Region:Asia

Author(s):Geetanshi

Product Code:KRAD1207

Pages:82

Published On:November 2025

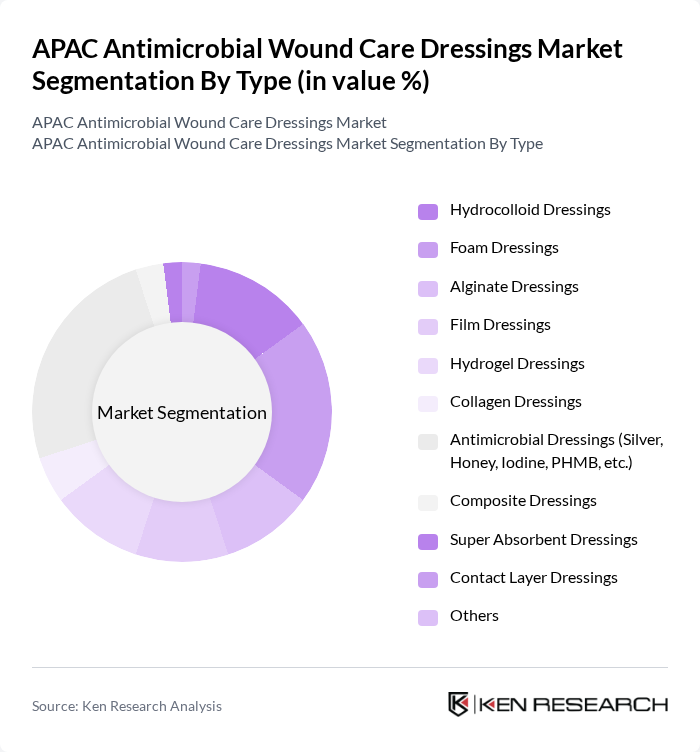

By Type:The market is segmented into various types of dressings, each catering to specific wound care needs. The subsegments include Hydrocolloid Dressings, Foam Dressings, Alginate Dressings, Film Dressings, Hydrogel Dressings, Collagen Dressings, Antimicrobial Dressings (Silver, Honey, Iodine, PHMB, etc.), Composite Dressings, Super Absorbent Dressings, Contact Layer Dressings, and Others. Among these, Antimicrobial Dressings are leading the market due to their effectiveness in preventing infections and promoting faster healing. The increasing incidence of surgical and chronic wounds, along with the adoption of silver-based, iodine-infused, and honey-treated dressings, has driven the demand for these specialized dressings, making them a preferred choice among healthcare professionals .

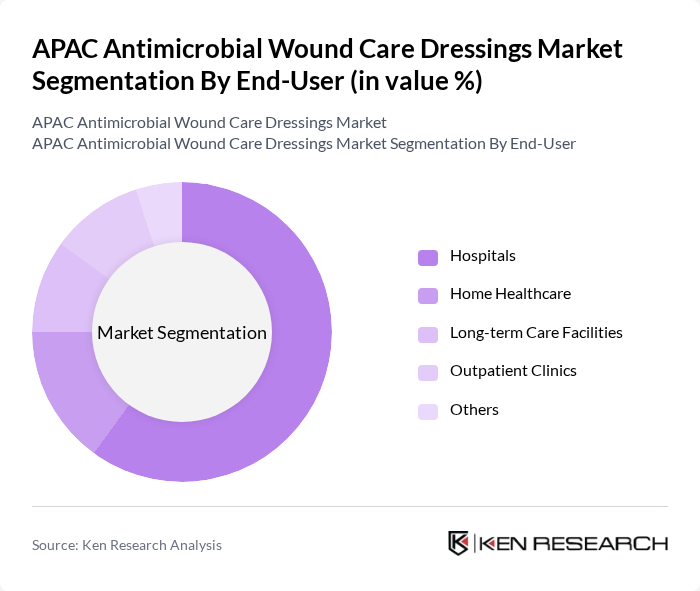

By End-User:The market is segmented based on end-users, including Hospitals, Home Healthcare, Long-term Care Facilities, Outpatient Clinics, and Others. Hospitals are the leading end-user segment, driven by the high volume of surgical procedures and the need for advanced wound care solutions in clinical settings. The increasing number of hospital admissions due to chronic diseases and injuries has further fueled the demand for antimicrobial wound care dressings in these facilities. Hospitals account for the largest share, followed by home healthcare and long-term care facilities, reflecting the trend toward both institutional and home-based wound management .

The APAC Antimicrobial Wound Care Dressings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smith & Nephew, 3M Health Care, Medtronic, ConvaTec Group, Mölnlycke Health Care, Acelity (now part of 3M), Paul Hartmann AG, Coloplast, BSN Medical (Essity), Derma Sciences (Integra LifeSciences), Integra LifeSciences, Ethicon (Johnson & Johnson), Medline Industries, Winner Medical, Advancis Medical, Lohmann & Rauscher, Urgo Medical, B. Braun Melsungen AG, Nitto Denko Corporation, Nichiban Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC antimicrobial wound care dressings market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As the region's healthcare infrastructure continues to improve, particularly in rural areas, access to advanced wound care solutions is expected to expand. Additionally, the integration of digital health technologies will enhance patient monitoring and care, leading to better outcomes. The focus on sustainability and personalized solutions will further shape the market landscape, fostering innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrocolloid Dressings Foam Dressings Alginate Dressings Film Dressings Hydrogel Dressings Collagen Dressings Antimicrobial Dressings (Silver, Honey, Iodine, PHMB, etc.) Composite Dressings Super Absorbent Dressings Contact Layer Dressings Others |

| By End-User | Hospitals Home Healthcare Long-term Care Facilities Outpatient Clinics Others |

| By Region | China Japan India Australia South Korea Rest of APAC |

| By Application | Surgical Wounds Traumatic Wounds Chronic Wounds (Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers) Burns Others |

| By Distribution Channel | Institutional Sales (Hospitals & Clinics) Retail Sales (Pharmacies, Drugstores) Online Retail Others |

| By Material | Natural Materials Synthetic Materials Biodegradable Materials Others |

| By Product Formulation | Silver-based Dressings Honey-based Dressings Iodine-based Dressings PHMB-based Dressings Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 60 | Procurement Managers, Supply Chain Coordinators |

| Wound Care Clinics | 50 | Wound Care Specialists, Clinic Managers |

| Pharmaceutical Distributors | 40 | Sales Representatives, Distribution Managers |

| Healthcare Professionals | 70 | Surgeons, Nurses, and Podiatrists |

| Regulatory Bodies | 40 | Health Policy Analysts, Regulatory Affairs Managers |

The APAC Antimicrobial Wound Care Dressings Market is valued at approximately USD 1.4 billion, driven by the increasing prevalence of chronic wounds, heightened awareness of advanced wound care products, and a growing geriatric population in the region.