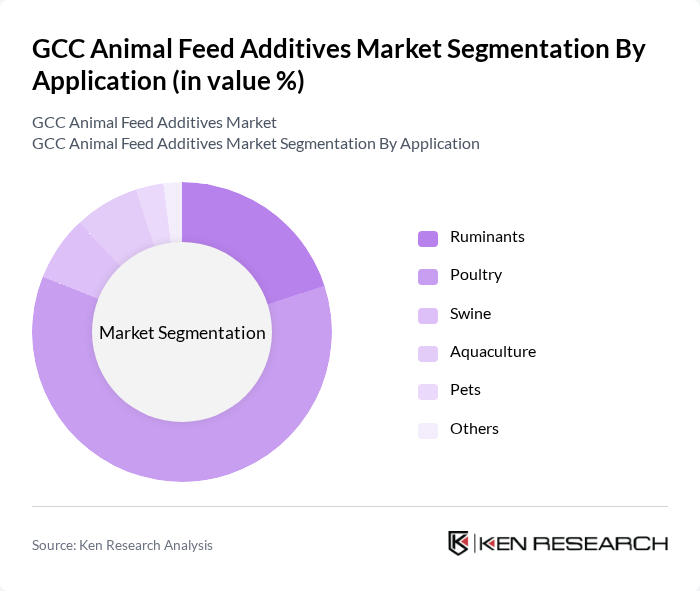

By Application:The application of animal feed additives spans across various sectors, including ruminants, poultry, swine, aquaculture, pets, and others. The poultry segment is the largest consumer of feed additives, driven by the rising demand for poultry products and the need for improved feed efficiency. The growing aquaculture industry also significantly contributes to the demand for specialized additives to enhance fish health and growth. Ruminant and swine sectors are also important, reflecting the region’s diversified livestock industry .

The GCC Animal Feed Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Inc., BASF SE, ADM Animal Nutrition, Alltech, Inc., Evonik Industries AG, Nutreco N.V., DSM-Firmenich (formerly DSM Nutritional Products), Kemin Industries, Inc., Phibro Animal Health Corporation, Novus International, Inc., Elanco Animal Health Incorporated, Merck Animal Health, De Heus Animal Nutrition, Adisseo, Trouw Nutrition, Chr. Hansen Holding A/S, Biomin (part of DSM-Firmenich), Zinpro Corporation, Lallemand Animal Nutrition, Miavit GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The GCC animal feed additives market is poised for growth, driven by increasing livestock production and a rising demand for high-quality protein. Innovations in feed formulation and a shift towards sustainable practices are expected to shape the industry landscape. As regulatory frameworks evolve, companies that adapt to these changes while focusing on animal health and nutrition will likely gain a competitive edge. The integration of technology in feed production will further enhance efficiency and product quality, ensuring a robust market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Amino Acids Enzymes Probiotics Prebiotics Acidifiers Antioxidants Flavors & Sweeteners Binders Others |

| By Application | Ruminants Poultry Swine Aquaculture Pets Others |

| By Formulation | Liquid Powder Granules Pellets Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By End-User | Commercial Farms Smallholder Farms Feed Mills Research Institutions Others |

| By Region | Saudi Arabia UAE Qatar Oman Kuwait Bahrain Others |

| By Price Range | Low Medium High Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Feed Manufacturers | 60 | Production Managers, Quality Control Officers |

| Veterinary Clinics | 50 | Veterinarians, Animal Health Technicians |

| Livestock Farmers | 70 | Farm Owners, Livestock Managers |

| Feed Distributors | 40 | Sales Managers, Distribution Coordinators |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

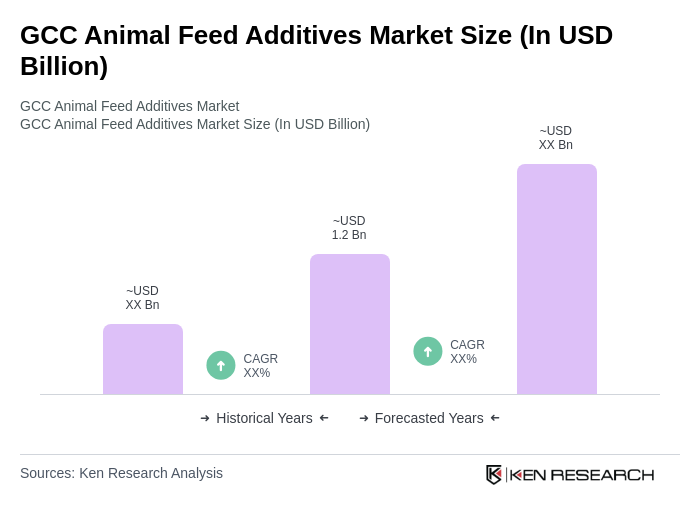

The GCC Animal Feed Additives Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increasing demand for high-quality animal protein and advancements in feed technology.