Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5989

Pages:83

Published On:December 2025

By Product Type:The product type segmentation includes various categories of surgical dressings that cater to different wound care needs. The subsegments are Basic Gauze and Cotton Dressings, Adhesive and Island Dressings, Absorbent Pads and Compression Bandages, Antimicrobial and Silver-impregnated Dressings, Foam and Hydrocellular Dressings, Hydrocolloid and Hydrogel Dressings, Alginate and Fiber Dressings, Film and Transparent Dressings, Advanced Combination / Bioactive Dressings, and Others. Among these, Antimicrobial and Silver-impregnated Dressings, together with other advanced dressings such as foam, hydrocolloid, hydrogel, and bioactive dressings, are increasingly capturing a larger share of the market due to their effectiveness in preventing infections, maintaining a moist wound environment, and promoting faster healing, especially for chronic and post-surgical wounds. The growing awareness of infection control, rising burden of diabetes-related ulcers, and adoption of evidence-based wound care protocols in surgical settings have significantly influenced provider preferences towards these advanced products.

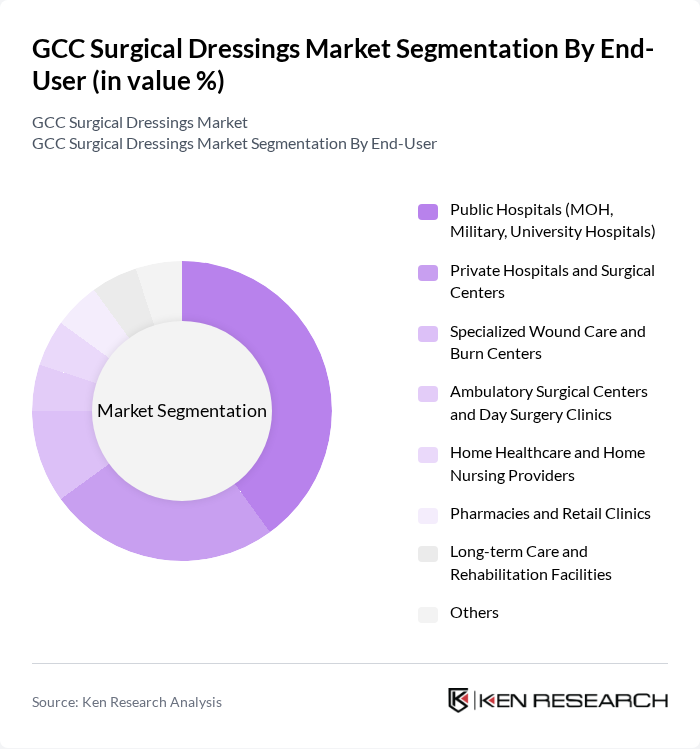

By End-User:The end-user segmentation encompasses various healthcare settings where surgical dressings are utilized. This includes Public Hospitals (MOH, Military, University Hospitals), Private Hospitals and Surgical Centers, Specialized Wound Care and Burn Centers, Ambulatory Surgical Centers and Day Surgery Clinics, Home Healthcare and Home Nursing Providers, Pharmacies and Retail Clinics, Long-term Care and Rehabilitation Facilities, and Others. Public Hospitals are the leading end-users due to their high patient volumes, comprehensive acute and chronic wound management services, and centralized government procurement that emphasizes clinically effective and cost-efficient wound care solutions. The increasing number of surgical procedures, expansion of day-surgery capacity, and the focus on improving outcomes for chronic wounds and post-operative care in these facilities are driving the demand for surgical dressings, while home healthcare and ambulatory centers are emerging segments as GCC health systems encourage care shift from inpatient to outpatient and home settings.

The GCC Surgical Dressings Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Health Care (3M Company), Smith+Nephew plc, Johnson & Johnson (including Ethicon), Mölnlycke Health Care AB, ConvaTec Group Plc, Coloplast A/S, Cardinal Health, Inc., Medline Industries, LP, B. Braun Melsungen AG, Hollister Incorporated, Integra LifeSciences Holdings Corporation, Lohmann & Rauscher International GmbH & Co. KG, Paul Hartmann AG, Acelity L.P. Inc. (now part of 3M), Gulf Medical Co. Ltd. (Saudi Arabia – regional distributor/manufacturer) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC surgical dressings market appears promising, driven by technological advancements and an increasing focus on infection control. As healthcare providers prioritize patient outcomes, the demand for innovative dressing solutions is expected to rise. Additionally, the integration of smart technologies into dressings will likely enhance monitoring and treatment efficacy. With a growing emphasis on personalized medicine, the market is poised for significant transformation, catering to diverse patient needs and preferences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Basic Gauze and Cotton Dressings Adhesive and Island Dressings Absorbent Pads and Compression Bandages Antimicrobial and Silver-impregnated Dressings Foam and Hydrocellular Dressings Hydrocolloid and Hydrogel Dressings Alginate and Fiber Dressings Film and Transparent Dressings Advanced Combination / Bioactive Dressings Others |

| By End-User | Public Hospitals (MOH, Military, University Hospitals) Private Hospitals and Surgical Centers Specialized Wound Care and Burn Centers Ambulatory Surgical Centers and Day Surgery Clinics Home Healthcare and Home Nursing Providers Pharmacies and Retail Clinics Long-term Care and Rehabilitation Facilities Others |

| By Application | Post-surgical and Acute Surgical Wounds Chronic Diabetic Foot Ulcers Pressure Ulcers (Bedsores) Venous and Arterial Leg Ulcers Traumatic and Orthopedic Wounds Burn and Plastic Surgery Wounds Infection Control and Post-operative Drain Sites Others |

| By Material | Cotton and Cellulose-based Materials Synthetic Polymers (Polyurethane, Silicone, Acrylic) Natural Fibers (Alginate, Chitosan and Collagen) Silver and Other Antimicrobial-infused Materials Bioengineered and Bioactive Materials Others |

| By Distribution Channel | Tender-based Institutional Procurement (MOH, Government Entities) Direct Sales to Hospitals and Large Provider Groups Local Distributors and Importers Hospital and Clinic Pharmacies Retail Pharmacies and Drug Stores Online B2B Medical Supply Platforms Cross-border Medical Distributors / Free Zones Others |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Policy Support | Government Healthcare Spending & Vision Programs (e.g., Saudi Vision 2030) Local Manufacturing and Localization Incentives Reimbursement and Insurance Coverage for Advanced Dressings Regulatory Fast-track and Quality Accreditation Support Public-Private Partnership (PPP) and Group Purchasing Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Surgical Units in Major Hospitals | 80 | Surgeons, Surgical Nurses |

| Manufacturers of Surgical Dressings | 45 | Product Managers, Sales Directors |

| Distributors and Wholesalers | 40 | Distribution Managers, Sales Representatives |

| Healthcare Policy Makers | 45 | Health Administrators, Regulatory Affairs Specialists |

The GCC Surgical Dressings Market is valued at approximately USD 1.1 billion, reflecting its significant share within the broader GCC wound care and global surgical dressing markets, driven by factors such as chronic wounds and an aging population.