Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7174

Pages:98

Published On:December 2025

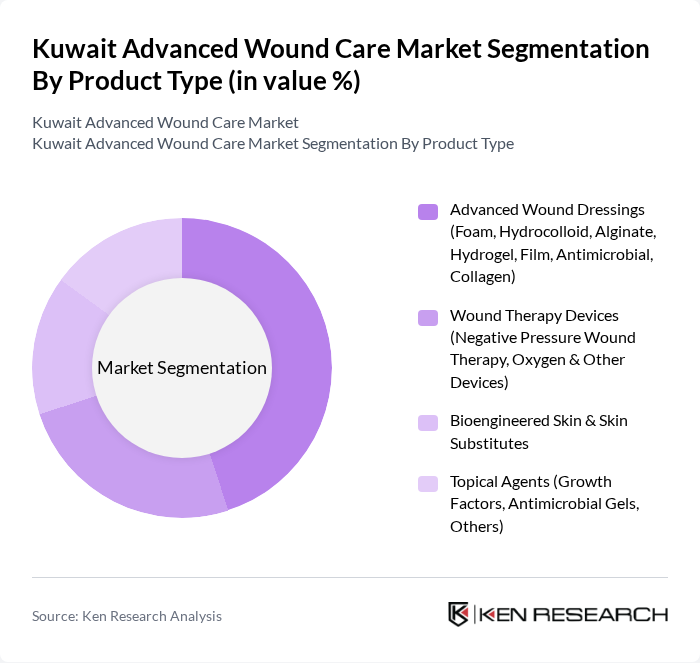

By Product Type:The advanced wound care market can be segmented into four main product types: Advanced Wound Dressings, Wound Therapy Devices, Bioengineered Skin & Skin Substitutes, and Topical Agents. This structure is consistent with prevailing regional and global market segmentation. Among these, Advanced Wound Dressings, which include various materials such as foam, hydrocolloid, alginate, hydrogel, film, antimicrobial, and collagen dressings, dominate the market due to their effectiveness in maintaining a moist wound environment, promoting healing, and preventing infections in chronic and post-surgical wounds. The increasing incidence of chronic wounds, particularly among the aging and diabetic population in Kuwait and the wider GCC, drives the demand for these products. Wound Therapy Devices, including negative pressure wound therapy systems and oxygen-based devices, are also gaining traction for complex and non-healing wounds; however, Advanced Wound Dressings remain the leading subsegment in terms of volume and usage across hospital settings.

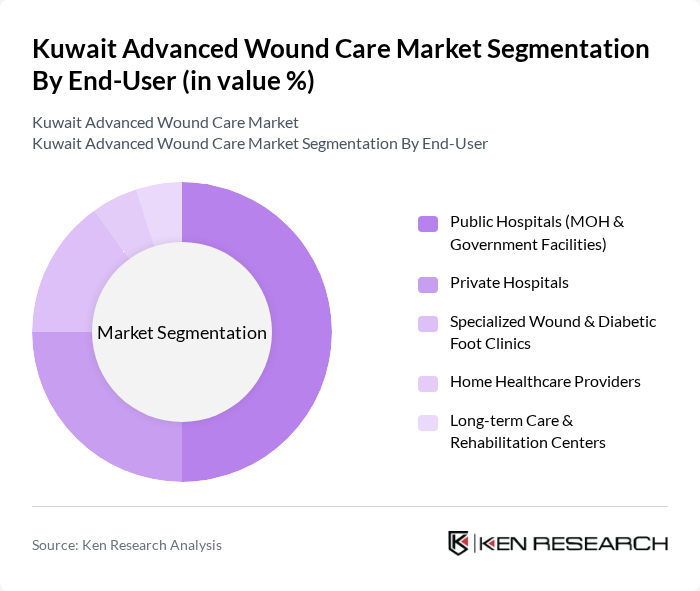

By End-User:The advanced wound care market is segmented by end-users, including Public Hospitals, Private Hospitals, Specialized Wound & Diabetic Foot Clinics, Home Healthcare Providers, and Long-term Care & Rehabilitation Centers. This end-user structure aligns with typical utilization patterns for advanced wound care in Kuwait and the broader GCC. Public Hospitals are the leading end-user segment, primarily due to their extensive patient base, the central role of the Ministry of Health in financing and delivering secondary and tertiary care, and government support for the adoption of advanced wound care treatments in high-volume hospitals. The increasing number of diabetic patients, high prevalence of pressure ulcers and venous leg ulcers, and the concentration of complex surgical and trauma cases in public facilities further contribute to the demand for specialized wound care services in these institutions. Private hospitals and specialized clinics are also significant contributors, particularly for insured and expatriate populations, but public hospitals hold the largest share of advanced wound care consumption.

The Kuwait Advanced Wound Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smith & Nephew plc, Mölnlycke Health Care AB, 3M Health Care (3M Company), ConvaTec Group plc, KCI Licensing, Inc. (3M – Formerly Acelity), Coloplast A/S, Paul Hartmann AG, B. Braun Melsungen AG, Johnson & Johnson MedTech (Ethicon), Baxter International Inc., Medtronic plc, Integra LifeSciences Corporation, Medline Industries, LP, Hollister Incorporated, Local & Regional Distributors (e.g., Al Dhow Medical, Advanced Technology Company, Gulf Medical) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the advanced wound care market in Kuwait appears promising, driven by increasing healthcare investments and a focus on innovative treatment solutions. The integration of digital health technologies is expected to enhance patient monitoring and care efficiency. Additionally, the growing emphasis on preventive healthcare will likely lead to increased demand for advanced wound care products, as healthcare providers aim to reduce complications associated with chronic wounds and improve patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Advanced Wound Dressings (Foam, Hydrocolloid, Alginate, Hydrogel, Film, Antimicrobial, Collagen) Wound Therapy Devices (Negative Pressure Wound Therapy, Oxygen & Other Devices) Bioengineered Skin & Skin Substitutes Topical Agents (Growth Factors, Antimicrobial Gels, Others) |

| By End-User | Public Hospitals (MOH & Government Facilities) Private Hospitals Specialized Wound & Diabetic Foot Clinics Home Healthcare Providers Long-term Care & Rehabilitation Centers |

| By Distribution Channel | Hospital & Tender-based Procurement Retail & Chain Pharmacies Medical Distributors & Offline Medical Suppliers Online & Direct-to-Patient Channels |

| By Material | Synthetic Polymer-based Products Natural & Collagen-based Products Composite & Bioengineered Materials Others |

| By Application | Surgical & Traumatic Wounds Diabetic Foot Ulcers Pressure Ulcers Venous & Arterial Leg Ulcers Burns & Other Complex Wounds |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Al Jahra Governorate Farwaniya & Mubarak Al-Kabeer Governorates |

| By Policy Support | Ministry of Health Procurement & Formulary Inclusion Public-Private Partnership (PPP) Support Grants & Incentives for Local Distribution / Value-add Manufacturing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Wound Care Departments | 120 | Wound Care Specialists, Nursing Staff |

| Private Clinics and Practices | 90 | General Practitioners, Dermatologists |

| Wound Care Product Distributors | 70 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 60 | Health Administrators, Policy Analysts |

| Patient Advocacy Groups | 50 | Patient Representatives, Community Health Workers |

The Kuwait Advanced Wound Care Market is valued at approximately USD 20 million, based on a five-year historical analysis. This valuation reflects the growing demand for advanced wound care solutions driven by chronic wound prevalence and healthcare advancements.