Region:Middle East

Author(s):Shubham

Product Code:KRAC2239

Pages:82

Published On:October 2025

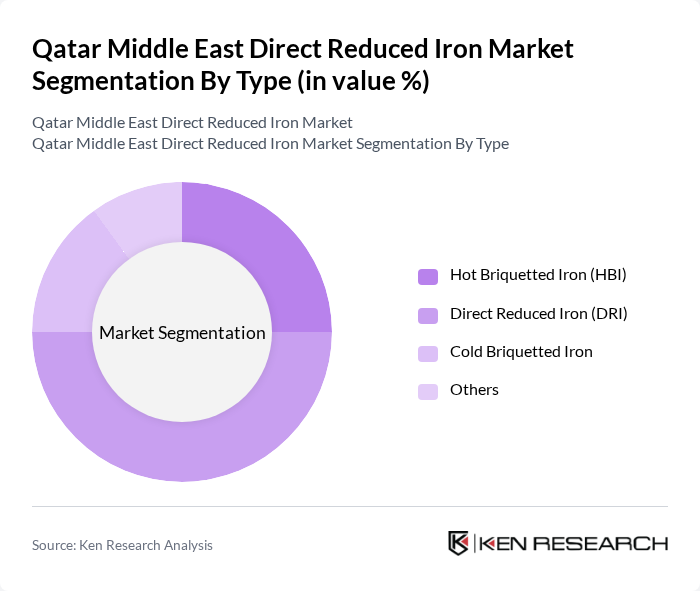

By Type:The market is segmented into Hot Briquetted Iron (HBI), Direct Reduced Iron (DRI), Cold Briquetted Iron, and Others. Among these, Direct Reduced Iron (DRI) is the leading sub-segment due to its high purity and efficiency in steelmaking processes. The increasing preference for DRI in the production of high-quality steel is driven by its lower impurities and higher yield compared to other types .

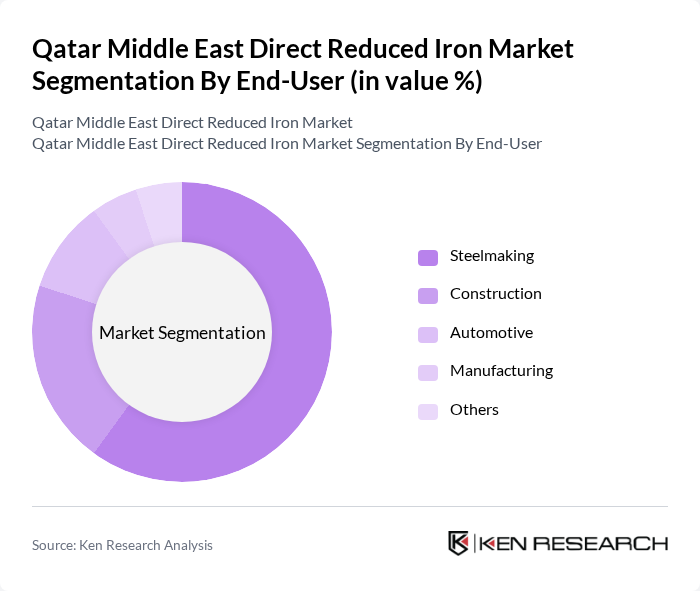

By End-User:The end-user segments include Steelmaking, Construction, Automotive, Manufacturing, and Others. The Steelmaking sector dominates the market, driven by the increasing demand for high-quality steel in construction and infrastructure projects. The shift towards using DRI in steel production is also a significant factor, as it enhances the quality and sustainability of the final product .

The Qatar Middle East Direct Reduced Iron Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Steel Company, Emirates Steel Arkan, SULB Company, Ezz Steel, Hadeed - SABIC, Mobarakeh Steel Company, Khouzestan Steel Company, Gol-e-Gohar Iron & Steel, Libyan Iron & Steel Company (LISCO), Hormozgan Steel Company, Vale S.A., ArcelorMittal, Nucor Corporation, JSW Steel Ltd., MIDREX Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar DRI market is poised for significant transformation, driven by increasing demand from the steel industry and government-backed infrastructure projects. As technological advancements continue to shape production methods, the market is likely to see a shift towards more sustainable practices. However, challenges such as fluctuating raw material prices and competition from alternative iron sources will require strategic responses. Overall, the market is expected to adapt and thrive, aligning with Qatar's long-term economic goals and sustainability initiatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Hot Briquetted Iron (HBI) Direct Reduced Iron (DRI) Cold Briquetted Iron Others |

| By End-User | Steelmaking Construction Automotive Manufacturing Others |

| By Application | Steel Production Foundries Metal Fabrication Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Quality Grade | Standard Grade High-Grade Low-Grade Others |

| By Production Method | Natural Gas-Based Reduction Coal-Based Reduction Hydrogen-Based Reduction Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Direct Reduced Iron Producers | 60 | Plant Managers, Production Supervisors |

| Steel Manufacturers | 50 | Procurement Managers, Operations Directors |

| Construction Sector Users | 40 | Project Managers, Material Engineers |

| Government Regulatory Bodies | 40 | Policy Makers, Industry Analysts |

| Market Research Analysts | 40 | Market Researchers, Economic Advisors |

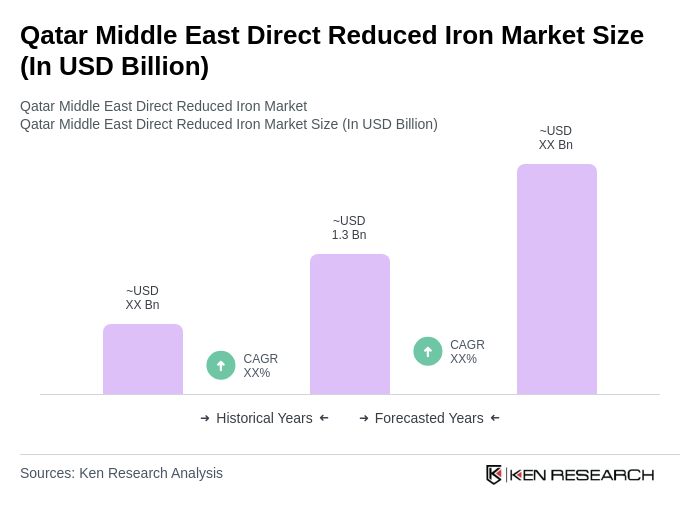

The Qatar Middle East Direct Reduced Iron market is valued at approximately USD 1.3 billion, driven by increasing demand for high-quality steel and investments in infrastructure projects across the region.