Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8195

Pages:90

Published On:November 2025

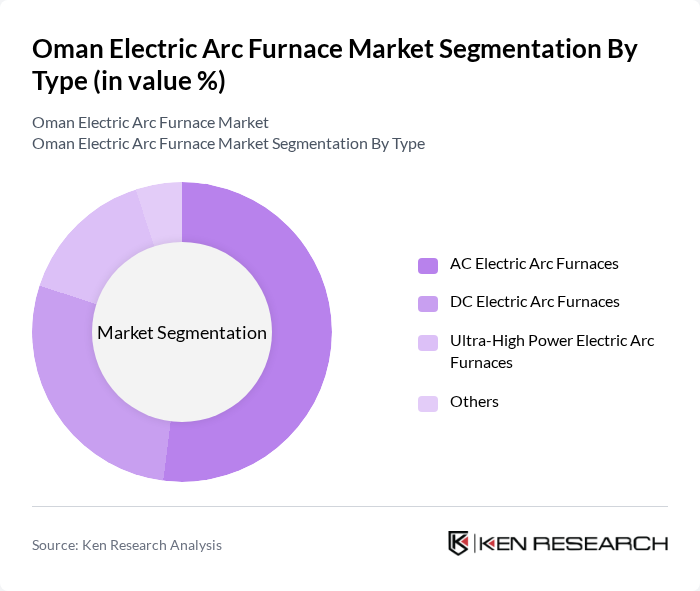

By Type:The electric arc furnace market in Oman is segmented into four types: AC Electric Arc Furnaces, DC Electric Arc Furnaces, Ultra-High Power Electric Arc Furnaces, and Others. AC Electric Arc Furnaces are the most widely used, favored for their cost-effectiveness, operational reliability, and suitability for processing a wide range of steel scrap and direct reduced iron. DC Electric Arc Furnaces are gaining prominence due to their ability to produce high-quality steel with reduced electrode consumption and lower energy use. Ultra-High Power Electric Arc Furnaces are increasingly adopted for large-scale, high-throughput operations, while the 'Others' category includes specialized furnaces for niche metallurgical applications .

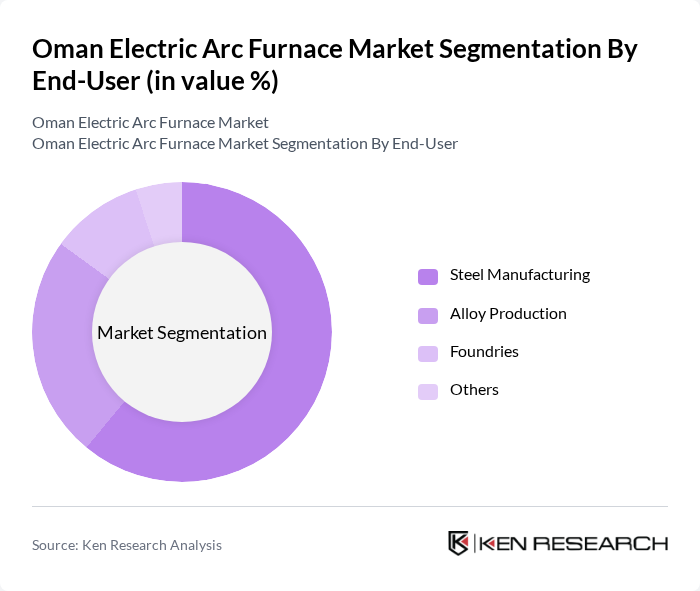

By End-User:The end-user segmentation comprises Steel Manufacturing, Alloy Production, Foundries, and Others. Steel Manufacturing remains the dominant segment, driven by robust demand from construction, infrastructure, and industrial projects. Alloy Production is significant, reflecting the rising need for specialized and high-performance steel grades. Foundries utilize electric arc furnaces for precision casting and recycling operations, while the 'Others' segment includes diverse industrial users requiring flexible steel and metal processing solutions .

The Oman Electric Arc Furnace Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Steel Industries, Gulf Steel Industries, Al Jazeera Steel Products Co. SAOG, Oman Cables Industry, Sohar Steel LLC, Muscat Steel, Al Anwar Holdings, Oman National Engineering & Investment Co. SAOG, Al Batinah International LLC, Oman Metal Industries, Al Hodaifi Group, Al Muna Group, Al Fajr Al Muneer, Al Mufeed Trading, Al Mufeed Steel, Jindal Steel Duqm, Vale Oman, Meranti Green Steel, Mitsui & Co. (Oman), Kobe Steel (Oman), ACME Group (Oman), Danieli Middle East, CHNZBTECH (Oman Projects) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman electric arc furnace market is poised for significant transformation, driven by technological advancements and a strong push towards sustainability. As the government continues to invest in infrastructure and renewable energy, the demand for efficient steel production will rise. Furthermore, the integration of smart manufacturing technologies is expected to enhance operational efficiencies. These trends indicate a robust future for the electric arc furnace market, with opportunities for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Electric Arc Furnaces DC Electric Arc Furnaces Ultra-High Power Electric Arc Furnaces Others |

| By End-User | Steel Manufacturing Alloy Production Foundries Others |

| By Region | Muscat Salalah Sohar Duqm Others |

| By Technology | Conventional Electric Arc Melting Advanced Electric Arc Refining Hydrogen-Ready Electric Arc Furnaces Others |

| By Application | Carbon Steel Production Stainless Steel Production Specialty Alloys Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Steel Production Facilities | 100 | Plant Managers, Production Supervisors |

| Electric Arc Furnace Manufacturers | 60 | Sales Managers, Technical Engineers |

| Raw Material Suppliers | 50 | Procurement Managers, Supply Chain Analysts |

| Industry Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| End-User Industries (Construction, Automotive) | 70 | Project Managers, Procurement Officers |

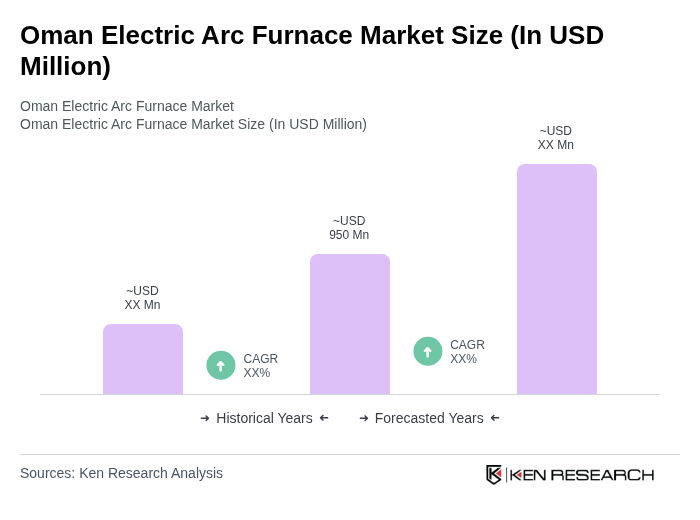

The Oman Electric Arc Furnace market is valued at approximately USD 950 million, reflecting a significant growth driven by increasing steel production demands and the country's focus on industrial diversification and sustainability.