Region:Asia

Author(s):Shubham

Product Code:KRAC8916

Pages:94

Published On:November 2025

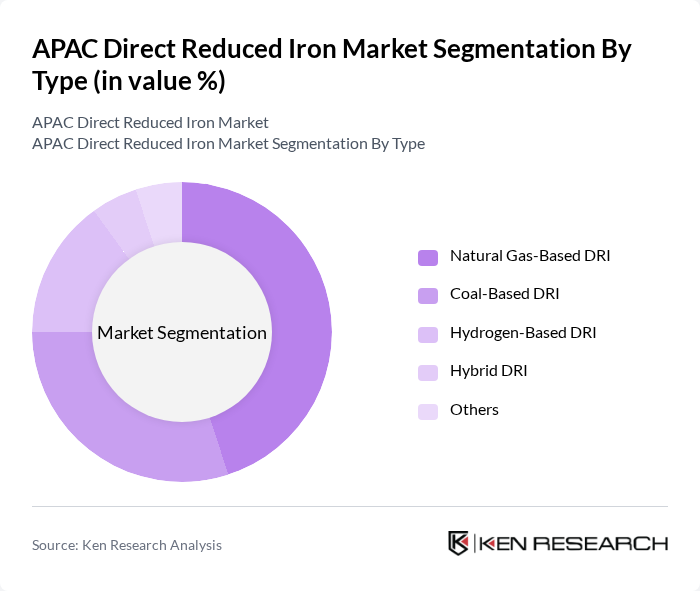

By Type:The market is segmented into various types of direct reduced iron, including Natural Gas-Based DRI, Coal-Based DRI, Hydrogen-Based DRI, Hybrid DRI, and Others. Each type has its unique production process and application in the steel industry. The Natural Gas-Based DRI is currently the most dominant segment due to its efficiency and lower carbon emissions compared to coal-based methods. Hydrogen-Based DRI is gaining traction as a future-oriented solution for green steel production, while coal-based DRI remains significant in regions with abundant coal resources .

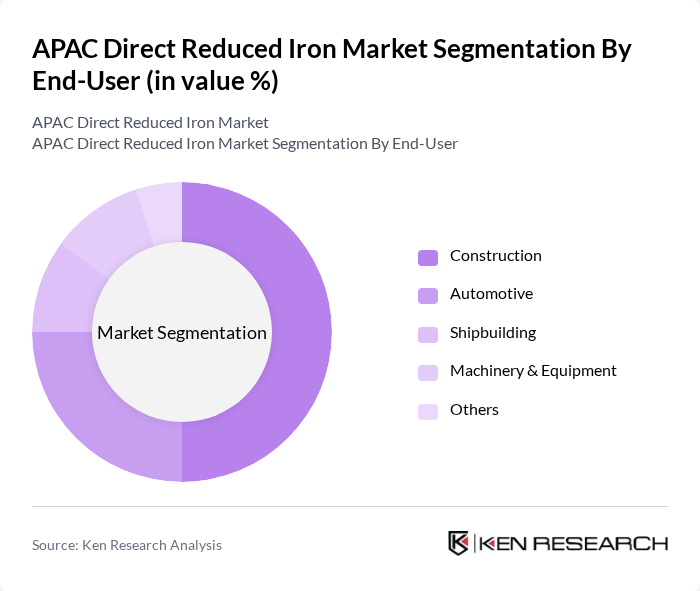

By End-User:The end-user segment includes Construction, Automotive, Shipbuilding, Machinery & Equipment, and Others. The construction sector is the largest consumer of DRI, driven by ongoing infrastructure projects and urban development across the region. The automotive industry also significantly contributes to the demand for DRI, as manufacturers seek high-quality steel for vehicle production. Shipbuilding and machinery sectors utilize DRI for specialized steel grades, while other industries benefit from its consistent quality and low impurity levels .

The APAC Direct Reduced Iron Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Steel, JSW Steel, Nippon Steel Corporation, POSCO, ArcelorMittal, Hesteel Group, JFE Steel Corporation, Steel Authority of India Limited (SAIL), China Baowu Steel Group, Hyundai Steel, Essar Steel (now AM/NS India), Shougang Group, Ansteel Group, Jindal Steel and Power Limited (JSPL), Kobe Steel, Ltd., Midrex Technologies, Inc., Tenova S.p.A., Qatar Steel Company FZE contribute to innovation, geographic expansion, and service delivery in this space.

The APAC Direct Reduced Iron market is poised for significant transformation as it adapts to evolving industry demands and regulatory landscapes. With a strong emphasis on sustainability, the shift towards low-carbon steel production is expected to accelerate, driven by government initiatives and consumer preferences. Additionally, the integration of renewable energy sources in DRI production processes will likely enhance operational efficiency and reduce environmental impact, positioning DRI as a key player in the future of steel manufacturing in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Gas-Based DRI Coal-Based DRI Hydrogen-Based DRI Hybrid DRI Others |

| By End-User | Construction Automotive Shipbuilding Machinery & Equipment Others |

| By Region | China India Japan South Korea ASEAN Countries Australia & New Zealand Rest of APAC |

| By Application | Steel Manufacturing Foundries Direct Use in Industrial Processes Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Government Subsidies Tax Incentives Renewable Energy Certificates (RECs) Others |

| By Technology | MIDREX Process HYL/Energiron Process Coal-Based Rotary Kiln Process Hydrogen-Based Direct Reduction Other Innovative Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Direct Reduced Iron Producers | 100 | Plant Managers, Production Directors |

| Steel Manufacturers Utilizing DRI | 80 | Procurement Managers, Operations Heads |

| Industry Analysts and Consultants | 50 | Market Analysts, Industry Experts |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Officers |

| Logistics and Supply Chain Experts | 40 | Supply Chain Managers, Logistics Coordinators |

The APAC Direct Reduced Iron market is valued at approximately USD 47 billion, driven by increasing steel production demands, particularly in emerging economies like China and India, and a shift towards sustainable iron production methods.